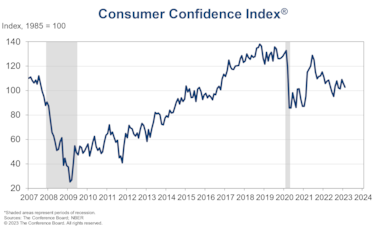

Consumer Confidence Index falls to 102.9 in February: What does that mean for the economy?

For the second straight month, consumer confidence drops in the U.S. as inflation looms over Americans.

The Conference Board measures consumer confidence by shelling out a report that tracks how consumers in the U.S. feel about wages, spending, and the economy. Their latest report, which came out this Tuesday, showed that consumer confidence slipped to 102.9 in their index this February from 106 in January.’

Ataman Ozyildirim, Senior Director, Economics at The Conference Board, said this Tuesday, “Consumer confidence declined again in February. The decrease reflected large drops in confidence for households aged 35 to 54 and for households earning $35,000 or more,”

News of inflation, the high cost of living, and a possible recession might have created a negative mindset for Americans. Thus constructing a narrative that directly affected consumer confidence, according to experts.

Spread between ‘expectations’ and ‘present situation’ components within Consumer Confidence Index from @Conferenceboard fell to -83.1 in February (lowest since March 2001) … as shown in chart, spread this negative historically consistent with recessions pic.twitter.com/ddTziogUXa

— Liz Ann Sonders (@LizAnnSonders) February 28, 2023

The news of this dip in confidence was expected. January is usually a good month because of wage spikes and the need to go out and purchase goods for the holidays. But, unfortunately, that was not the case this year. So this dip confirms those glooming news.

What does this lack of Consumer Confidence mean for the U.S. economy?

The board has seen some first indicators of consumer spending restraint, notably concerning big purchases like appliances, cars, and houses. In addition, many consumers have scaled down their vacation plans in February in response to the economy.

This lack of spending and trust in their finances could slow down the economy. Moreover, the fed has been inclined to keep raising points, tying up funds and making it challenging to have liquidity for many American households.

What the report says about the market and its conditions:

Consumers on short-term business conditions in February

- 14.2% expect conditions to improve. From 18.4% in January

- 21.9% expect business conditions to worsen. From 22.6% in January

Related stories

Consumers about Short-term labor market

- 14.5% expect more jobs to be available. From 17.7% in January

- 20.3% Expect fewer jobs. From 21.4% in January

Consumers on short-term income prospects

- 13.4% expect their incomes to increase. From 17.4% in January

- 11.6% expect their incomes will decrease. From 13.4% in January