Money and finance news summary | 30 January 2022

Tax season is here as inflation continues to keep prices high, and the market struggles to stabilize after the Omicron variant. Here is the latest news you need.

Show key events only

Personal finance and money: live updates

Headlines

- Private industry wages and salaries up 5% in 2021, but when adjusted for inlfation are down 1.9% (BLS)

- New parents in the US could received increased refunds this tax season.

- A fourth stimulus check doesn't look like happening: here's why.

- Inflation could impact your taxes this year: how?

- A look back at all President Biden's comments on student loan cancellation.

Helpful information & links

Tax season

- IRS encourages Americans to file taxes early and electronically, warns of refund delays

- What is the Letter 6419?

Child Tax Credit

-How many enhancedChild Tax Credit payments were there?

Unemployment benefits

- Are any US states offering unemployment insurance extensions?

Payments and interest on federal student loans have been on pause since the covid-19 pandemic started; those with private student loans haven't been so lucky.

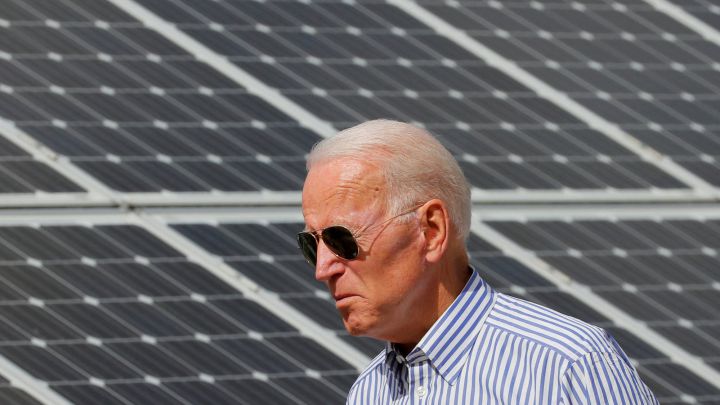

Why don't Senators Manchin and Sinema approve of the Build Back Better bill?

With negocations having ended in December, and Biden announcing that Democrats may look to break up the Build Back Better bill to pass certain measures... many are wondering if it is possible the bill could be saved.

Social security benefits are received by millions in the United States and for many it is their only source of income. Once retirees begin to claim benefits, they will not be able to work at the same levels they had as or they risk jeopardizing their benefit amount.

During tax season those who receive social security will have to calculate their combined income. This figure income includes the adjusted gross income (i.e. wages, salary, investments) and social security benefits as well as some types of non-taxable interest. After determining this amount, a beneficiary will know whether they need to pay taxes or not.

Could lawmakers rally around an alternate Child Tax Credit expansion

Most of the key provisions of President Biden's agenda when he came into office are packed into the Build Back Better Act. One add-on that progressive Democrats convinced the White House to include the Child Tax Credit expansion has garnered many new adherents. Those advocates want to see the changes continue, which included monthly advance payments.

However, the extending the enhanced Child Tax Credit is one of the reasons the Build Back Better Act hasn't gotten through the Senate. But what if there was another way that could get bipartisan support? Perhaps Mitt Romney's proposal from last year could do the trick.

There are trade-offs for both sides of the aisle, but its worth a gander.

Depending on their income, beneficiaries have to pay federal taxes on a portion of income from Social Security. There are twelve states in 2021 that also tax Social Security benefits.

The formula for how Social Security benefits are taxed vary from state to state.

Social security benefits are received by millions in the United States and for many it is their only source of income. Once retirees begin to claim benefits, they will not be able to work at the same levels they had as or they risk jeopardizing their benefit amount.

With tax season here, many on social security are wondering if their benefits are taxable. The answer depends on your combined annual income..

An arguement for universal basic income

The enhanced Child Tax Credit when implemented in July last year was seen as a kind of scale model of universal basic income. Over six months eligible households, around 35 million, received monthly installments of up to $300 per child on the 2021 Child Tax Credit. Extending the changes for 2021 is a key priority for Democrats and was included in the Build Back Better Act.

However, the Child Tax Credit extension is one of the provisions that is keeping the bill from passing the Senate where it has languished since November. Senator Joe Manchin objects to the cost of the measure over the longrun and worries that it isn't targeted. He has further concerns about how recipients will spend the money and its effect on inflation.

Critics of the policy say that it will keep people at home, chosing to collect the money and not work or work less. The last, working less, isn't such a bad idea in the opinion of Tim O'Reilly, author of "WTF: What's the Future and why it's up to us" a Wall Street Journal bestseller. He discusses the potential of universal basic income.

What is in the Build Back Better Act? Find out

The Build Back Better Act passed by the House of Representatives in November, and awaiting a vote in the Senate ever since, is a sweeping bill containing many of the remaining key priorities for the Biden administration. The sheer size and complexity of the bill can be hard to wrap one's head around. A CBS/YouGov surveyin October found that only 10 percent of respondents knew many of the specifics.

Some of the most popular parts of the bill include the expansion of Medicaid, allowing Medicare to negotiate drug prices, and funding for more affordable housing. One of the key priorities for the White House and Democrats is the extension of the enhanced Child Tax Credit, but President Biden admitted that it may not make it into a final version of the bill.

To raise the public's awareness of the numerous policies in the legislation, Indivisble provides this explainer of the Build Back Better Act. They also provide a way for you to contact your Senator to make your voice heard.

Budget surpluses could see states sending residents tax rebates

Several states had unexpected budget surpluses again in 2021 and are thinking about sending their residents a protion of that money. Where the tax rebate isn't mandated by state laws on budget surpluses, the proposals are being put forward as a way to help residents deal with the continuing covid-19 and high inflation which doesn't appear to be slowing. Forbes takes a look at the various proposals around the nation.

Families and businesses begin to feel the abscence of Child Tax Credit payments

The American Rescue Plan enhanced the Child Tax Credit which has been around for nearly three decades in a few specific ways besides increasing the amount households could claim per child.

It removed the earnings floor of $2,500 to begin to claim the credit, the amount a taxpayer was eligible for increased with the amount they earned to a maximum of $2,000 per child. At the same time it made the whole of the credit refundable, so that parents could receive the full credit even if they had no "earned income." These two features greatly expanded access to the tax credit to lower income families and non-traditional families such as those where the grandparents, who don't have earned income, are raising their grandchildren.

A major change to the credit was the creation of a monthly advance payment scheme which began in July last year and ran for six months. Those payments began as many families were beginning to run out of funds from the third round of stimulus checks and just weeks before enhanced unemployment benefits expired.

The payments stopped in December when the Build Back Better Act failed to pass the Senate before the changes expired. The lack of a monthly booster is now being felt not just by families but also businesses. Families who couldn't afford daycare, after receiving the financial aid enrolled the children in daycare.

However now that the payments have stopped parents have had to make hard choices on limited budgets and pulled the children out. Many are choosing to not work and stay at home with their kids instead.

Tax season 2022: filing deadline

A reminder that the deadline by which most taxpayers in the US must file their tax return for the 2021 tax year is 18 April 2022.

There are exceptions, though. For example, filers in the states of Maine and Massachusetts will have until 19 April, because of the Patriots' Day holiday in those states.

Take a look at the IRS' fact sheet on when you have to file by

The stimulus bill passed by Democrats last spring enhanced several tax provisions that could see families with children receive larger refunds.

Make sure you report cryptocurrency activity in tax return

Hiding cryptocurrency activity on your US federal tax return can lead to stiff penalties, tax specialist Ryan Losi has told CNBC.

Taxpayers will have to answer a yes-or-no question early in their tax return on whether or not they need to declare activity with virtual currency in 2021.

If you mark ‘no’ when it should be a ‘yes’, “that’s where the hammer comes down because they can say that you lied on a government document under penalties of perjury,” Losi said.

“You’re playing with fire if you don’t report it,” another tax expert, David Canedo, told CNBC.

Graduates across the United States have amassed a combined student loan debt of more than $1.75 trillion and some lawmakers want to see the majority of it cancelled.

Tips for avoiding delays in the processing of your tax return

To avoid delays in having your return processed in tax season 2022, the IRS is recommending that US taxpayers file early and electronically.

The agency also urges Americans to avoid common errors that lead to hold-ups, such as listing your name and Social Security Number exactly as they appear on your Social Security card.

To help you fill out your tax return, the IRS has prepared an info sheet on avoiding common errors.

Unlike the cash or credit cards you carry around in your wallet using cryptocurrencies for day-to-day transactions isn’t straightforward. For those merchants that don’t want to hold onto digital coins some payment platforms have solved the problem.

One major reason that cryptocurrencies aren’t widely accepted for payment is that they can be a risky asset to have with the frequent fluctuations in value. That has been shown once again recently with Bitcoin, the dominant cryptocurrency dropping to its lowest level since last summer.

AS USA's Greg Heilman has the full lowdown on payment in cryptocurrencies in the US

There have been three federal stimulus checks in the US since the start of the covid-19 pandemic.

Tax season 2022 got underway earlier this week and the IRS is hoping that this year’s tax filing goes more smoothly than the previous two. Tax returns submitted in 2020 and 2021 were disrupted by the pandemic and the IRS has acquired a backlog of more than six million unprocessed filings.

In order to work through that backlog efficiently IRS chief Charles Rettig has called on filers to submit their tax returns using the e-Filing online system. The tax agency is also sending out letters to households who received Child Tax Credit payments or stimulus checks during 2021, advising them how to include the payments in their return.

However the IRS has admitted that some versions of the Letter 6419, sent out to Child Tax Credit recipients, include mistakes that could affect your filing.

While previous waves of the virus have been associated with a discussion of another round of stimulus checks, a fourth one will not be coming. This comes as many households feel with the effects of historic inflation and the vast majority of economic programs to support households have expired.

There has been no noise out of the Biden administration on the matter for some time as the president's hopes are pinned upon passing his Build Back Better legislation. That was supposed to include lots of support for families affected by covid-19, but is no closer to being passed than when it was first mooted in March 2021.

Money and finance live updates: welcome

Hello and welcome to our personal finance live feed for Sunday 30 January 2022, bringing you the latest updates on direct payments and other forms of financial relief available in the United States. We'll also keep you updated with the information you need on tax season 2022.

- IRS

- Joseph Biden

- Washington D.C.

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Child poverty

- Covid-19 economic crisis

- Science

- United States Congress

- Personal finances

- Unemployment

- Coronavirus Covid-19

- Economic crisis

- Inland Revenue

- Taxes

- United States

- Home economics

- Poverty

- Tributes

- North America

- Parliament

- Employment

- Childhood

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- Public finances

- America

- Economy

- Work

- Social problems

- Finances

- Politics

- Society