Personal finance news summary: Saturday 19 March

The latest updates and information on gas prices, plus breaking news on Social Security payments, the Child Tax Credit and tax season 2022.

Show key events only

Personal money and finance: live updates

Headlines:

- Higher mortgage rates, prices weigh on US home sales in February

- All systems go for Fed's liftoff of interest rates

- No federal tax filing extension expected for 2022

- Quit rates in 3 states rose in January, while 12 states saw a decrease

- Consumer Price Index continues its historic rise with inflation topping 7.9 percent over the last year.

- US stock market stays in the green this week after seeing weeks of losses in light of the Russian invasion of Ukraine

Useful information

- How long does the IRS take to process you tax return?

- Medicare:a brief history

- Does Social Security have a healthy future?

Related news articles:

Three stimulus checks have been sent out by the US federal government during the coronavirus pandemic.

Despite the turmoil in markets and commodities surrounding the Russian invasion of Ukraine, the warning signs are yet to appear in US unemployment data. Recently released, it shows more than 678,000 jobs were created in the month of February, 200,000 more than the 467,000 added in January. Promisingly, the number of people receiving benefits fell to 1.419 million people, the lowest since 1970.

IRS reminds filers that the American Rescue Plan changes may benefit

With the child and dependent care credit increasing 2021, the Internal Revenue Service advises filers to a look at #IRS Pub. 503 to see how the American Rescue Plan changes may benefit you when filing the tax return.

Inflation key to interest rate lift

Inflation is now the motivation for the raise as the Fed's preferred gauge of price pressures is currently increasing at an annual rate that is triple the central bank's 2% target, and the environment of war, rising energy costs, and climbing wages has drawn parallels to the 1970s and early 1980s when the Fed pushed the economy into recession to break the cycle.

If the Coronavirus pandemic led to unpredictable economics, developments in Europe have made the situation almost Byzantine when it comes to forecasting.

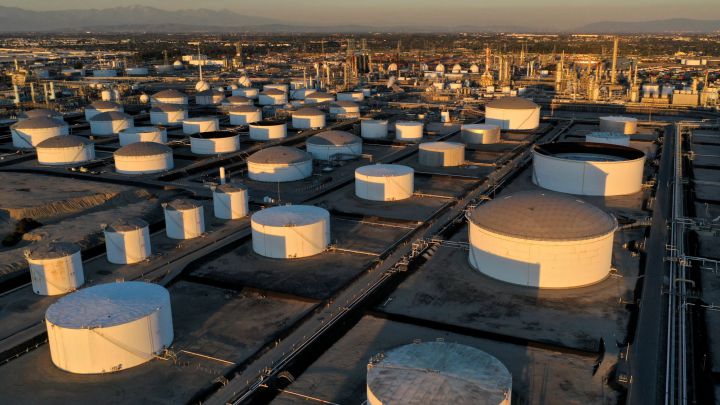

The price of U.S. West Texas Intermediate crude, for example, rose about 33% to $123 a barrel in the days following Russia's Feb. 24 attack on Ukraine. On Tuesday, it had fallen back to about $95 a barrel, near where it was before the war.

But that decline was driven largely by new coronavirus-related lockdowns in China that could cause economic problems of their own - including more inflation.

The situation "couldn't be worse for the Federal Reserve, which is already chasing inflation for the first time since the 1980s. The disruptions we are seeing are adding fuel to a well kindled inflation fire," wrote Diane Swonk, chief economist at GrantThonton.

Powell "will be walking a tightrope, balancing the need to raise rates and rein in a more systemic rise in inflation with the need to avert a meltdown" if the central bank is seen raising rates so fast it might risk a recession, she added.

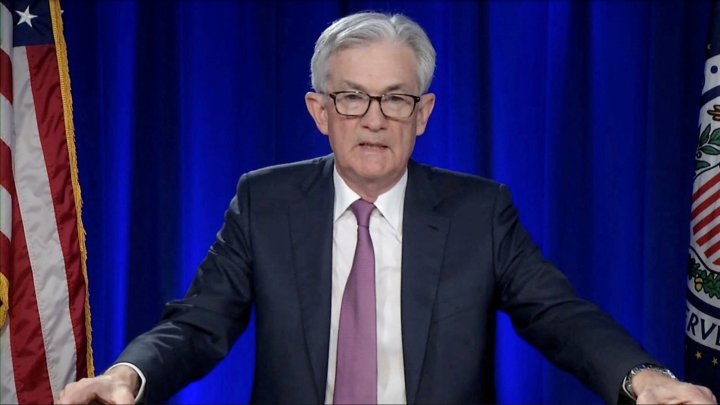

Challenge ahead admits Powell

"We haven't faced this challenge in a long time," Jerone Powell said in testimony before the U.S. House of Representatives Financial Services Committee. "But we all know the history and we all know what we need to do."

The new projections due to be issued alongside the policy statement at 2 p.m. EDT (1800 GMT) will show just how aggressive officials think they may need to be, and whether policymakers see the target federal funds rate rising to the sort of restrictive levels that could actually crimp the economy and increase unemployment.

Since the 2007-2009 financial crisis and recession, the Fed has penciled in those sorts of restrictive policies only once, in response to former President Donald Trump's run-up of deficit spending in 2017 and 2018, but rates never rose that high before the economy started to buckle.

Urgency surrounding the Fed's policy meeting

Yet the urgency surrounding the Fed's policy meeting this week has intensified because inflation has shown no signs of easing and may even rise further on the back of Russia's invasion of Ukraine, which fueled an oil price spike this month.

The precise language of the Fed's new policy statement and the details of updated quarterly economic and interest rate projections will provide the first concrete guidance about how all that has influenced policymakers, and in particular whether it has rattled faith that the current economic expansion can stay on track even as inflation is driven lower.

Fed Chair Jerome Powell, speaking to lawmakers in Congress earlier this month, said he felt it was "more likely than not that we can achieve what we call a soft landing ... which is get inflation back under control without a recession."

But he also acknowledged the central bank was in uncertain terrain, perhaps more reminiscent of the high-inflation days of the 1970s than of the weak inflation environment that has conditioned monetary policy since the early 1990s.

All systems go for Fed's liftoff of interest rates

The Federal Reserve on Wednesday will close the door on its ultra-easy pandemic-era monetary policy and step up the fight against stubbornly high inflation with the first in what is likely to be a series of interest rate hikes this year.

The shift, beginning with an expected quarter-percentage-point increase in the U.S. central bank's benchmark overnight interest rate, has been in the works since last fall and has already driven up the cost of home mortgages and other key types of credit in anticipation of what the Fed will do to curb prices that are rising at their fastest pace in 40 years.

Personal money and finance, live updates: welcome

Good morning and welcome to our daily finance live blog for Saturday, 19 March, focusing on the US. We'll be reporting on rising gas prices, providing useful information on tax season 2022, and bringing you updates on American economic support schemes such as Social Security and the Child Tax Credit.