Inflation relief checks by state live online, summary Saturday 26 November 2022

Inflation Relief: Latest Updates

Headlines: Saturday, 26 November 2022

- Unemployment increased in 24 states in October

- California continues to send out Middle Class Tax Refund to millions of households

- Student debt moratorium will be extended through June as the Supreme Court reviews the legality relief program

What you need to know about the FTX collapse

- FTX collapse continues to roil cryptocurrency markets, Bitcoin dipped to lowest point in two years.

- Class action lawsuit filed against FTX founder and numerous celebrity promoters, including Tom Brady

Browse our latest articles:

Student debt forgiveness heads to the Supreme Court

After the Biden administration's student debt relief was rejected by a DC court, the Department of Justice appealed, and now the case is headed to the Supreme Court.

While the White House is hopeful that they will "prevail," some borrowers do not see the fact that it case is headed to the highest court in the land as a positive sign. There is a strong conservative majority on the Supreme Court, and five justices are needed to uphold the ruling. With three liberal justices, two others would be needed. The decision is not expected until June, so President Biden has extended the payment moratorium to avoid a situation wherein borrowers begin to pay back debt that would be forgiven in a few months.

Already, the Department of Education has sent approval letters to 16 million borrowers, and they are continuing to evaluate the additional ten million requests.

The White House has also made its intentions clear, saying it "will never stop fighting for hardworking Americans most in need" and that it will confront special interests that are trying their best destroy the program.

Gasoline prices continue to outpace price increases seen for other goods

The Federal Reserve has been tracking changes in consumer prices for decades.

Over the past three decades, gasoline prices have grown faster than the average CPI index, which tracks prices for hundreds of goods. These differences in pace are not insignificant, with the central bank tracking an average yearly increase in the CPI of 2.4 percent, while gasoline prices rose on average 1.5 percent more (3.9 percent).

Additionally, while it is clear that changes in the price of gasoline do impact the overall CPI, the relationship is not as linear as one would expect, given the current inflationary crisis, driven mostly by increased energy costs.

Florida Governor Ron DeSantis speaks during a rally ahead of the midterm elections, in Hialeah, Florida, U.S., November 7, 2022. REUTERS/Marco Bello / MARCO BELLO / REUTERS

All you need to know about inflation relief checks in Florida

In July of this year, Florida Govenor Ron DeSantis announced a new relief program that included the sending of one-time checks to some of the state's poorest residents.

The Florida Temporary Assistance for Needy Families (TANF) program targeted low-income families and aimed to provide greater flexibility for families with children and to

"reduce the dependency of needy parents by promoting job preparation, work and marriage." The program is coated in conservative language to match their governor's political leanings and came as Florida implemented an even stricter abortion law.

Only parents and guardians are eligible, and while the state said that another objective of the program was to "prevent and reduce the incidence of out-of-wedlock pregnancies," it remains unclear how a one-time payment of $450 would be able to deliver such a result in the long run. Reducing the number of abortions or unwanted pregnancies is a long-term policy objective and cannot be achieved through stopgap measures.

For more information, check out benefits.com.

With prices getting ever higher, despite recent drops in speed, people will be asking bosses for more money so inflation doesn’t swallow their wallet. Living is expensive and although there are laws for minimum amounts jobs can pay workers, the amount is so low that it is not at all liveable for any person.

In fact, the current minimum wage has not changed since July 2009.

Currently, the US federal minimum wage is $7.25 per hour, meaning that a person earning this wage who worked 40 per week every week of the year, would bring home $15,080 annually. That is less than half the US median annual average and slightly above the US poverty threshold at $13,590 for an individual.

Read more from Oli Povey in our full coverage.

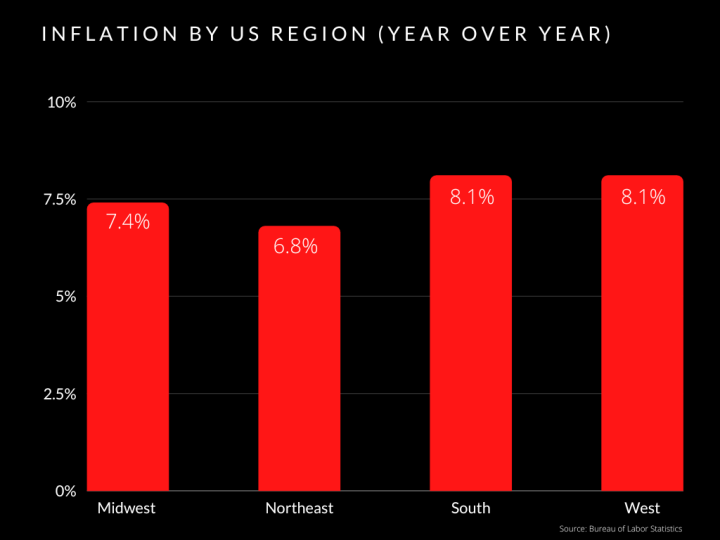

Which areas in the US have seen the highest rates of inflation?

Inflation has impacted the four regions of the US to varying degrees. What causes these differences? There are many variables, one being the transportation networks responsible for delivering goods. Higher oil prices can lead to an increase in logistics and transport costs, which consumers see reflected in the goods they consume in their grocery stores and other retailers.

At 8.1 percent, the West and the South saw the greatest increases in the Consumer Price Index between October 2021 and 2022. Followed by a 7.4 percent surge in the Midwest and a 6.8 percent boost in the Northeast.

In Western states, the BLS tracked a major increase in the price of gasoline (33 percent), which has contributed to their higher rates of inflation. When you remove the increases in energy and food markets, the year-over-year figure moves down to 6.4 percent.

In the South, food at home, meaning groceries, has increased 12.7 percent over the last year, which has contributed to their over eight percent increase in the CPI. Aside from food, shelter also drove the increases, with the BLS reporting that the "owner’s equivalent rent increased 8.6 percent over the past year and rent of primary residence rose 10.2 percent."

The California Franchise Tax Board (CFTB) has sent payments for the Middle Class Tax Refund to over 17 million Californians. The inflation relief payments, which range from $200 to $1,050, are being sent as either direct deposit or debit card.

While those receiving the direct payment to help with the rising cost of living should have already seen the money deposited in their account, the last payments were scheduled to be issued 14 November, the mailing of debit cards follows a separate schedule.

What are the average social security amounts for 2023?

Supplemental Security Income (SSI) payment averages will increase to $914 for an eligible individual, $1,371 for an eligible individual with an eligible spouse, and $458 for an essential person.

The 2023 COLA will increase the average monthly Social Security Disability Insurance (SSDI) benefit for a disabled worker by $119, from $1,364 to $1,483.

Both Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) can be collected by the same person. For claimants, there are no rules in place to prevent them from receiving both parts of benefit support. However, receiving both payments could take you over the income threshold for SSI payments as SSDI payments are included in counting towards the eligibility for the former.

While the unofficial Cyber Monday date is a couple of days away, Monday 28 November, the differentiation between Cyber Monday and Black Friday is virtually non-existent. Many businesses have been doing deals for the last few weeks in preparation, but the big ones are expected for Cyber Monday.

Each store will be doing their own deals at different times and finding out is easier than ever. Check up on the website of your preferred store for the exact times. More than likely, midnight is go-time so make sure you can buy what you want before stock is exhausted.

Watch out for Californian inflation relief scams

If you still haven't received your Middle Class Tax Refund payment from the state of California, that is likely because you will be receiving the support in the form of a pre-paid debit card. The physical cards are being sent out at the moment, but California officials have warned members of the public to be on the lookout for fraudulent cards.

Here's what you need to look out for...

Thanksgiving and the economic outlook

Despite some of the positivies touted by POTUS here, there are a number of stastics that make worrying reading for everyone this holiday weekend:

Turkey prices up 24% in a year

Mashed potato up 20%

Cranberry sauce up 18%

Overall, the ingredients for a traditional Thanksgiving meal will cost shoppers 13.5% more this year compared to last, the market research firm IRI predicted earlier this month, using data from October.

Black Friday has become a part of American retail culture over the course of decades as shoppers gear up for the holiday season by taking advantage of the post-Thanksgiving deals. But in recent years, with the rapid growth of online shopping, the annual retail bonanza has spawned a new, online equivalent: Cyber Monday.

With Black Friday over, Cyber Monday takes place the following week and now considered the last chance to grab some online bargains before Christmas.

Housing prices have been increasing since the covid-19 pandemic. The underlying reasons for the dramatic rise in the cost of buying a house nationwide are many. However, the raising of rates by the Federal Reserve to tackle high inflation has sent mortgage rates climbing as well.

Despite the biggest one-day drop since 1981, a 30-year fixed rate home loan is still double what it was at the start of the year. The higher interest payments coupled with overvalued homes have caused a slump in the sale of existing homes.

What is not known is how a building slowdown, evidenced in the added tweet below, will affect houses next year.

California is by some distance the most populous state in the country with 38 million residents, comprising 12% of the United States’ total population. It is also one of the states with the highest costs of living and the highest typical incomes.

Data from the Census Bureau’s 2020 American Community Survey Five-Year Estimates shows that California has numerous cities where the mean household income is in excess of $250,000.

In 2020 California had a median household income of $78,672, an increase on the figure of $75,235 recorded in 2019. The median amount is taken from the middle value in a list of all household incomes, ordered from smallest to largest.

Black Friday and Cyber Monday are the two biggest shopping days of the year - but which one has the better deals?

Welcome to AS USA!

Good morning and welcome to AS USA, your one-stop-shop for financial news and inflation payment updates.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/26Y2U5JO22RUFFUS326L5XUOQA.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/6YXINPGRX2V2QTKJHDJBFQG7CM.jpg)