How do changes to the Federal funds rate affect to the inflation rate?

When the Federal Reserve hopes to clamp down on inflation, they raise interest rates. We took a look at the sensitive relationship between these two economic indicators.

The US Federal Reserve, the country’s central bank, has a dual mandate.

The bank is responsible for establishing a monetary policy that keeps inflation under two percent and supports full employment. These two priorities often come into conflict during periods of economic uncertainty and crisis because the main tool deployed by the Fed is the raising and lowering of the Federal Funds Effective Rate. As the lender of last resort, the central bank specifies a base rate – the Federal Funds Effective Rate –that reflects economic conditions, which other lenders often tack additional interest onto before dispersing loans to individuals and businesses.

The relationship between interest rates and inflation

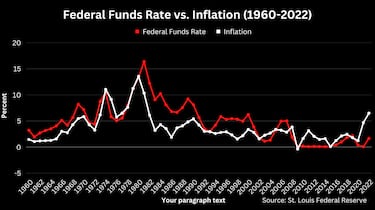

Looking at the graph below, we see a red line that tracks the Federal Funds Rate and a white line representing the percent change in the prices of commonly purchased goods and services.

The graph clearly shows how these two indicators move together with a time delay as shifts in monetary policy impact prices across the market.

For instance, check out the period between the mid-70s and early 80s. Inflation is through the roof, and the Fed, noticing this, moves up rates to their highest levels recorded.

In 1980, rates exceed inflation and continue to rise, hitting an annual average of 16.38 percent. And in 1981, year-over-year inflation falls to for the first time since 1976.

The man behind this policy was Paul Volcker, a former Chairman of the Federal Reserve, and the sky-high rate increases he pushed through are often described as “the Volcker shocks.” Many households suffered during this period, with real wages falling 5.4 percent between 1979 to 1983 and the unemployment rate rising from 5.9 percent to nearly ten.

How can low interest rates lead to higher inflation?

When rates are lower, borrowing is cheaper, meaning that more individuals and firms are likely to take out loans to, say, start or expand a business or purchase property. However, low rates can mean major gains for businesses and the economy as a whole and often leads to the absorption of workers into the labor force, decreasing unemployment. When fewer workers compete for many jobs, those searching and to an extent, those employed can use this leverage to demand higher wages and better conditions.

But, if firms are unwilling to accept those demands and increase prices to offset any net losses experienced by paying higher wages, inflationary pressure can build in the market. While the average salary of a worker may have risen in nominal terms, their purchasing power actually decreases because the price of goods begins to trend upward. This concept is sometimes referred to as a wage-price spiral when the back-and-forth between employers and the employed occurs quickly over a short period.

What does the Federal Reserve do to decrease inflation?

When inflation surpasses its two percent target, the Federal Reserve can increase interest rates, which slows the movement of money through the economy. Raising rates can lead major businesses, particularly those that hold high amounts of corporate debt, to lay off workers or slow hiring. As a result, the unemployment rate increases, further slowing the circulation of money as consumer demand drops. Then, as demand falls, prices follow, which brings inflation back under the central bank’s targets.

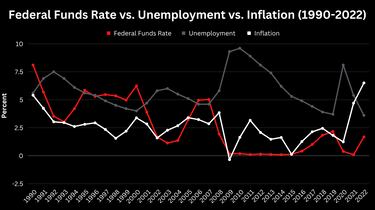

This relationship can be seen in the graph from 1998 to 2003.

In the late 1998s, after the Federal Reserve had managed to reduce inflation to 1.5 percent – the lowest level in over two decades prices – prices started to move upward.

By 2000, annual inflation had jumped to four percent, leading the Fed to increase rates from 4.97 percent in 1999 to six percent. By 2003, inflation was back under two percent, but the unemployment rate had risen from four percent in 2000 to six percent in 2003.

In addition to increasing the number of unemployed workers, these rate increases stalled real wage growth.

In 1996, real wages began to rise, and by 2000 average weekly earnings had grown by 6.7 percent.

The impact on wage growth was fairly immediate: no change in real wages was reported between 2002 to 2008.

The impact higher interest rates can have on wage growth is one reason why many progressive economists, like Noble Prize winner Joseph Stiglitz, have urged the Federal Reserve to proceed with caution. Balancing the Fed’s approach to ensure that rates are not increased to points that will undermine the power of workers is critical to ensuring poor families are not sacrificed to get inflation under control.

If unemployment increases and fewer jobs become available because businesses enact hiring freezes, workers will be forced to accept lower wages. As record profits sore across industries, Stiglitz and others worry that higher rates will have the inverse effect and increase prices.

Related stories

Stiglitz argues that “raising interest rates could do more harm than good, by making it more expensive for firms to invest in solutions to the current supply constraints.” If supply chain disruptions lead to shortages, prices are likely to increase. The same is true in the housing market, where higher interest rates have led to decreased construction of new homes, “precisely what is needed to bring down one of the biggest sources of inflation: housing costs.”

The Federal Reserve will announce its plan of action in early February, where further increases are expected to be announced.