Personal finance news summary, Friday 18 March 2022

The latest updates and information on gas prices, plus breaking news on Social Security payments, the Child Tax Credit and tax season 2022.

Show key events only

Personal money and finance: live updates

Headlines:

- No federal tax filing extensionexpected for 2022

- Quit rates in 3 states rose in January, while 12 states saw a decrease

- Consumer Price Index continues its historic rise with inflation topping 7.9 percent over the last year.

- US stock market stays in the green this week after seeing weeks of losses in light of the Russian invasion of Ukraine

- Federal Reserve raises rates a quarter point, first of several rate hikes expected

Useful information

- How long does the IRS taketo process you tax return?

- Medicare:a brief history

- Does Social Security have a healthy future?

Related news articles:

Employer costs for employee compensation for civilian workers averaged $40.35 per hour worked in December 2021, the U.S. Bureau of Labor Statistics reported today. Wages and salaries cost employers $27.83 and accounted for 69.0 percent of total costs, while benefits cost $12.52 and accounted for the remaining 31.0 percent. Total employer compensation costs for private industry workers averaged $38.07 per hour worked in December 2021.

Wage and salary costs averaged $26.86 and accounted for 70.5 percent of employer costs, while benefit costs were $11.22 and accounted for 29.5 percent.

State and local government employer costs averaged $54.96 per hour worked. Wages and salaries averaged $34.09 per hour worked and represented 62.0 percent of total compensation costs, while benefit costs averaged $20.87 and accounted for the remaining 38.0 percent.

Within total benefits, supplemental pay costs averaged $1.21 per hour worked or 3.0 percent of total compensation for civilian workers, $1.32 per hour worked (3.5 percent) for private industry workers, and $0.52 per hour worked (0.9 percent) for workers in state and local government.

Maine's governor raises one-time direct payments $100 to help with inflation

On Friday, Maine Gov. Janet Mills announced changes to the supplemental budget proposal. Among them was a $100 boost to proposed one-time payments to residents in the state increasing the total amount to $850.

The governor proposed the higher amount after the Maine State Economist has estimated inflation will cost the average Maine resident more than $560 this year.

Michigan governor vetos Republican lawmakers' $2.5 billion in tax cuts

Like several states across the US, Michigan came out of the pandemic with an unexpected $7 billion budget surplus. Republican lawmakers, which control the Michigan Legislator, proposed a permanent state income tax cut along with a child tax credit and more deductions for seniors.

The veto had been expected by Gov. Gretchen Whitmer explaining that it would have robbed funding for essential government services and blown a hole in future budgets. Her administration points out that the current surplus is a one-off event and can't be expected down the road to support the $2.5 billion in tax cuts.

Russia's war in Ukraine will cause food inflation even after fighting stops

Even before Russia invaded Ukraine the numebr of people deemed food-insecure was at its highest level in a decade at 800 million. The two nations rank among the top five exporters of many oilseeds and grains. And Russia is the single largest exporter of ingredients needed to make fertilizers.

The conflict started by Russia will have consequences for food prices long after the fighting stops. But in the short-term can other nations make up for the loss of supply from the two nations.

American travel expenditures dropped by over half during covid-19 pandemic

The hospitality and leisure industries were and still are some of the most affected by the covid-19 pandemic. Data released by the US Bureau of Labor Statisitcs show the dramatic decline in consumers spending on travel going from on average from $2,100 in 2019 down to less than half that amount at $962 with the start of the covid-19 pandemic, a reduction of 56 percent.

2022 tax refunds 13 percent larger than last year

The Internal Revenue Service has processed almost 62 million 2021 tax returns as of 11 March. Of those over 45 million have received a tax refund totaling nearly $152 billion sent to taxpayers. Compared to this time last year refunds are 13 percent bigger than in 2021. The average refund going out is for $3,352 in 2022, $385 more than last year according to IRS data.

Long-term effects of novel covid virus produces Social Security headache

The covid-19 pandemic has claimed the lives of nearly 970,000 Americans, but according to a University of Michigan study 40 percent of those that have survived an infection have experienced "long covid". This is when patients experience new or persistent symptoms that occur four or more weeks after infection. For those that have been hospitalized for covid-19, more than 87 percent had at least one persistent symptom around 60 days on average after symptom onset.

Long covid for some is resulting in debilitaing conditions where they cannot make the most basic exertion of effort without becoming exhausted, their hearts flutter and they cannot remember basic words. Despite indepth medical testing, neurological exams, EKGs and chest X-rays come back clean. But objective medical test show these people are unable to perform work.

This is causing a novel problem, where these individuals are too sick to work according to the doctors treating them but they cannot meet the evidence threshold insurers and Social Security Administration demand to receive disablility benefits.

According to the Washington Post the Social Security Administration since the beginning of the pandemic the agency says it has received about 23,000 disability applications that include a mention of covid in some way.

For 2022, the IRS announced new tax brackets for those filing their taxes this year. This was announced at the back end of 2021, and there is much change compared to last year. This is due to the high inflation in the US, meaning the Treasury needs to keep tax as fair as possible.

Rouble stabilises near 104 vs dollar as central bank holds rates

Reuters - The Russian rouble eased slightly in light trading in Moscow on Friday, stablising near a psychologically important threshold of 100 against the dollar after the central bank opted to hold rates at 20%.

Russia's central bank kept its key interest rate unchanged on Friday, as predicted in a Reuters poll of analysts, following an emergency rate hike in late February designed to support financial stability.

The central bank warned of higher inflation and an economic contraction this year but did not give new forecasts.

Governor Elvira Nabiullina, who was nominated for another term by President Vladimir Putin earlier on Friday, will present the rate decision and shed more light on future steps at 1400 GMT, two hours later than originally scheduled.

By 1121 GMT, the rouble was 1.2% weaker against the dollar at 104.37 after earlier firming to 101.70, a level last seen on March 4. Against the euro, the rouble gained 0.1% to 113.81, small moves compared to recent wild swings.

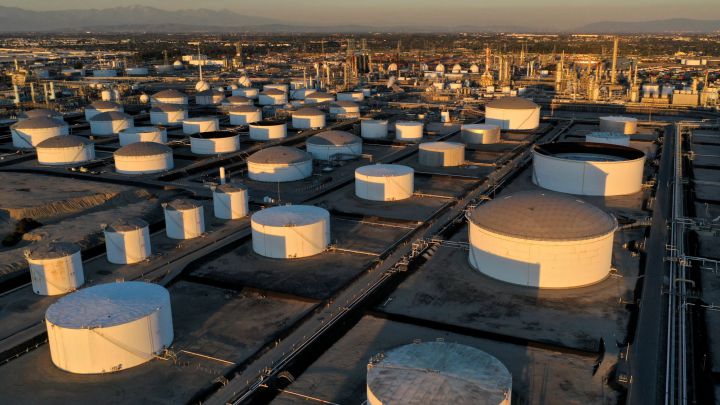

The modern world runs on energy either to produce electricity or to power motor vehicles. Many factors go into how the price is set for what we have to pay at the pump or on our electricity bill.

Although there is a push to find more sustainable ways to move our cars and power, all the things we depend on in our daily lives, fossil fuels still play an outsized role. The price of the raw material, whether crude oil or natural gas, influences how much you pay down the line as a consumer.

Press secretary takes aim at price gougers

I wanted to make a note on gas prices. Right now, oil prices are $94 per barrel. When oil was at this level one month ago, the average cost of a gallon of gasoline was $3.49. And yet now, the average cost of gas is $4.32.

When it comes to oil and gas prices, many accept that gas prices rise quickly but fall slowly — the so-called “rockets-and-feathers” phenomenon.

But President Biden rejects that. Americans deserve relief, and fast, as oil prices fall.

Retail gasoline prices are updated at least daily, and if gas retailers’ costs are going down, they need to immediately pass those savings onto consumers.

So, I will reiterate what the President said to oil and gas companies last week: The invasion of Ukraine and the volatility of the oil market is no excuse for excessive price increases, profit padding, or any effort to exploit American consumers. No one should capitalize on Putin’s aggression by taking advantage of American families.

Mortgage rates are on the rise

Americans will find it even harder to become homeowners.

Mortgage rates have hit 4%, the highest it's been in three years.

Child poverty on the rise

After payments for the child tax credit ended in December, more than 3.7 million children are living in poverty. The benefit was able to reduce the rate by 40 percent but with payments for the credit ending abruptly, many families are falling back into poverty.

Tax day, 18 April, is approaching quickly and after taxpayers have been offered an automatic extension the last two years, many are wondering if another may be coming.

To date, no extension has been announced and none are expected as there are not significant changes to the tax code or other disruptions that require a nationwide extension.

Lack of equal pay affects Social Security benefits and retirement savings

Social Security Administration bases the retirement entitlement on data gathered throughout your working life which is formed into an earnings record. This information is than used, with a three-part process, including

Average Indexed Monthly Earnings, Primary Insurance Amount and Age of claim, to calculate the size of payments.

The SSA uses your 35 best-paid years to calculate your Average Indexed Monthly Earnings but for women working right now they are only getting 83 cents on the dollar compared to men. That can have consequences down the road when they retire.

Fortunately, this year saw Equal Pay Day arrive earlier than ever falling on 15 March, with women closing the gap by a penny over last year. However, they still had to work 74 more days to earn what men did in 2021.

IRS 2020 tax return backlog will be cleaned up by the end of the year

IRS Commissioner Chuck Rettig spoke to the House Ways and Means Committee on Thursday on the state of the 2022 filing season. He said that the tax agency had gotten off to a "strong start" with respect to 2021 tax return processing and IT systems operations.

As of 11 March the IRS had processed 63 million individual tax returns, issuing 45 million tax reufnds for a total of $151 billion. The agency is focusing on processing those returns that will receive a refund over "paid in full" and those that have an outstanding liability.

When asked about the historically big backlog of 2020 tax returns that have yet to be fully processed the IRS had going into the 2022 filing season, Rettig said that it would be cleared "absolutely before December."

Photo by Emily Elconin via Reuters of IRS Commissioner Charles Rettig testifying before a House Ways and Means Committee.

Personal money and finance, live updates: welcome

Good morning and welcome to our daily finance live blog for Friday 18 March, focusing on the US. We'll be reporting on rising gas prices, providing useful information on tax season 2022, and bringing you updates on American economic support schemes such as Social Security and the Child Tax Credit.