Relief checks news summary | 26 April 2023

Negotiations over the debt ceiling continue this week as the Fed prepares another rate hike. How both are likely to impact the economic outlook and inflation...

Show key events only

US Inflation Relief: Latest Updates

Headlines | Wednesday, 26 April 2023

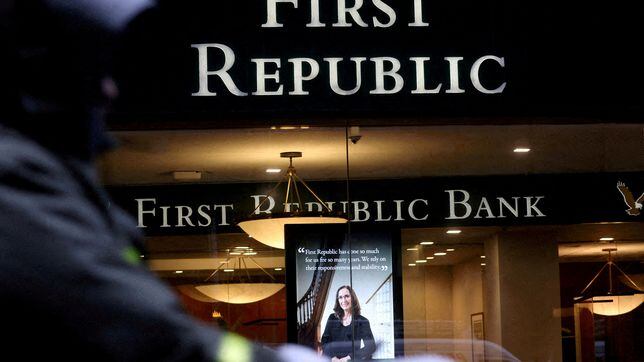

- First Republican Bank has lost more than ninety percent of its value since March

- Median home selling prices increased 2.6 percent in March

- Fed looks set to implement one more rate hike at next meeting in May

- The rate of families with an unemployed member fell three percent from 2021 to 2022 to 4.7 percent

- Workers in Alaska, New Jersey, and Wyominghave been hit hardest by layoffs this year

- Federal Tax Day has passed for most, but counties in eight states got a extension

- Housing prices continue to fall, is it a good time to buy?

- Various states will continue to issue inflation relief checks and generous tax refunds in April

Related stories:

Mass layoffs are continuing in the United States.

With inflation cutting into purchasing power, general uncertainty in the market, and the Federal Reserve hiking interest rates, some stock prices are starting to fall. While 2022 saw the second-largest increase in new jobs in the history of the country, 2023 could tell a completely different story.

The initial response to these economic conditions from the tech sector was mass layoffs. Now, the world’s largest employer, Walmart, will follow suit by closing down various locations to cut costs and improve its financial performance.

This report gives a complete list of Walmart supermarkets that will close in 2023 in each state

Homeowners feel trapped by lower mortgage rates

Many homeowners who want to sell their homes are choosing to postpone their plans because of mortgage rate concerns, according to Yahoo Finance.

Approximately 82% said they felt trapped by the current low mortgage rate on their home, a Realtor.com poll of over 1,200 potential sellers in February found. More than half planned to wait until rates fell further before selling, while a quarter planned to sell soon for personal reasons, despite feeling locked in.

While the feeling of being trapped spanned generations, younger generations felt the most stuck in their home and current mortgage, with 97% of Gen Zers, 87% of millennials, and 87% of Gen Xers citing this sentiment.

New financial aid has been approved in Miami-Dade, Florida.

County Mayor Daniella Levine Cava has announced new financial relief for homeowners who are behind on their monthly mortgage payments. Cava said this new program is expected to provide assistance to 15,000 eligible families.

This report tells us who are qualified to receive the one-time payment of $1,500, which must be used to pay past due bills, as well as homeowners association dues and property insurance, among other property-related expenses.

Lawmakers prepare bill to create investment fund to prop up Social Security

Reports have indicated that the Social Security Trust Fund could run out of cash as early as ten years from now. To help replenish the money, legislators are proposing a bill that would allow the agency to invest in the stock market.

At the moment, the money of contributors may only be invested in US Treasury Bonds or cash.

First Republic bank shares plunge to record lows

First Republic Bank's market value plunged again as investors waited to see if it would be able to find buyers for assets and engineer a turnaround without government support.

The bank's market capitalization briefly sank as much as 41% to about $888 million and the first time under $1 billion, a far cry from its peak of more than $40 billion in November 2021. It closed around $1.1 billion.

First Republic's advisers have approached at least four banks with a proposal to buy some of the bank’s assets. Three of those have said they don’t see a way forward without government support, according to sources.

However, government officials are reportedly unwilling to intervene in the First Republic rescue process at the moment.

The 2019 tax returns came due during the pandemic, and many people may have overlooked or forgotten about these refunds. We want taxpayers to claim these refunds, but time is running out… We recommend taxpayers start soon to make sure they don’t miss out

Filers for the tax year of 2019 should check if they have filed their tax return with billions of dollars still unclaimed, the IRS reports.

In an announcement earlier this month, the IRS said nearly $1.5 billion in refunds for tax year 2019 are still unclaimed. Nearly 1.5 million taxpayers are eligible. The average median refund is $893.

Back in August, President Biden announced details of the long-awaited student loan forgiveness initiative that he had promised while campaigning for the 2020 election. As a candidate, Biden had pledged to enact widespread debt forgiveness for student loan borrowers but offered few specifics on what graduates could expect.

Speaking from the Roosevelt Room two months ago, Biden said: “When I campaigned for President, I made a commitment — I made a commitment that we’d provide student debt relief. And I’m honoring that commitment today.”

Read full coverage for details on the eligibility requirements and the status of the program.

First Republic Bank is on the brink of collapse this week after interventions to rescue the lender by larger institutions failed to quell investors’ nerves last month.

First Republic Bank’s stock price has lost over ninety percent of its value since early March. The bank has lost more than a third of its deposits in the last year.

In part, the dramatic decline relates to the reaction of investors to the collapse of Silicon Valley Bank. Wealthier investors at First Republic who held more than the FDIC-insured limit of $250,000 began to pull their money out of the bank over worries that it could fall victim to a similar investor-led bank run that sunk SVB.

Read our full coverage for details on what has been done to try to save the bank, and why those measures may have failed.

Before the pandemic, the bottom fifty percent (or 61.5 million) of households, in terms of wealth, only owned around twelve percent of real estate in the United States. This figure is only slightly less than the topone percent of households that in early 2020 owned 14.5 percent.

However, during the pandemic, many households saw incomes rise, and with the explosion of remote work, many families relocated. And by late 2022, the percentage of real estate owned by the bottom fifty percent of households had increased to 13.4.

Read our full coverage for how the pandemic has impacted the housing market and for information on why interest rate hikes from the head haven't brought down prices.

Many Americans are saddled with student loans that they have been paying off for years. Over 40 million borrowers are paying off their debt, with the average balance standing at more than $37,000, according to Education Data.

The government of President Joe Biden has begun rolling out programs to ease this burden, and for those who wish to take advantage of these benefits, there are some dates to watch out for so as to avoid missing crucial deadlines for actions that need to be taken.

Read more in our full coverage on when one can expect the Supreme Court to announce its decision.

Wall Street drops on worries of an economic downturn

Wall Street's major averages suffered their deepest declines so far this month as a downbeat UPS forecast exacerbated investor concerns about a slowing economy, while plunging deposits at regional First Republic Bank added to jitters about the bank sector's health.

Shares in United Parcel Service fell 10%, its biggest daily loss since July 2006, after the courier company forecast full-year revenue at the lower end of its prior target.

This helped push the Dow Jones Transport Average index down 3.6%, for its biggest one-day drop since September.

Also worrying was data showing consumer confidence fell to a nine-month low in April.

First Republic Bank considers divesting $50-$100 billion in assets

Beleaguered First Republic Bank is considering selling off between $50 billion to $100 billion of its assets in an attempt to pull itself out of the turbulence that has rocked the banking industry in recent months.

According to Bloomberg, the self-rescue plan includes the sales of long-dated mortgages and securities. The move hopes to correct the imbalance between the company's assets and liabilities which has pummeled the lender after they saw a run on deposits last month.

3M lays off 6,000 workers

3M Company has announced they will cut 6,000 jobs as part of a broader restructuring plan, according to Yahoo Finance.

The cuts, along with an earlier reduction of 2,500 workers announced in January, amount to roughly 9% of 3M's workforce as of Dec. 31. The move will help the company “adjust to slowing end-market demand,” according to 3M CFO Monish Patolawala .

The maker of Scotch Tape and N-95 masks reaffirmed its gloomy outlook for fiscal-year 2023.

Hello and welcome to AS USA's live blog on inflation relief and economic news.

Tax season is wrapping up, and millions are waiting for their returns. Those who have received an extension have until mid-October to submit their return.

Yesterday, the US Census Bureau released the March Home Sales report, which showed that from February to March, the median price increased by 2.6 percent. This means that even while interest rates are sitting at their highest level in decades, the market is still red hot in many parts of the country.

The Supreme Court is set to decide on the legality of student loan forgiveness in June. Until then, the public will know very little, as oral arguments were heard earlier this year.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/Z4R7572C5YIVXJU6DEOGZEB664.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/GSEFX46O7KBODB2LZDIM2CPJZ4.jpg)