Inflation relief checks, Social Security retirement and disability payments | Summary news 18 November

Inflation relief: live updates

Headlines: Friday 18 November 2022

- 24 states saw increases in their unemployment rate in October

- 30-year fixed mortgage rates see biggest drop in almost 40 years

- Estimated $183 bn wiped off crypto markets after FTX collapse

- Class action lawsuit filed against FTX founder and numerous celebrity promoters, including Tom Brady

- Mass resignations at Twitter,Elon Musk closes offices to workers

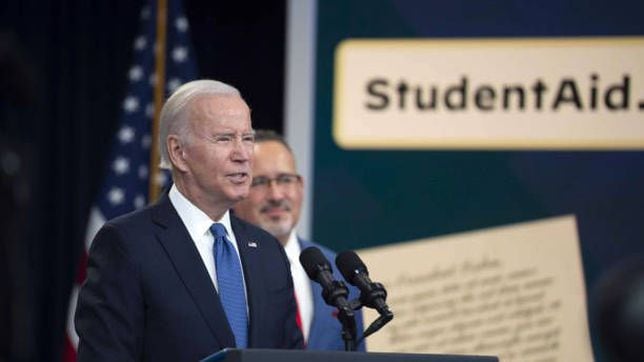

- St Louis court issues another block on Student Loan Forgiveness

- White House considers extending the student loan moratorium

- Elizabeth Holmes, founder of failed Theranos, to be sentenced on fraud convictions Friday

Browse our latest articles:

Initial unemployment claims decreased last week

The St. Louis Fed has reported a decrease in the number of new claims to receive unemployment benefits over the last few weeks.

Enhanced unemployment benefits ended in September 2021, and since then the levels have remained quite consistent. Since January the rates have never surpassed 260,000, and have remained under 250,000.

Real wages decreased from 2021 to 2022

Real wages have fallen since October 2021, with the BLS reporting a 3.7 percent decrease over the last year.

This figure factors in the 2.8 percent decrease seen in rural hourly earnings those in the private sector (non-farm), plus, the additional 0.9 percent fall in the average workweek, which brought wages down even further.

This comes as inflation has cut into purchasing power in very significant ways and shows that wages are not keeping up with the pressure.

Interest rates for 30-year fixed rate mortgages plunge

The 30-year fix mortgage rates have been rising rapidly since the Federal Reserve moved to increase rates in an attempt to slow inflation. In the housing market, rate increases have lowered demand as mortgage payments are much higher now than they would have been a year ago. The higher interest is also aggravated by soaring home prices since the covid-19 pandemic upended life.

However, the lower than expected inflation numbers for October have reversed upward pressure on mortgage rates sending them plummeting. This week saw them drop by half a percentage point compared to last week to 6.61%, the largest drop in almost forty years.

Low-cost internet initiative to boost connectivity

In May President Biden announced that 20 internet providers, including AT&T, Comcast and Verizon, have committed tothe Affordable Connectivity Program (ACP). The program is designed to ensure access to high-speed internet service for no more than $30 per month, for eligible households. Roughly 80 percent of Americans live in communities where these providers operate.

The program also provides eligible households $30 per month off their internet bills, so families can receive high-speed internet at no cost when paired together. To check your eligibility, head over to the Affordable Connectivity Program website, or call (877) 384-2575.

Divided Congress will prevent any major tax legislation but potential for some agreement

Republicans narrowly gained control of the House of Representatives in the 2022 Midterm Elections. However, the "Red Wave" never materialized and Democrats who held onto the Senate may still pick up an additional seat.

Without both chambers and a limited mandate, neither party will be able to push through sweeping agendas. However, smaller but important changes could be on the table that both sides could agree to. The Tax Policy Center takes a look at what could be acheived.

Hope for soft landing despite Federal Reserve raising interest rates

There has been much talk about the US entering a recession but the economy has yet to experience a major slowdown. There are fears though that the aggressive rate hikes by the Federal Reserve could tip the scales with St Louis Fed President James Bullard calling on his colleagues to raise rates to a minimum of 5% to 5.25%.

With data showing that inflation is slowing there had been hope that the Fed would ease up on future rate hikes which sent markets higher last week. But Bullard’s comments dampened their enthusiasm.

Even so though, a report from Goldman Sachs is predicting that the US will narrowly avoid a recession in 2023. While there will be a slowdown in labor demand, they expect that the slack will come from the large numbers of vacancies reducing and not from rising unemployment. At a labor conference the new Boston Fed President Susan Collins concurred with that assessment.

The future of Twitter appears uncertain at the moment after a swathe of staff exits as a result of Elon Musk’s chaotic stewardship of the company. Despite having only taken charge a few weeks ago, Musk has done little to convince staff that he can make the company profitable after his leveraged buyout.

The final straw for many appears to have been a sharply-worded email circulated to staff in which he demanded they sign up for “long hours at high intensity,” or leave. If the unthinkable were to happen and Twitter goes under, where else can you look for an alternative platform?

New CEO gives scathing review of prior management at bankrupt FTX

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.

From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.

Federal Reserve loose monetary policy helped create crypto bubble

Over the past 14 years, since the start of the Great Recession, the Federal Reserve has had in place ultra-loose monetary policy. This has put a lot of liquidity in the market making capital cheap and encouraging investors to be speculative. While “you can’t blame the Fed for people doing stupid things” according to former FDIC Sheila Bair, the near zero interest rates have “contributed to all these bubbles” including the rise of cryptocurrencies.

However, a lack of discipline and due diligence by investors has become costly with yet another crypto exchange, FTX, collapsing last week and news this week that cryptocurrency lender Genesis was seeking an emergency loan of $1 billion from investors before it suspended withdrawals on its website.

Another crypto business faces cashflow troubles

Hot on the heels of the drmatic collapse of online exchange FTX, cryptocurrency lender Genesis has reportedly sought an emergency loan of $1 billion from investors. The Wall Street Journal reported on Thursday that it had seen a confidential fundraising document which shows that a cash injection is needed or the company may have to limit withdrawals.

The document suggests that Genesis is working through a "liquidity crunch due to certain illiquid assets on its balance sheet".

Continuing legal problems for President Joe Biden’s student debt cancellation programme has his government looking at all available methods to try and assist students while the hold continues. One of these ideas could be to extend the payment moratorium beyond the end of this year despite this being previously ruled out.

We’re just 44 days away from when the student loan payment switch is set to flip back on, adding to the immense economic pressure that millions of borrowers are already facing. The Administration must continue the pause until a manageable path towards repayment is in place.

Experts concerned over COLA for seniors

Starting in January, the cost-of-living adjustment for Social Security benefits will be 8.7%. That's the biggest increase since 1981, when the COLA hit an all-time high of 11.2%.

But not everyone thinks next year's boost is enough to deal with ongoing inflation: 55% of retirees said the 2023 COLA should have been higher, according to a poll from The Motley Fool.

They're not alone. Advocates for seniors argue that the Consumer Price Index for Urban Wage Earners and Clerical Workers -- the metric used to calculate the annual adjustment -- isn't an accurate bellwether for their economic needs.

David Avery digs into the detail.

Cryptocurrency regulations on the horizon

FTX has entered bankruptcy and is amplifying calls for more regulation of the cryptocurrency market. Billions of dolalrs are invested into these comapnies which have very little oversight from government or regulators.

The collapse of FTX is a danger for other companies with holdings in the now-defunct exchange. Further risks come from a likelihood that other companies may have been as acting as unscrupulous as FTX, if reports are to be believed.

New FTX CEO slams previous board

The collapse of the cryptocurrency exchange FTX has been one of the most dramatic and high-profile cooperate failings of recent years. Not only has the company gone bankrupt but millions of users have been denied access to funds for weeks, with uncertainty spreading to the biggest names in cryptocurrency, the new CEO of FTX has revealed the extent of the company's failings.

Cryptocurrencies devalued by $183bn after FTX collapse

Since news of FTX's imminent demise first began circulating at the start of this month, the collapse of one of the world's most widely-used cryptocurrency exchanges has been rapid. So complete has been its downfall that it has taken the broader crypto market with it, wiping an estimated $183 billion from the total market cap since the start of the month.

This has highlighted the instability that, while allowing cryptocurrency investors to make quick money during boom periods, is harming the chance of eventual adoption as a mode of transaction.

As you may have seen, Sam Bankman-Fried, FTX’s founder who resigned as CEO last week, is dealing with enormous legal headaches.

And yesterday an FTX investor sued Bankman-Fried as well as several celebrity endorsers of his bankrupt crypto company, including Tom Brady, ex-wife Gisele Bundchen and Steph Curry.

“The deceptive FTX platform maintained by the FTX entities was truly a house of cards,” the proposed lawsuit states.

Welcome to AS USA!

Hello and welcome to our rolling blog in which we'll be bringing you all the latest news and information on inflation, relief payments, Student Loan Forgiveness and more.

Stay with us throughout the day or check in from time to time. We've got you covered...