Stimulus check: how to claim the payment if you're one of the 9 million Non-filers

An estimated 9 million people in the US are eligible for a stimulus payment but may not even know it. Here's how tax non-filers can apply for a stimulus check.

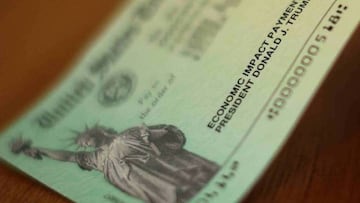

More than 160 million Americans have received Economic Impact Payments from the IRS as part of the first coronavirus relief package that was passed in March.

But there are some 9 million people who have yet to claim the stimulus payment valued at $1,200 per individual ($2,400 per married couple) plus $500 per qualifying child.

As these 9 million people didn't file a federal income tax return in either 2018 or 2019, they may not even know that they are entitled to a stimulus check. But, in fact, many of them are and will be sent a letter from the IRS regarding how they can claim their payment.

Following an internal analysis, the IRS found that these 9 million people are those who don't typically file a tax return because they have very low incomes. But many in this group are still eligible to receive the stimulus check.

"The IRS has made an unprecedented outreach effort to make sure people are aware of their potential eligibility for an Economic Impact Payment this year," said IRS Commissioner Chuck Rettig.

"Millions who don't normally file a tax return have already registered and received a payment. We are taking this extra step to help Americans who may not know they could be eligible for this payment or don't know how to register for one. People who aren't required to file a tax return can quickly register on IRS.gov and still get their money this year."

The letter, officially known as IRS Notice 1444-A, will be sent out to an estimated 9 million Americans but Rettig has urged people not to wait to receive the letter. If you think you are among these 9 million people eligible for a stimulus check, you can start the process to claim it right away. Below you'll find all you need to know on how to do so…

Stimulus checks: the Non-filers tool

You don’t need to wait to receive the letter as the IRS has set up the Non-Filers tool, which is designed for people with incomes below $12,200 for singles and $24,400 for married couples (This includes couples and individuals who are experiencing homelessness).

As the IRS points out, people who don't work or have no earned income are also eligible. “But low- and moderate-income workers and working families eligible to receive special tax benefits, such as the Earned Income Tax Credit or Child Tax Credit, cannot use the Non-filers tool. They will need to file a regular return as soon as possible,” it says.

The IRS also specifies that you should NOT use the Non-filers tool if you will be filing a 2019 return.

Entering you information on the Non-filers tool

Once you’ve entered the Non-Filers tool intro page, read the details before scrolling down to the “Enter your Information” button. Below the button, you can see the “Information you will need to provide” and “What to expect” before you start the process.

- Second stimulus check: what did McConnell say about relief bill?

- Will there be a second stimulus check?

- Second stimulus check: new possible date to approve the second relief package

What's the deadline to request your stimulus check?

You will have until October 15 to request your payment using the Non-filers tool. After that date, the only way you can claim a payment is by filing a federal income tax return.

If you are looking to claim the $500 for child dependents, the IRS warns that you need to use the Non-Filers tool by September 30. (For information about qualifying children, visit the Economic Impact Payment Information Center)

Tracking your stimulus payment

Two weeks after registering, you will be able to track the status of your payment using the Get My Payment tool.

Who should use the Non-filers tool?

Related stories

You can use the Non-filers tool if:

• Your income is less than $12,200

• You’re married filing jointly and together your income is less than $24,400

• You have no income

People receiving the following benefits are also eligible to apply using the Non-filers tool:

• Those receiving Social Security retirement, disability (SSDI), survivor benefits

• Supplemental Security Income (SSI) recipients

• Recipients of Veterans Affairs Compensation and Pension (C&P) benefits

• Individuals who receive Railroad Retirement (RRB) benefits