Inflation Relief Checks news summary: 9 October 2022

States like California are distributing payments to help residents combat inflation. What others are offering support?

Show key events only

Inflation Relief Checks: live updates

Headlines: Sunday, 9 October 2022

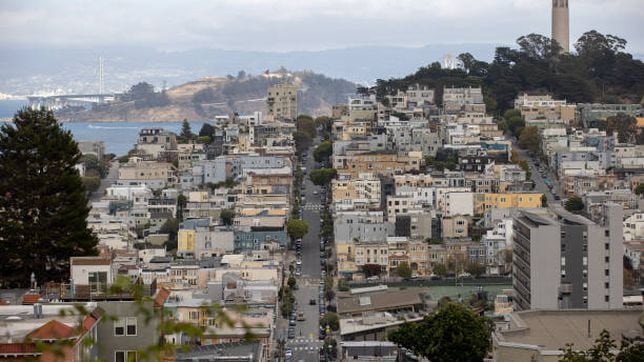

- Gas prices in California reach record highs as the state begins to send inflation relief payments to millions across the state.

- Key dates for the California “inflation relief checks”

- Social Security Administration to announce 2023 COLA this week

- Low-income New Yorkers could be eligible to receive a $270 payment from the state

- Virginia will offer an inflation relief payment worth $250 or $500

- Several states, including Maine, have passed relief bills that include direct payments: check them out.

The Cost of Living Adjustment (COLA) is the amount that the Social Security Administration (SSA) increases benefits every year to keep payments up to speed with price rises. Were it to not exist, benefits claimants would see their real-world support decrease every year.

The COLA change is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) which is published monthly by the US Bureau of Labor Statistics.

A COLA of 8.7 percent is extremely rare and would be the highest ever received by most Social Security beneficiaries alive today. There were only three other times since the start of automatic adjustments that it was higher (1979-1981).

COLA increase expected to arrive on Thursday

The Senior Citizens League (SCL) believes the new COLA will be around 8.7 percent. This would be the largest in four decades.

Last year, it was announced that the COLA rise would be 5.9 percent. This was done at a time when annual inflation stood at 6.2 percent, so was slightly behind. Now, with inflation at 8.3 percent, the same increase would be well short of what is necessary.

The first payments for the Middle Class Tax Refund were sent out on October 7. People will of course be hoping to receive their money as soon as possible and fortunately the Californian Franchise Tax Board (CFTB) has published information for when people should receive their payment.

Beginning in September, around 3 million Georgians received a check worth $350. This is because Governor Brian Kemp released up to $1.2 billion in covid-19 aid to send people funds to deal with inflation. While some could see this as a bit of a bung considering upcoming gubernatorial elections in November, the money will be happily received by many living in one of the most serious economic periods in the last three decades.

“This assistance will help some of Georgia’s most vulnerable citizens cope with the continued negative economic impact of the covid-19 public health emergency and 40-year-high inflation caused by disastrous policies that were implemented by the Biden administration,” Kemp’s office said in a statement.

Virginia Governor Glenn Youngkin explains tax refunds being sent in his

As Virginians face high inflation and prices coming from policies set in Washington, these one-time tax rebates will help families lower the cost of living.

"Past administrations have overtaxed Virginians and by returning taxpayer money to Virginia's taxpayers we are ensuring that hard working Virginians get to keep more of their paycheck during these difficult economic times.

After seeing a budget surplus, the Golden State has established a new tax credit, Middle-Class Tax Refund (MCTR), that will be distributed to millions.

The state allocated around $9.5 billion for the refund and hopes that families will be able to use the payments to keep up with prices. The state leads the country in the cost of gas and after a brief period of relief from high prices from July to September, they are on the climb once again.

The payments for the tax refund are worth anywhere between $200 and $1,050, depending on one’s income, tax filing status, and whether or not one claimed a dependent on their taxes in 2021.

Read our full coverage for how payments break down by filing status and when they can be expected.

It was announced last August that a plan for accessing the student debt forgiveness plan would come in October. This is yet to have happened but CNN reports that the application plan is due out very, very soon, so you should keep switched on to the news or be aware of updates on the Federal Student Aid website as the details will be released there first.

Pell Grant recipients and non-grantees will be able to cut $20,000 and $10,000 in student loan debt, respectively, so long as they make under $125,000 a year (250,000 for married couples). Of those surveyed in a Data for Progress poll in August, 29 percent of students had less than $10,000 in debt, highlighting the large impact President Biden’s decision will have on millions of borrowers.

Read our full coverage for more details on President Biden's plan to cancel some student loan debt.

Maine offers inflation relief payments

Maine governor, Janet Mills, touted the sending of $850 checks that will be sent to 850,000 residents as a part of a bipartisan bill to support households as inflation continues to cut into purchasing power.

Those who have yet to receive their checks should check in with the state's tax authority.

More money could be distributed to California taxpayers

This week the first batch of payments for the Middle Class Tax Refund were sent out.

Additionally, Gov. Gavin Newsom has announced that he is calling a special session to have the legislature pass a law that would increase taxes on profits made by oil and gas companies.

The news comes as the state sees gas prices increase rapidly as global markets have seen decreases in the price of a barrel of oil.

A windfall tax would increase state revenue on the profits these companies see that is over and above what they made in previous years.

The idea would be to use the increased revenue collected through the new tax as a tax credit for taxpayers in the form of a rebate.

Californians who filed a 2020 tax return by 15 October 2021 will start receiving direct payments 7 October from the state’s Middle Class Tax Refund. The tax rebate plan will provide up to $1,050 to millions of California families to help with inflation and high gas prices which are on the rise again.

Democratic California Governor Gavin Newsom and legislative leaders agreed at the end of June to spend part of the state’s bumper budget surplus on the $17 million inflation relief package.

Read more on the payments in our full coverage.

Welcome to AS USA's live blog on inflation and the measures states are taking to assist residents in combatting its impacts for Sunday, 9 October.

Last week, California sent out its first batch of payments for the Middle-Class Tax Refund, which will send checks worth up to $1,050 to millions of households across the state.

Additionally, this week, the Social Security Administration will announce the 2023 Cost-of-living adjustment that will be made to payments in January.

Follow along for more news on the payments being sent in other states, as well as support that may come from the federal level.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/BVOTEGSLML44IPCX36HL7AZXMI.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/6XRT5QV7P5K4FGHAUQ557FTVRY.jpg)