Debt ceiling deal reached: What does it mean for the US economy?

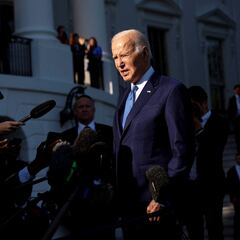

Economists have attempted to predict the consequences of a “catastrophic default”, the term used by US President Joe Biden on social media.

United States President Joe Biden and House Republican speaker Kevin McCarthy have tentatively agreed a deal to raise the federal government’s $31.4 trillion debt ceiling. However, as McCarthy stated after the latest discussions had come to a conclusion, “there is still a lot of work to”.

Congress to vote on deal on 31 May

The deal must be passed through Congress, with a vote expected to take place on Wednesday 31 May. A positive outcome will be required to ensure the U.S. doesn’t run out of money and is able to keep its financial obligations beyond 5 June. Congressional leaders on both sides will have to do their bit to convince enough of their member to vote in favour of the agreement, which includes certain provisions that lawmakers in each party are theoretically not enamoured with.

Full details of the agreement have yet to be officially released, with the bill text scheduled to be released later on Sunday. The main points are thought to include raising the debt limit for two years and keeping non-defence government spending flat until 2024, with a 1% increase permitted in 2025.

Earlier this evening, Speaker McCarthy and I reached a budget agreement in principle.

— President Biden (@POTUS) May 28, 2023

It is an important step forward that reduces spending while protecting critical programs for working people and growing the economy for everyone. And, the agreement protects my and…

President Biden: “catastrophic default prevented”

As for the how the US economy will be affected by the agreement, it’s perhaps more pertinent to ask how it won’t be affected.

Following the news that a deal in principle been agreed, President Biden posted a message on social media, claiming that it “wasn’t what everyone wanted” but insisting that a possible disaster had been averted.

“This agreement is good news for the American people, because it prevents what could have been a catastrophic default and would have led to an economic recession, retirement accounts devastated, and millions of jobs lost”.

Economists forecast debt ceiling no-deal

It’s difficult to say exactly what could happen were the U.S. to default, as it has never happened before. However, that hasn’t stopped economists from trying. The general conclusion is that increased borrowing costs would force the general public to pay higher interest rates for things such as business, car and home loans, as well as on credit card balances.

The White House and Republican negotiators reached a tentative deal late Saturday to raise the US debt ceiling and avert a default that threatened to send tremors through the global economy https://t.co/cQaMHXdTD2 pic.twitter.com/BZ1sWeEgRP

— Bloomberg (@business) May 28, 2023

Related stories

With balance sheets shrinking across the board, a report carried out by Moody’s Analytics in 2023 likened the situation to the Great Recession, suggesting that GDP could drop by 4%, household wealth by $12 trillion, the stock market plummeting by as much as a third, with six million jobs disappearing and unemployment rate rising to 7%.

Internationally, the global economy would also be severely affected given that the dollar is the world’s reserve economy. And with countries unable to sell to one of their key trading partners, who would be unable to buy as much as in the past, the price of commodities would rise across the board.