Fourth stimulus check and Child Tax Credit summary: 15 July 2021

News and information on the third stimulus check in President Biden's coronavirus relief bill, and updates on a potential fourth direct payment.

Show key events only

What happens if I don’t want to receive the $3,000 or $3,600 Child Tax Credit Monthly payments?

The Internal Revenue Service sent millions of families the first installment on the 2021 Child Tax Credit on Thursday. Five more installments will go out each month until December unless parents decide to opt out of the advance payments.

Housing out of reach for full-time minimum wage earners

The federal minimum wage is $7.25, and has been since 2009, and there isn’t a single of the more than 3,000 counties nationwide in the US where a person working full-time on a minimum wage can afford a two-bedroom rental. In just 218 counties, or 7 percent of counties nationwide, that same worker could afford to rent a one-bedroom abode. This is according to a new report from the National Low Income Housing Coalition.

Is there a limit of children a family can claim for the $3,000 to $3,600 Child Tax Credit?

Families large and small that meet the income eligibility requirements will be able to claim the expanded Child Tax Credit in 2021 for each of their young ones. Each child under six at the end of the year could be eligible for up to $3,600, and those six through 17 at the end of 2021 could be eligible for up to $3,000.

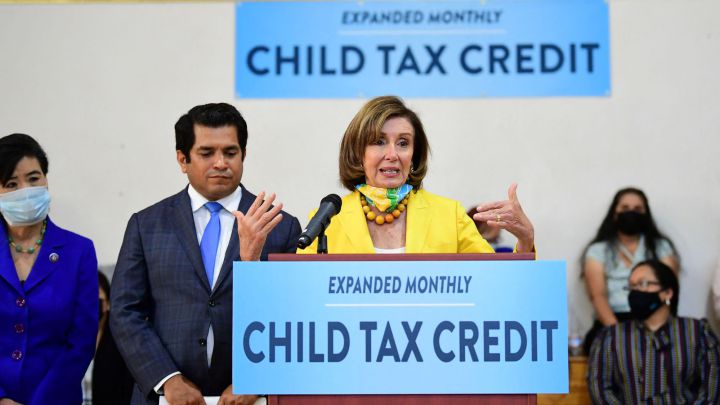

House progressives are standing up. We will tank the bipartisan infrastructure bill unless we will also pass the reconciliation bill.

House progressives flex muscles over infrastructure bill

Speaking at a virtual town hall event US Representative Alexandria Ocasio-Cortez made the Progressive caucus’ intentions known, that if there isn’t the Democrat-only reconciliation bill alongside the bipartisan infrastructure bill they will “tank” the latter. The threat is valid given Democrats’ slim margin in the House.

The current proposal for the Democrat caucus reconciliation bill would include all of President Biden’s major proposals from the American Families Plan, including extending the changes to the Child Tax Credit beyond 2021. As well there would be immigration reform and action on climate change. If any of those proposals get watered down that would put the bipartisan bill at risk as well.

“If they approve our reconciliation bill we will approve their bipartisan bill,” Ocasio-Cortez said. “And if they try to strip immigration reform, if they try to, you know, claw back on childcare, climate action, etc., then we’re at an impasse, it’s a no go.”

How to contact the IRS about $3,000 to $3,600 Child Tax Credit

The much-anticipated monthly advance payments on the 2021 Child Tax Credit have started, millions of families will begin seeing extra federal assistance to cover the cost of raising children. However, if you need to contact the IRS about the payments the agency has provided three online tools to handle different needs related to the payments.

Advance 2021 Child Tax Credit payments will help those still struggling

The changes to the Child Tax Credit included in the American Rescue Plan are currently set to expire at the end of the year. However, President Biden has asked Congress to extend the expansion and monthly payments through 2025.

Proposals to extend the program have been drawn up that would be included in the Democrats second "soft" infrastructure bill, but no exact length has been stated yet. That piece of legislation is supposed to be passed along side the bipartisan "traditional" infrastructure bill currently being finalized in the Senate.

Here's how it will help one family of seven still recovering from the economic fallout from the pandemic.

Inflation has increased notably and will likely remain elevated in coming months before moderating. Inflation is being temporarily boosted by base effects, as the sharp pandemicrelated price declines from last spring drop out of the 12-month calculation. In addition, strong demand in sectors where production bottlenecks or other supply constraints have limited production has led to especially rapid price increases for some goods and services, which should partially reverse as the effects of the bottlenecks unwind. Prices for services that were hard hit by the pandemic have also jumped in recent months as demand for these services has surged with the reopening of the economy.

President Biden is "confident" he can get what he proposed on infrastructure passed through Congress.

What does an increase in the Consumer Price Index mean?

What does an increase in the Consumer Price Index mean?

To protect against inflation and monitor the stability of the economy, the US Department of Labor tracks an indicator called the Consumer Price Index (CPI). The CPI "measures the change in prices paid by consumers for goods and services.”

As the economy reopens and markets find their equilibrium, many shoppers have reported paying higher prices for basic goods.

The Bureau of Labor Statistics, which calculates the CPI has released the June data showing that consumers are paying around 2.4 percent more for food and almost five percent more for appeal, compared to their levels a year ago.

Read our full coverage for more about what products have seen the largest and smallest decrease in price.

What has Biden said about states restarting unemployment benefits?

What has Biden said about states restarting unemployment benefits?

The Republican state-led move to end the unemployment benefits three months had prompted outcry from workers and politicians alike.

The legal fights that challenged the move had prevented the sudden termination of benefits but Governors were determined to appeal and overturn the judges' rulings.

But the President's camp has poured cold water over these plans and said the unemployment programmes can restart after the Governors' appeals were dismissed in appeals court.

The payments are still scheduled to end federally on September 6.

Read our full coverage for more on what President Biden has said.

Fed Chairmen Powell testifies on Capitol Hill

Federal Reserve Chairmen Jerome Powell tells Senators that inflation "has increased notably and will likely remain elevated in coming months before moderating."

While above the levels the central bank would like to see, the increases are normal because of the sharp increase in prices for "services that were hard hit by the pandemic," which "have also jumped in recent months as demand for these services has surged with the reopening of the economy."

Watch the full committee meeting here.

What is President Biden doing to increase economic competition during the economic recovery?

In an address on 9 July, the President spoke to the Executive Order he would be signing to promote competition. The order will impact three major sectors pharmaceuticals, agriculture, and technology.

In his address, President Biden stated that he hopes this action will "lower prices and increase wages, and takes a critical step to create an economy that works for everybody."

Read more about the Executive Order here.

TODAY: President Biden speaks to the impact the advanced payments of the Child Tax Credit will have on families in the US.

$3000/$3600 Child tax credit: are children between 6 and 17-years-old included?

Child tax credit: Are children between 6 and 17-years-old included?

Yes. Families with children under seventeen are eligible to receive the credit. However, the credit’s value does change depending on the age of the child.

For children under six, the total value of the credit is $3,600, with a monthly payment of $300 through December. Families with children between the ages of six and seventeen will receive a credit worth $3,000, with monthly payments of $250.

Read our coverage for more on the other changes the American Rescue Plan made to the Child Tax Credit.

The Hill reports that Republican Senators are fuming after Senate Majority Leader Chuck Schumer plays "hardball" to get the bipartisan infrastructure package finalized.

Negotiations over the bipartisan infrastructure package get tense as a White House official walked out of the meeting that had been going on for two hours.

Interested in hearing from the experts on the impact the Child Tax Credit will have?

Tune in to a webinar hosted by the Wall Street Journal where journalist Jeanne Cummings, Catherine Lucey, Richard Rubin, will speak to the impacts the credit could have on families in the US.

Can undocumented people receive the second Golden State Stimulus check in California?

On Monday California Gov. Gavin Newsom signed into law the largest recovery package in the state's history: the California Comeback Plan. In doing so, Newsom said the state was “taking on the inequities laid bare by the pandemic, expanding our support for Californians facing the greatest hardships, increasing opportunity for every child, confronting homelessness head-on.”

The $100 billion package builds on the Golden State Stimulus bill which was passed earlier this year, and extends some of the programme included in it to more people. Roughly two-thirds of all residents are now thought to be eligible for the Golden State Stimulus checks, but does this include undocumented workers and their families?

IRS tax refunds will be sent out this week

The IRS has been battling through a huge backlog of unprocessed tax returns which reportedly reached 35 million in May, while also sending out stimulus checks and Child Tax Credit payments. As a result this has led to delays in other facets of the IRS' work, with tax refund recipients facing long delays.

However the tax agency has announced that on Friday they expect to make a wave of 4 million tax refund payments. Many of these are for unemployment benefits recipients who overpaid tax on support received during 2020.

$3000/$3600 Child Tax Credit eligibility: Who is getting it? How to know if I qualify

The IRS has begun distributing the first payment of the Child Tax Credit, which are expected to arrive in recipients' bank account on 15 July or shortly after if the tax authority sent them a physical check.

This distribution structure is new and was implemented after the passage of the American Rescue Plan. Rather than receiving the credit with a tax refund, families will be paid monthly through December. The remaining balance of the credit will be claimed when taxes are filed next year. Who will be getting the lucrative new payments and how much could it be worth to my family?

New Child Tax Credit goes live today

Senator Mazie K. Hirono of Hawaii is optimistic about the benefits of the American Rescue Plan, which she helped support in Congress. The $1.9 trillion stimulus package included the overhaul of the Child Tax Credit which goes into effect today. The IRS will continue sending out monthly payments for the rest of 2021 but there are already plans in place to see it extended beyond then.

What will the Child Tax Credit payment look like?

The IRS has spent the last four months developing an enormous distribution system designed to get the Child Tax Credit payments out to the roughly 35 million eligible families. The online portal went live earlier this month, allowing families to update their information or check out how large their payment will be, but some are unsure about the programme.

This handy video from the White House Twitter account shows exactly what the payment will look like when it lands in your bank account...

Child Tax Credit payments arrive for 35.2 million families

The US Treasury Department has confirmed that the IRS has sent out payments as part of the new Child Tax Credit system, providing a cash boost for some 35.2 million families.

“For the first time in our nation’s history, American working families are receiving monthly tax relief payments to help pay for essentials like doctor’s visits, school supplies, and groceries,” Treasury Secretary Janet Yellen said in a statement. “This major middle-class tax relief and step in reducing child poverty is a remarkable economic victory for America — and also a moral one.”

$3000/$3600 Child Tax Credit: how to apply and claim if not yet received

An estimated 88% of American families are eligible to receive monthly payments as part of the new Child Tax Credit programme. Payments begin today, 15 July, and will continue each month until December. The final six months of payments will come in a lump sum at the end of the tax year.

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service (IRS) then good news; you will get this tax relief automatically. However non-filers will need to complete a simple process to ensure that the IRS has all the relevant details...

How will families spend the Child Tax Credit?

The Washington Post's economic correspondent Jeff Stein has taken a look at how American families intend to use the monthly direct payments provided by the Child Tax Credit. The new system is unlike anything that has gone before it in the United States and there is still uncertainty about what the long-term impact will be.

To illustrate that fact, Democratic Sen. Cory Booker of New Jersey described it as “the most transformative policy coming out of Washington since the days of F.D.R."

$3000/$3600 Child Tax Credit 2021: How to calculate how much money will I receive

The IRS will today start sending out the first round of Child Tax Credit payments, which will continue on a monthly basis for the rest of 2021 at least. The Biden amdinistration is trying to extend the programme beyond its initial duration and has included a four-year extension in his American Families Plan.

But how much are the new payments worth? Well that depends on you personal situation, household income and the number of children claimed as dependents on your most recent tax return. Here's everything you need to know...

Companies could get stimulus boost from the Child Tax Credit

Earlier this year the two rounds of stimulsu checks passed in quick succession were linked to a marked increase in consumer spending in April and May. Although a fourth stimulus check seems a long way off, there is hope that the upcoming Child Tax Credit payments could have a similar effect.

An estimated 39 million families are expected to received hundreds of dollars in monthly payments for the rest of the year. As a result, a report from Cowen’s Washington Research Group suggets that this “underappreciated stimulus” could provide a 'back-to-school' boost for the likes of Walmart, Target, Amazon, Wingstop and Nike.

How much money is provided by the 2021 Child Tax Credit and how many payments?

Today the IRS will finally begin sending out money as part of the new-look Child Tax Credit, the broad new programme providing monthly direct payments for families. The change is a result of the American Rescue Plan, which was signed into law back in March, but it took the tax authority fourth months to prepare the new payment system.

There is great optimism amongst Democrats in Congress about the impact that the programme could have. Sen. Cory Booker described it as “the most transformative policy coming out of Washington since the days of F.D.R." We take a look at what the new programme means for families and how long the payments will last for...

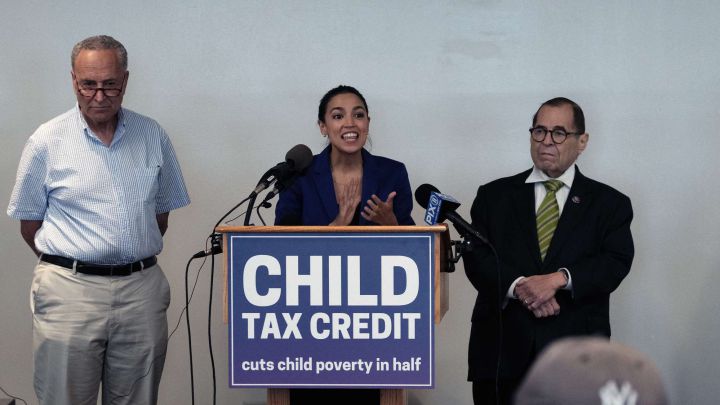

New Child Tax Credit could cut childhood poverty in half

Democrats have been very optimistic about the impact that the new Child Tax Credit will have once introduced, and with the IRS scheduled to send out the first wave of payments later today. The new system will see parents received up to $300 per child in the form of a monthly direct payment which is due to continue until at least the end of 2021.

Will there be problems receiving IRS Child Tax Credit payments?

For the past four months the IRS has been preparing to take on a new task; starting today 15 July, the agency will begin sending advance monthly payments to parents for the 2021 Child Tax Credit. But there still may be some last-minute hurdles to overcome.

The American Rescue Plan made a series of changes to the Child Tax Credit which has existed since 1997. It greatly expanded the value of the credit and made it available to many low- and moderate-income families who previously either couldn’t take advantage of it or only in a limited fashion.

Online Child Tax Credit eligibility tool is available in Spanish

The Internal Revenue Service has launched a new Spanish-language version of its online tool, Child Tax Credit Eligibility Assistant, which has been designed to help families determine whether they qualify for the Child Tax Credit and the special monthly advance payments of the credit which started going out today, 15 July.

Available exclusively on irs.gov, the new Spanish version of the tool, like its English-language counterpart, is interactive and easy to use. By answering a series of questions about themselves and their family members, a parent or other family member can quickly determine whether they qualify for the credit.

How many tax refunds is the IRS sending on 14 July, and who are getting them?

The IRS have confirmed that tax refund payments are continuing throughout the summer as the tax authority looks to work through a huge backlog. The latest round is set to go out this week, with an average refund amount of $1,265 per filer.

In May the Treasury Department released a report stating that by early March the IRS had already found 7.3 million tax returns that were eligible for a refund, and that number is now thought to have doubled. Do not worry if you are not included in this round of payments, there are plenty more to come later this year. Here's everything you need to know about the payment schedule and how to track your tax refund...

Poll shows 46% of Americans support Biden's infrastructure plan

A Reuters/Ipsos poll, conducted earlier this month, asked Americans’ opinion on President Biden’s American Jobs Plan as well as several individual infrastructure proposals. It found that 46% of Americans support the plan. A previous poll fielded March 31-April 1, 2021, right after details of the package were released, found that 45% of Americans supported the $2 trillion infrastructure and economic recovery package.

The results of the poll showed that 38% of participants are "strongly in favour of increasing taxes on the highest-earning Americans to pay for infrastructure improvements".

Where is my $600 second Golden State stimulus check? How can I track its status?

Where is my $600 second Golden State stimulus check? How can I track its status?

On 13 July, California Gov. Gavin Newsom signed a law that will allow for the sending of the second round of direct payments. Those who received a check during the first round are not eligible for a second. However, taxpayers in the care of children are able to receive an additional $500 payment.

At the signing event, which focused on various pieces of legislation, in addition to the direct payments, Gov. Newsom said, “California is roaring back from this pandemic because we have your back.”

Payments are expected in September. Read our full coverage for the steps you need to take to receive yours.

Why should some families opt out of the advance 2021 Child Tax Credit payments?

The deadline to opt-out of the Child Tax Credit payments is approaching.

CTC payments are monthly but not mandatory, we take a look at why some families are choosing to delay payment of the credit.

Senate Democrats discuss $3.5 trillion spending package

Senate Democrats met with President Biden for lunch in the Capitol on Wednesday to discuss some of the points in the proposed $3.5 trillion spending package. The proposal would expand Medicare to cover dental, vision and hearing services for senior citizens. Also included are provisions for paid family and medical leave and affordable housing. "This is a huge bill, a complicated bill. This is a transformative bill. In some cases, it doesn’t provide all the funding that I would like right now," Bernie Sanders told reporters after the meeting.

2021 Child Tax Credit will provide financial stability

Some 36 million families will see payments begin to arrive in the coming days in their bank accounts or in the post. The IRS is set to disburse the first of the monthly payments today (15 July) and depending on how you got your tax refund will determine how the agency will send those payments.

You can check the IRS 2021 Child Tax Credit website for the credit to see whether you were automatically registered. If you are scheduled to receive a paper check, which will take longer to receive, you can update the payment method to direct deposit for the August payment using the Manage Payments portal.

Parents will receive up to $300 per month per child under 6 and $250 for each child 6 to 17, to help with the day to day costs of raising their children.

Dems to extend expansion of Child Tax Credit

Although still a work in progress, details of the Democrat-only "soft" infrastructure bill are coming out. The $3.5 trillion spending proposal would include parts of President Biden's American Jobs Plan that left on the cutting room floor when a bipartisan group of 21 senators found a $1.2 Trillion compromise proposal for "traditional" infrastructure.

The sweeping bill would also include all the major proposals from the American Families Plan. One of which is the extension of the 2021 Child Tax Credit, but for how long is uncertain. The overall price tag of the bill will determine whether the changes will be until 2025 at least, which Biden has asked for. Democrats would like to make the changes permanent but that doesn't look likely at this time.

More than 2 million Kentucky, Indiana families are eligible for the expanded Child Tax Credit. The Kentucky Center for Economic Policy estimates that more than one million children and families in the state are eligible for CTC. “More than 46,000 families in Louisville will receive up to $300 per month per child for the rest of 2021 and even more when they file their taxes next year,” Democratic Rep. John Yarmuth explained, adding that he hopes that both the monthly payments and increased amount of money per child will be extended beyond 2021.

$3000/$3600 Child Tax Credit 2021: How to calculate how much money will I receive

The first payment of the expanded Child Tax Credit, worth $250 and $300 per child will hit bank accounts from today, Thursday 15 July, we take a look at how to calculate your payment.

$3000/$3600 Child Tax Credit eligibility: Who is getting it? How to know if I qualify

From today, the IRS will start sending a new series of direct payments to around 39 million American families and 65 million children. With just hours before the first batch of advance 2021 Child Tax Credit payments are made, families are still trying to find out if they are eligible.

When will the $3,000 to $3,600 Child Tax Credit money be sent?

The Internal Revenue Service will begin sending monthly advance payments on the expanded 2021 Child Tax Credit from today, Thursday 15 July, either as a direct deposit or a paper check. Although the money is leaving the IRS, depending on how you will receive the money will determine how long you have to wait to actually be able to use it.

Biden wants to extend expanded Child Tax Credit into next year

The Biden administration is looking at prolonging the expandedChild Tax Credit into 2022. Changes to CTC were made as part of the American Rescue Plan. The first payments will go out to day and run monthly until December. However, the president is hoping to extend CTC for four years, until 2025 and eventually make it permanent. "There's no disagreement on that the ultimate goal is for this to go on indefinitely," a senior official explained.

Caregivers want to be included in infrastructure bill

The White House and Democrats have been pushing to include care work as part of their infrastructure bill. They argue that this “non-traditional” type of infrastructure helps those with family members that need taking care of get to work just as a highway or commuter system.

Caregivers would welcome more protections and better working conditions. According to ZipRecruiter over half the workers in the industry earn less than $26,000 annually, the average wage is $12 per hour.

Do you have to pay back the Child Tax Credit 2021?

Starting from today, Thursday 15 July, millions of American families will receive federal financial support in the form of direct payments to help covering the costs of raising children. The payments are an advance on the 2021 Child Tax Credit greatly expanded in the American Rescue Plan passed in March by Democrats.

Unlike the stimulus checks paid out over the past year, the new advance payments on the Child Tax Credit will have to be repaid if you get more than you are eligible for.

Stimulus check live updates: welcome

Hello and welcome to our daily live blog for today, Thursday 16 July 2021, bringing you updates on a possible fourth stimulus check in the US.

We'll also provide you with information on the third round of stimulus checks, which began going out in March as part of President Biden's American Rescue Plan, in addition to news and info on other economic-support programs such as the new, expanded Child Tax Credit.

- Joseph Biden

- Washington D.C.

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- IRS

- Unemployment compensation

- Child benefits

- Unemployment

- Social support

- United States

- Inland Revenue

- North America

- Employment

- Money

- Payment methods

- Social policy

- Credits

- Public finances

- America

- Banking products

- Work

- Bank

- Finances

- Society

- Politics