Fourth stimulus check | News summary for 16 July

Latest news and information on related benefits from President Joe Biden's coronavirus relief bill, and updates on a potential fourth direct payment.

Show key events only

US stimulus check and Child Tax Credit latest news | 16 July 2021

Headlines:

- Infrastructure disruption | AOC warns progressives could "tank" infrastructure bill if tax changes are not included

-Paying the price | Shoppers hit by Consumer Price Index increase, what is driving up prices? (Full story)

-CTC expansion | Families with 17-year-old children are now eligible for the Child Tax Credit. (Full story)

- Unemployment | States ending federal benefits see a slower decrease in unemployment and a look at what states will be ending benefits next.

- New CTC begins | The first payments of the Child Tax Credit have been sent (Full story)

Useful information / links

Child Tax Credit | need to calculate your payments or opt-out?

-Mortgage rates fall: Is now the time to refinance? (Details)

- Everything you need to know about the Golden State Stimulus Check:How to apply and are undocumented residents eligible?

-Child Tax Credit is there a limit on the number of children? (details)

- Still waiting for your tax refund?So are millions of other Americans. Should you update your tax return information? Find out when to contact the IRS.

Take a look at some of our related news articles:

A busy week for the IRS

The Internal Revenue Service had a busy week but it put a smile on a lot of people's faces.

On Tuesday the agency got another batch of long-awaited tax refunds out to 4 million Americans who had claimed income from unemployment benefits in 2020 and filed their taxes early. Due to changes to the tax code mid-tax season, those individuals were given a potential $10,200 tax break on that income in the American Rescue Plan. Unfortunately, they had to wait months for their return in some cases.

The other big roll out this week was the advance payments on the 2021 Child Tax Credit. The first of six monthly payments this year began hitting bank accounts on Thursday. The average parent received a $423 payment to help with thee cost of raising their children.

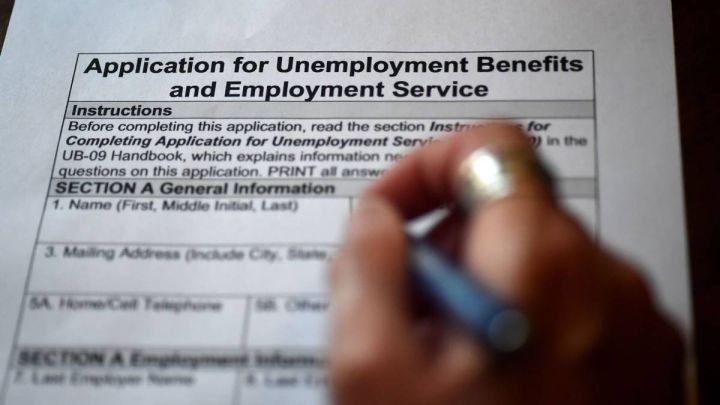

What states have ended federal unemployment benefits and are more people working?

The US Bureau of Labor Statistics released its report on state employment numbers on Friday showing that half the states had job growth, while one lost jobs from May to June. The remaining states and the District of Columbia saw no significant change in employment.

All but two of the states that announced they would end one or all of the federal pandemic employment programs early have now done so, while one has reinstated them under court order. Despite jobless claims falling in states that have ended the federal programs, the expansion of new hires is still lagging in nine of them and Alaska lost 2,700 jobs last month.

Read our full coverage for more details.

Center of Budget and Policy Priorities take a deep dive into SNAP benefits and find that the program "lifts millions out of #poverty &improves food security, but it's relatively modest benefits — which are based on an outdated model & averaged less than $1.40 per person per meal — may not be enough to meet the needs of America’s poor.

How have average hourly earnings changed over the last year?

New data from the BLS, shows that earnings increased around 1.7% over the last 12 months.

How many unemployment benefit claims have been made in the last week?

The Department of Labor has released data on unemployment claims for the week ending on 10 July. The weekly release shows that "initial claims was 360,000, a decrease of 26,000 from the previous week's revised level." This figure is the lowest since 14 March, where claims began to spike as the pandemic led to a massive wave of layoffs.

Additionally, the total number of people claiming benefits for 3 July was "3,241,000, a decrease of 126,000 from the previous week's revised level." This too was the closest level seen to pre-pandemic claims made.

States that saw the largest increase in initial claims were, "Pennsylvania (+5,296), New York (+4,730), Texas (+4,645), and California (+2,588)." Those that saw the largest decrease were, "Oklahoma (-2,461), Massachusetts (-1,778), Washington (-1,596), Connecticut (-1,563), and Virginia (-1,371)."

Deputy Secretary of the Treasury, Wally Adeyemo, visited Huston today to speak about the enhanced Child Tax Credit. Payments for the credit began on 15 July, with the first batch being sent to around 35 million families.

In order for the changes to have the intended outcome of bringing child poverty rates down, the government must ensure that the most economically vulnerable families are registered. These families could be left out because the IRS uses tax information to distribute the payments and many of them may not be required to submit a return.

To garner more support for the Bipartisan Infrastructure plan, Secretary of Transportation, Pete Buttigieg took a trip to Chicago to speak about the measures included in the package.

During his comments, he thanked the members of the House of Representatives who have passed major legislative packages that have allowed public transit systems, like the CTA, "going."

What private sector actors support the bipartisan infrastructure plan?

Big tech companies have begun throwing their support behind the infrastructure package that has support from both parties.

The Internal Revanue Service announced that Child Tax Credits payments worth $15billion, were sent to 35 million families. Of the checks, 86 percent were made through direct deposit.

Read our coverage on the Child Tax Credit to answer some of the more frequently asked questions.

Mortgage rates fall: Is it a good time to refinance my mortgage?

Mortgage rates fall: Is it a good time to refinance my mortgage?

The average interest rate for traditional 30-year mortgages decreased to 3.09% last week, the lowest level since February, from 3.15% the prior week.

Rates continued to fall across the board this week for different length mortgages, except for a 15-year fixed-rate mortgage. All fixed-rate mortgages have decreased in interest in comparison to this time last year.

Read our full coverage for more information on the mortgage market.

Did states ending federal unemployment benefits see decreases in June?

Did states ending federal unemployment benefits see decreases in June?

In May, as the national vaccination campaign picked up speed and more businesses started to reopen, many Republican governors began to announce that they would end the payments of federal unemployment benefits.

Since Montana and Carolina became the first states to make the change, over twenty others have followed, including Louisiana, led by the only Democrat.

Since April, these more states planning to end benefits have seen an increase in their unemployment rate. Eight states have all seen increases, while four states -- Kansas, Vermont, Illinois, and Michigan -- that will continue the payments have had their unemployment rates rise.

Read our full coverage for which groups of states saw a larger decrease in unemployment; the answer may surprise you!

What does an increase in the Consumer Price Index mean?

What does an increase in the Consumer Price Index mean?

Shoppers across the country are asking, what is driving up prices so much?

To protect against inflation and monitor the stability of the economy, the US Department of Labor tracks an indicator called the Consumer Price Index (CPI). The CPI "measures the change in prices paid by consumers for goods and services.”

The Bureau of Labor Statistics, which calculates the CPI, has released the June data showing that consumers pay around 2.4 percent more for food and almost five percent more for appeal than their levels a year ago.

Read our full coverage for more details on what goods have seen the sharpest increase in price as well as a fruit with a surprisingly high price tag.

Which states have resumed unemployment payments as the lawsuits increase?

Which states have resumed unemployment payments as the lawsuits increase?

Jobless residents in two states will be able to keep their additional unemployment benefits payments after courts ruled that their states could not deny them access to the federal support.

Unemployed workers in Maryland did not have their payments lapse, while out-of-work residents in Indiana are expected to regain the $300 per week additional payments on Friday 16 July. In both cases the states’ Republican governors has attempted to move forward the finish date of the programme from 6 September to 3 July, citing concerns that the federal support was discouraging residents from seeking work.

Read our full coverage for more details.

Which states saw the largest decrease or increase in unemployment in June?

States that are cutting unemployment benefits are bolded.

Largest Increases.

.2% -- Ohio and Kansas

.1% -- Maryland, Mississippi, Illinois, Iowa, Montana, South Dakota, Vermont, Arizona, Florida, Indiana, Missouri, and New Jersey

Largest Decreases

3% -- Hawaii

.2% -- Louisiana, Connecticut, Oklahoma, West Virginia, District of Columbia, North Carolina, Oregon, Virginia

Read full report here.

Golden State Stimulus checks will widen eligibility requirements

The first round of Golden State Stimulus checks was only sent to low-income residents, typically those who receive support from the state's CalEITC programme. However, after reporting a record-breaking budget surplus on 2020-21 Gov. Gavin Newsom has announced the introduction of a new bill which will send stimulus checks to two-thirds of Californians.

For more info, check out Who will receive the Californian stimulus check?

$3000/$3600 Child Tax Credit 2021: How to calculate how much money will I receive

The American Rescue Plan was passed in March and brought about a complete overhaul of the Child Tax Credit. Rather than being a non-fundable credit for those above a certain income, the credit is now fully refundable and is worth up to $3,600 per child for some families.

Before the changes made under the trillion-dollar stimulus legislation, the credit would be sent with a taxpayer’s refund and was only worth a maximum of $2,000 per child. So how much should you be getting from the Child Tax Credit? Use this handy calculator to find out...

Child Tax Credit brings financial relief

This report from CNN speaks to a family of six who have recently received the Child Tax Credit. Margaret McGaw Sulivan says that they will use the money to cover the cost of essentials like mortgage repayments and utility bills, adding that the household budget has been particularly stretched during the pandemic.

Do you have to pay back the Child Tax Credit 2021?

Yesterday millions of American families started to receive federal financial support in the form of direct payments to help covering the costs of raising children. The payments are an advance on the 2021 Child Tax Credit, a programme greatly expanded in President Biden's American Rescue Plan.

The Child Tax Credit has been around since the late 1990s and was normally claimed by families as a single annual tax credit when they reported their tax burden. The overhaul of the Child Tax Credit created a monthly payment scheme whereby parents would receive installments on the credit throughout the year.

However this opens the possibility that some parents may have to repay them at a later date if their household income increases. Here's everything you need to know...

Concern that Child Tax Credit is not reaching the most vulnerable children

A White House insider has told the Washington Post that the administration is concerned that many low-income families will not be reached by the new Child Tax Credit because they have not filed taxes. For most eligible households the money will arrive automatically but those who do not usually file taxes, typically because they do not earn enough for it to be required, had to register separately.

The new Child Tax Credit programme had been hoped to halve the number of children in poverty but for now the IRS is having trouble even reaching these families.

Biden priases "transformative" effect of new Child Tax Credit

The introduction of the new Child Tax Credit payments has been met with praise from Democrats with President Biden holding a White House press conference to extoll the virtues of the new programme. He has already made steps to extend the one-year programme through 2025.

Biden's Treasury Secretary, Janet Yellen, also released a statement saying: "For the first time in our nation's history, American working families are receiving monthly tax relief payments to help pay for essentials like doctor's visits, school supplies, and groceries."

Can undocumented people receive the second Golden State Stimulus check in California?

Last week Gov. Gavin Newsom signed California's 2021/22 budget into law, which included funding for the biggest recovery package in the Golden State’s history: the California Comeback Plan. Newsom said the state was focusing on “taking on the inequities laid bare by the pandemic, expanding our support for Californians facing the greatest hardships, increasing opportunity for every child, confronting homelessness head-on.”

The $100 billion package builds on the Golden State Stimulus bill which was passed earlier this year. Roughly two-thirds of all residents are now thought to be eligible for the Golden State Stimulus checks, but does this include undocumented workers and their families?

How are families using the new Child Tax Credit?

With the first round of payments from the new Child Tax Credit going out yesterday, we are starting to see what impact the support will have on American families. This report from NBC News recounts the story of single mother Sasha Dempski in Arkansas who lost her job while suffering with covid-19 earlier this year.

Child Tax Credit expansion is "a big effin' deal"

Echoing the language used by Vice President Biden when he congratulated President Obama on the introduction of the Affordable Care Act, Sen. Chuck Schumer is passing on the same sentiment to Biden now.

The expansion of the Child Tax Credit has long been a focus for some progressives in the Democratic Party but had failed to win the mainstream support required to become a reality. Schumer himself has spoken publically about his desire to see the new Child Tax Credit extended, one of Biden's main priorities for the new infrastructure package.

Is there a limit of children a family can claim for the $3,000 to $3,600 Child Tax Credit?

The American Rescue Plan, President Biden’s first large-scale stimulus bill, included substantial changes to the Child Tax Credit. Among those changes, the age of qualifying children was raised to 17, the earnings floor was abolished and the whole of the credit was made refundable to ensure that low-income households will not lose out.

The new programme is going to very lucrative for American families and there are already plans in place to see it extended through 2025. But are there limits on how much a family can receive from the new payments?

Child Tax Credit arrives; how are people using them?

Yesterday was an historic day as the first batch of Child Tax Credit monthly payments was sent out, the first large-scale programme of its kind in the United States. The new support has been expected to halve the number of children living in poverty across the country and it is clear to see how important the payments will be to millions of American families.

Here, the Washington Post's economic reporter Jeff Stein speaks to a single mother from Philadelphia to discuss how the Child Tax Credit payments will affect her and her family's life.

Did stimulus checks spur new entrepreneurial boom?

Figures published by the New York Times suggest that each of the three rounds of stimulus checks has been followed by an uptick in business registrations in New York state. This seems to suggest that the stimulus payments have allowed people to make the plunge and start a new business, even during a pandemic.

For balance it should be added that there was a significant fall in registrations at the start of the pandemic, which would likely have led to more businesses popping up in the future as the US' economic recovery continued.

Keep an eye out for Child Tax Credit payments

The IRS confirmed yesterday that around 35.2 million families across the United States had been sent a direct payment as part of the new Child Tax Credit, which came into effect on 15 July. The new system is unlike anything that had gone before and the White House is extremely optimistic about the impact that the programme could have.

However because the payments are new, some recipients are unsure what they will look like. If you're not sure, check you bank account for a recent payment entitle 'CHILDCTC'.

Stimulus & Child Tax Credit: the similarities

There are some similarities between CTC money and stimulus checks. In both cases, there are no spending restrictions. Furthermore, households will receive the money if they fall under a certain income limit. The IRS determines stimulus checks and CTC payouts using tax-return data.

The income limits for full payment are the same for stimulus-check money and expanded CTC payouts. The thresholds are $75,000 a year for individuals, $150,000 a year for married couples filing jointly, and $112,500 a year for people like single parents who are filing as Head of Household.

In both cases, the IRS is looking at whichever recent tax return is available in a two-year window. For the third round of stimulus checks and the CTC, the tax collection agency is looking at 2020 returns, or 2019 returns if this year’s return isn’t yet available.

Andrew Keshner explains more.

Watch out, stimulus scammers are about

With the launch of the new Child Tax Credit, the IRS are quick to remind us that there will always be criminal looking to take the money away from those who deserve it.

Always access your details through official channels.

New Child Tax Credit: payments are go

Tens of millions of families have been sent the first payment of the expanded child tax credit, the Internal Revenue Service and the Treasury Department said on Wednesday night. The beefed-up credit will provide them with extra funds each month through the end of 2021 along with a tax break next year.

As we've been reporting, the payments were approved as part of the Democrats' $1.9 trillion stimulus package that President Joe Biden signed into law in March. The first installment totaled $15 billion.

The infusions may offer the greatest benefit to low-income families, cutting child poverty nearly in half - but the extra cash will also go to better-off American families.

Here are some early reactions from parents, brought to you by CNN.

Minimum wage not enough in housing world

The federal minimum wage is $7.25, and has been since 2009, and there isn’t a single of the more than 3,000 counties nationwide in the US where a person working full-time on a minimum wage can afford a two-bedroom rental. In just 218 counties, or 7 percent of counties nationwide, that same worker could afford to rent a one-bedroom abode.

This is according to a new report from the National Low Income Housing Coalition.

Full details on this story brought to you by Anna Bahney

Is there a limit of children a family can claim for the $3,000 to $3,600 Child Tax Credit?

Families large and small that meet the income eligibility requirements will be able to claim the expanded Child Tax Credit in 2021 for each of their young ones. Each child under six at the end of the year could be eligible for up to $3,600, and those six through 17 at the end of 2021 could be eligible for up to $3,000.

The American Rescue Plan, President Biden’s first major legislative initiative as part of his Build Back Better program, included substantial changes to the Child Tax Credit. Among those changes, the age of qualifying children was raised to 17, the earnings floor was abolished and the whole of the credit was made refundable.

Greg Heilman brings you all the latest.

AOC threatens to "tank" infrastructure bill without reforms

Speaking at a virtual town hall event US Representative Alexandria Ocasio-Cortez made the Progressive caucus’ intentions known, that if there isn’t the Democrat-only reconciliation bill alongside the bipartisan infrastructure bill they will “tank” the latter. The threat is valid given Democrats’ slim margin in the House.

The current proposal for the Democrat caucus reconciliation bill would include all of President Biden’s major proposals from the American Families Plan, including extending the changes to the Child Tax Credit beyond 2021. As well there would be immigration reform and action on climate change. If any of those proposals get watered down that would put the bipartisan bill at risk as well.

“If they approve our reconciliation bill we will approve their bipartisan bill,” Ocasio-Cortez said. “And if they try to strip immigration reform, if they try to, you know, claw back on childcare, climate action, etc., then we’re at an impasse, it’s a no go.”

Biden "still has confident" on infrastructure plan

President Biden say he is "confident" he can get what he proposed on infrastructure passed through Congress and that he "trusts" the Republican senators who have made a committment.

"They are men and women of honor," he added, no doubt hoping to nudge their sense of duty.

President Biden's drive towards economic recovery?

In an address earlier this month, the US President spoke about the Executive Order he would be signing to promote competition. The order would impact three major sectors: pharmaceuticals, agriculture and technology.

In his address, President Biden stated that he hopes this action will "lower prices and increase wages, and takes a critical step to create an economy that works for everybody."

Read more about the Executive Order here and watch him speak below.

Can undocumented people receive the second Golden State Stimulus check in California?

California Gov. Gavin Newsom signed the state’s 2021/22 budget into law earlier this week, which included funding for the biggest recovery package in the Golden State’s history: the California Comeback Plan.

Upon passing the new budget, Newsom said the state was focusing on “taking on the inequities laid bare by the pandemic, expanding our support for Californians facing the greatest hardships, increasing opportunity for every child, confronting homelessness head-on.”

Will Gittins brings you the latest.

Schumer stance stings senators

The Hill reports that Republican Senators are far from happy after Senate Majority Leader Chuck Schumer plays "hardball" to get the bipartisan infrastructure package finalized.

Schumer announced on the Senate floor Thursday that he will force a key test vote on Wednesday where he will need at least 60 votes to advance the shell legislation, meaning the support of 10 Republicans if every Democrat also goes along with the strategy. If Republicans agree to start debate, they could then substitute in the bipartisan text when it’s done.

Do you have to pay back the Child Tax Credit 2021?

The 15 July arrived yesterday and that started the process of millions of American families receiving federal financial support in the form of direct payments to help covering the costs of raising children. The payments are an advance on the 2021 Child Tax Credit greatly expanded in the American Rescue Plan passed in March by Democrats.

The Child Tax Credit has been around since the late 1990s and was normally claimed by families as a single annual tax credit when they reported their tax burden. The overhaul of the Child Tax Credit created a monthly payment scheme whereby parents would receive installments on the credit throughout the year.

A question that we are often asked, however, is whether or not is has to be paid back. Here we provide you with all you need to know.

Stimulus check live updates: welcome

Hello and welcome to our daily live blog for today, Friday 16 July 2021, bringing you updates on a possible fourth stimulus check in the US.

We'll also provide you with information on the third round of stimulus checks, which began going out in March as part of President Biden's American Rescue Plan, in addition to news and info on other economic-support programs such as the new, expanded Child Tax Credit.

- United States

- Inland Revenue

- North America

- Employment

- Money

- Payment methods

- Social policy

- Credits

- Public finances

- America

- Joseph Biden

- Banking products

- Work

- Bank

- Finances

- Society

- Politics

- Washington D.C.

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- IRS

- Unemployment compensation

- Child benefits

- Unemployment

- Social support