Inflation relief checks by state news summary | 10 November 2022

New consumer price index data is to be released today to give the Biden administration more inflation news to deal with. Follow live with AS USA.

Show key events only

Inflation relief in the US: latest updates

Headlines: Thursday, 10 November 2022

- CPI inflation data for October shows annualized price increases at 7.7%

- Biden hails CPI report: "My economic plan is showing results"

- Inflation rate falls from 8.2% in September, a 0.5-point drop

- Two states voted to increase their state's minimum wage on Tuesday

- US stocks rise after October inflation report, record best rally since 2020

Related AS USA articles:

In eary October payments of California’s inflation relief checks started to be sent out to residents. Payments are going out as either direct deposit or debit cards and will be sent through mid-January with payment schedules based on which format the payment is made.

Wall Street has best day in two years after lower inflation report

The stock market surged on Thursday recording its biggest rally since 2020 on the back of news that the Consumer Price Index was 0.5% lower in October than the month before. The slower pace of rising prices gave investors hope that inflation has peaked and which could lead the Federal Reserve to tame its aggressive rate hiking strategy in coming months.

The Dow Jones Industrial average jumped 1,201 points for a 3.7% gain. The S&P 500 spiked 5.54% to close at just over 3,956. The Nasdaq composite had the best day since April 2020 shooting up 7.35% finishing the day a smidge above11,114.

Inflation report welcome news

Today’s news that inflation is cooling faster than experts predicted is a welcome sign for working families.

Investing in both 401(k) and IRA simultaneously

The federal government in an effort to encourage Americans to build up a nest egg for retirement gives tax benefits for squirreling away funds to be used in your golden years. Two of the most commonly known are 401(k) retirement plans and an Individual Retirement Account (IRA).

Joe Raedle / AFP

Voters in Nebraska and Nevada approved ballot initiatives to increase their state’s minimum wage

Republicans won big in Nebraska on Tuesday. Jim Pillen, the governor-elect, beat his Democratic opponent Carol Blood by over twenty-five points. Voters also elected three GOP congressional representatives, and down-ballot, Republicans were elected to key positions, including Lieutenant Governor and Attorney General.

Surprising to some was that in such a “red” state, voters approved a ballot initiative, Initiative 433, to increase the state’s minimum wage to $15 by a 58 to 42 percent margin.

With similar news expected in Nevada, many are asking Democrats to think about why it is that their policies are favored in places where their candidates are not.

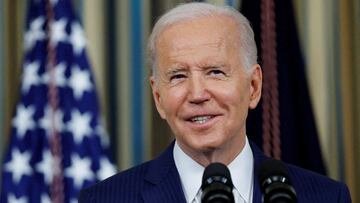

President Biden responds to .4 percent increase in the CPI in October

It will take time to get inflation back to normal levels – and we could see setbacks along the way – but we will keep at it and help families with the cost of living. Americans are already paying around $1.20 less per gallon of gas than this summer. Today’s report shows a much-needed break in inflation at the grocery store as we head into the holidays. And millions of Americans shopping for health insurance plans are continuing to save $800 per year, thanks to legislation I’ve signed into law. In less than eight weeks, my plan to bring down prescription drug prices and energy costs goes into effect.

Compensation down 3.4 percent since last year

In real terms compesnation, meaning the purchasing power of wages, is down 3.4 percent compared to last year. This is the largest decrease in compensation since the BLS began tracking this indicator in 1948.

This comes as productivity, defined by the Bureau as "measures how efficiently the U.S. converts inputs into the outputs of goods and services," decreased by 1.4 percent since October 2021.

Experts react to position inflation trends

The October inflation report has made pleasant reading for President Biden off the back of months of sustained high inflation. The 0.5-point drop in the annualised rate of price increases has taken some by surprise and exceded most projections.

Speaking to CNBC, five experts react to the CPI report...

President Biden’s approval rating have suffered greatly in 2022, due in large part to the rampant inflation which has pushed up prices for consumers. Shortly after the CPI report was published this morning, Biden issued a statement highlighting the progress made in the economy.

“Today’s report shows that we are making progress on bringing inflation down, without giving up all of the progress we have made on economic growth and job creation,” he said.

Wall St rallies on CPI report

The infation report for October suggests that the United States may be over the worst after months of sky-high price rises, and the news appears to have sparked confidence in Wall St. Above all else, investors want stability in economic policy and, with inflation beginning to fall, the Federal Reserve is less likely to impose and new actions to address inflation.

"Today’s report shows that we are making progress on bringing inflation down, without giving up all of the progress we have made on economic growth and job creation. My economic plan is showing results, and the American people can see that we are facing global economic challenges from a position of strength."

Prices of goods in the US are up 7.7% compared to a year prior as the US Bureau of Labor Statistics published the data for October. This represents a decrease in inflation rate from the data recorded in September and a sign that inflationary pressures in the United States are beginning to subside.

In addition to that headline figure, core inflation , ie. all items less food and energy index, rose by 6.3%. This also represents a slowdown.

Hopes of a "soft landing" for US economy

The Federal Reserve has been put in the tricky position of trying to cool the United States' economy in recent months, in a bid to help bring down rampant inflation. But doing so, through measures like interest rate hikes, also risks slowing the economy to the point of recession and hampering the post-pandmeic recover.

For now, analysts suggest, the balance is being struck.

Has inflation peaked?

After sustained levels of high inflation for much of the past year, there is now real evidence that the rate of price increase is slowing. The latest CPI report for October was released within the last hour, showing that the rate has dropped to 6.3%.

One of the key principles of inflation is that concern about imminent price rises often brings about further increases, so today's figures should help to ease concern and slow the overheated economy.

What are some of the items that have increased the most in price?

The inflation news will be positive for the Biden administration on the back of better-than-expected midterm election results.

Taking ouvolatile items like energy and food, core inflation fell to 6.3%. Clearly ignoring tow items that are the most important for avergae Americans is not thathelpful but does reflect growing positivity on the inflation front.

Headline price changes

- Food at home: +12.4%

- Food away from home: +8.6%

- Gasoline: +17.5%

- Electricity: +14.1%

- New vehicles: +8.4%

- Apparel: +4.1%

CPI inflation data released

October's inflation data has just been released with the headline being a further reduction after the drop in September.

Inflation slowed slightly to 7.7% year-on-year, in comparison to September's rate of 8.2%.

Markets reacted quickly to the announcement. Futures tied to the Dow Jones Industrial Average up more than 800 points.

Households across the nation reeling from rising prices that receive Social Security benefits will get a big boost to their finances come the new year. The Social Security Administration announced its 2023 COLA and it was a whopper. At 8.7 percent, it is the fourth largest in the history of the annual cost-of-living adjustments and the biggest since 1981.

The average recipient of retired worker benefits will see a monthly payment of $1,827 an increase of $146. That will translate into an extra $1,752 over the course of 2023.

How is the CPI used to calculate the COLA?

The increase in the annual COLA is calculated using the CPI-W, but the Social Security Administration only uses the third quarter of each year to calculate the COLA. Comparing the year-on-year change of the three months in the third quarter, July, August and September, the agency formulates how much benefits will be increased for the next year. The COLA is applied to payments beginning in January of the following year.

However the first payments for the next year go out at the end of the year in which the COLA is calculated.

The US Bureau of Labor Statistics scrutinizes a range of goods and services that urban consumers spend their money on. The agency formulates different Consumer Price Indices to look at the economy from various perspectives.

To estimate the Cost-of-Living-Adjustment, the Social Security Administration uses the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) which specifically tracks retail prices as they affect urban hourly wage earners and clerical workers, representing roughly 32 percent of the population according to the US Bureau of Labor Statistics.

Later today the consumer price index data for October's inflation will be released.

Inflation in the US continues to be with the current rate, 9.1 percent, the highest for over 40 years. This contributes to increased prices on many goods with commodities relating to energy the fastest climbing.

When inflation is as high as it is, the Fed will, and has, raised interest rates. This measure means borrowing money suddenly gets a whole lot more expensive. With the highest interest rates since the 2008 financial crash, businesses are being incentivised to take less financial risks; save money. If this goes the way the Fed is planning, a recession is very likely with thousands of jobs at risk.

Why inflation may not have been as important as initially thought

People don't love the economy, but they're not getting laid off, which allowed other issues like abortion, like immigration, like the 'Big Lie' on the right to instead dominate the closing weeks of the election.

Inflation proved to not be as critical for voters as expected

Inflation riding at 8% was said to be a factor that was to kill the Democrats these midterms. Indeed, exit polling suggested the state of the economy was the prime thought of voters.

However, other issus proved to be just as important, especially in Democrat minds. They tend to remain more positive than Republicans and independents, ranking such economic concerns behind other issues, such as climate change, racism and abortion.

Stock markets fall on election news

Stocks were lower on Wednesday as results of the midterm elections provided no clear answers about who would control Congress yet.

Despite ballots closing in states nearly full 24 hours ago, a number of states ahve yet to declare. Proecions seem to show Republicans winning a slim House majority while the Senate could remain in Democrat hands.

Inflation relief in the US: welcome

Good morning and welcome to AS USA's live blog for Thursday 10 November 2022, bringing you updates on the measures being taken in the US to combat inflation - and its effects on Americans' purchasing power.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/EGVQK2O7FRBLBFYLIAPE7LJDLI.jpg)