California inflation relief checks: who will qualify and how much money will they get?

Millions are set to receive new checks as part of the new state budge which will be the largest of its kind for state checks.

While nationwide stimulus checks ended a long time ago, individual states have been taking steps in an attempt to keep their residents protected. The covid-19 pandemic may as well be over from a macro-economic point of view, but the high inflation currently present in the US is putting serious strain on people’s budgets. At its last measurement, year-on-year inflation stands at 8.6 percent. It is expected to continue to grow throughout the year.

California has become the latest state to take the action of dispensing checks. In a $17 million inflation relief package, more than 23 million Californians will receive checks in the fall.

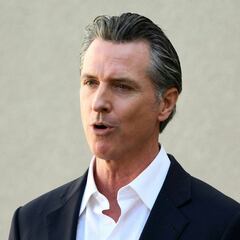

“Millions of Californians will be receiving up to $1,050 as part of a NEW middle class tax rebate,” Gov. Newsom tweeted on Sunday.

NEW: Millions of Californians will be receiving up to $1,050 as part of a NEW middle class tax rebate.

— Gavin Newsom (@GavinNewsom) June 27, 2022

That’s more money in your pocket to help you fill your gas tank and put food on the table.

“It seems that what everybody wants from their state lawmakers right now is help reconciling and addressing the fact that many families are really struggling with inflation and other pressures while state budgets and corporate profits are doing very well,” said Dylan Grundman O’Neill, senior state policy analyst at the Institute on Taxation and Economic Policy.

Not everyone will recieve the full $1,050 checks, as the amount received is based upon the amount of earnings as well as number of dependents.

Who qualifies for the checks?

Under the tax rebate plan, Californians earning as much as $75,000 for individuals or $150,000 for joint filers would receive $350 per taxpayer, plus an additional $350 if they have at least one dependent. A single parent would therefore receive $700 and two-parent families would receive $1,050.

Asm Budget chair @AsmPhilTing on why California is doing rebate checks but not touching gas taxes:

— Jeremy B. White (@JeremyBWhite) June 27, 2022

“We decided that the taxpayers would get a bigger check directly through the rebate rather than giving people pennies at the pump."

Related stories

The amount would decrease to $250 per taxpayer for households making as much as $125,000 for individuals or $250,000 for joint filers, and to $200 per taxpayer for households making as much as $250,000 for individuals or $500,000 for joint filers. In both of these tiers, parents would receive an additional $250 or $200, respectively, if they have at least one dependent.

People making more than $250,000 will not receive a rebate.