Relief checks: 9 February summary news

We will bring you the latest on the debt ceiling negotiations, increasing unemployment benefits, and tax season 2023.

Show key events only

Financial news: Live updates

Headlines: 9 February 2023

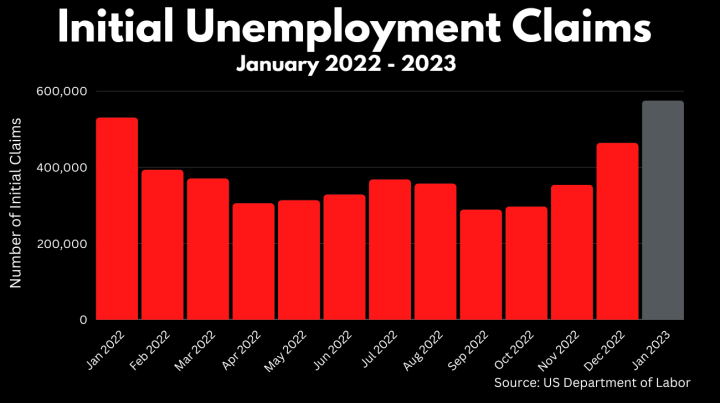

- Last week, initial unemployment claimsincreasedby 13,000 to 196,000

- More taxes on the rich, Biden’s formula against inequality

- Michigan to send $180 inflation relief checks: who qualifies and when will they arrive?

- Debt ceiling negotiations continue with cuts to Social Security and Medicare off the table after confrontation at the State of the Union

- US trade deficit grew to $67.4 billion in December up from $61 billion a month earlier

2023 Tax Season

- A look at the most undervalued housing markets in the United States

- Tax season is here: top tips to avoid errors when filing your return

- Actions that can be taken if your tax refund is stolen or never arrives

Read more from AS USA:

The housing market has endured a tumultuous few years. Economic uncertainty put a halt on purchases during the early months of the pandemic, before a period of low interest rates made borrowing more affordable and convinced more people to take the plunge into home ownership.

Currently the market is down from its peak in the summer of 2022, cooled by rising borrowing rates, and many previously red-hot markets being overvalued. But will the US see a housing market crash in 2023?

Unemployment applications remain historically low

Last week the White House celebrated an incredible January jobs report, which had found that the United States had added more than 500,000 jobs in a single month. Unemployment fell to a 70-year low and the US economy appeared to be staying strong. That trend continued this week as first-time unemployment applications were at just 196,000, albeit slightly higher than economists' projections.

The 2023 Child Tax Credit is available to parents with dependents under 17 as of 31 December 2022 and who meet certain eligibility requirements. In 2021, the American Rescue Plan made big changes to the credit for one year that helped many families by allowing them to receive half of the value of the credit over six months rather than as a bulk sum when they file their taxes.

We take a look at the Child Tax Credit for this year, and who is eligible to receive the support...

Entitlements may be involved in debt ceiling negotiations

Expect to hear a lot more about the debt ceiling in the coming months as the Democrats and Republicans search for a solution that will stop a first ever US national default. Failing to fulfil debt obligations would be an absolute catastrophe for the global economy, but the two sides have very different ideas on how an agreement can be reached.

President Biden is insisting that a clean bill be passed by Congress, allowing for the debt ceiling to be raised without any other conditions. However many Republican lawmakers are eager to extract some concessions from the White House in return for passing the legislation in the GOP-held House.

Tax season 2023 is now well underway, but the IRS is advising that recipients of the various state-organised relief checks should hold off on their submission for now.

The tax agency is yet to decide whether these relief programs – like California’s Middle Class Tax Refund – should be subject to taxation. The IRS released a statement earlier this month telling filers who received a payment during 2022 to delay their tax return filing for now:

“The IRS is aware of questions involving special tax refunds or payments made by states in 2022; we are working with state tax officials as quickly as possible to provide additional information and clarity for taxpayers."

Read more on the IRS' decision-making process in our full coverage.

The Democrats are a big-tent party dominated by liberal centrists but home to a growing number of progressives seeking to disrupt Washington’s status quo.

President Biden has worked in Washington since the early 1970s and has historically taken a moderate and emphatically capitalist position. For the Biden administration to bring all of the factions of his party together, he has had to move to the left without abandoning more moderate members of the caucus.

One of the most controversial topics within the party is taxation, particularly the question of what tax rates should be applied to the super-rich and corporations. During the campaign, then candidate-Biden, proposed a review of the US tax law to guarantee a fairer distribution of wealth. There is a strong desire to see reforms passed in Washington that decrease income and wealth inequality in the country.

Read our full coverage of President Biden's proposal and an explanation of why is it unlikely to pass.

Initial Unemployment claims increase in early February

The first week of February saw more 196,000 people workers claim unemployment benefits. This is an increase of 13,000 over the week prior.

Additionally, while more than half a million workers got added to the payroll last month, a similar number began receiving unemployment benefits. The number of initial claims in January surpassed any level seen in 2022. However, the total number of workers receiving benefits fell from 2.23 million to 1.68 million from December to Janaury.

Numerous workers across different professions receive tips as a portion or the bulk of their earnings which must be reported to the IRS. We’ll explain how.

EITC could provide a nearly $7,000 tax credit

The Earned Income Tax Credit (EITC) is targeted at low-to-moderate income households. The credit is refundable, meaning that any amount that exceeds what you owe in taxes, even if you owe none, will be tacked onto your tax refund. The credit can be worth up to $6,935 if you qualify.

The US is experiencing a “rolling recession”

President Joe Biden touted the strength of the US economy at his State of the Union address on Tuesday evening. He could feel good with the Labor Department reporting outsized job growth in January with 517,000 new hires, much larger than had been predicted.

As well, unemployment dropped to its lowest level since 1969. That despite the Federal Reserve raising interest rates to loosen the tight labor market through aggressive rate hikes to bring down four-decade high inflation at its peak.

The pace of rising prices has slowed but economists are baffled by the US economy at the moment. The common wisdom was that the US was heading for a recession but the gloom has turned to optimism that the policymakers at the central bank will pull off a soft landing.

However, Sung Won Sohn, professor of finance and economics at Loyola Marymount University and chief economist of SS Economics, says there may not be either a hard, soft or any landing, so to say. Last experienced in the 1980s, he says that the US is experiencing a “rolling recession” where instead of a general downturn, the slump sweeps slowly across different segments of the economy.

Housing prices that soared over the past two years are cooling, but the increase in values wasn’t uniform across the nation. Some markets are undervalued.

Last year, inflation in the United States reached historic levels.

Given the rising prices, particularly of staple goods, a number of government institutions approved sending stimulus checks or tax refunds as inflation relief for hard working Americans. Although inflation has fallen in recent months, support continues to be sent.

Here are the states sending checks or refunds in February and what the amounts are.

US oil stockpiles surge, price holds steady

The Energy Information Administration reported that US crude oil stockpiles hit their highest level since June 2021. The surge in stocks was aided by increased production which is at its highest level since April 2020.

The greater inventories, along with belief that the Federal Reserve will continue to raise interest rates, helped balance out optimism that demand for oil will rebound as China’s economy begins to rev up again and inflation drops to keep oil prices steady on Thursday. Both Brent and WTI are up 6% this week with predictions crude could hit $100 per barrel by the second half of the year.

Stimulus checks feel like a long distant memory, the thought drifting away like trying to remember last night’s dream.

While there are no federal financial support plans announced, especially with most ending definitively with the expected announcement of the ‘end’ of the pandemic coming in May, individual states and cities are. These range from tax refund to trials of universal basic income. Many of these programmes is no longer accepting applications.

However, at the state level, relief remains available.Check out our full coverage for the details.

It is appropriate to move in smaller steps while we assess the effects of our cumulative tightening in the economy and inflation.

Jonathan Ernst / REUTERS

Federal Reserve officials see additional modest rate hikes in 2023

Speaking publicly for the first time since raising interest rates by a quarter of a percentage point to the 4.50%-4.75% range, Federal Reserve officials see “smaller steps” moving forward. The latest increase to the cost of borrowing was the smallest since March last year. That first increase after dropping interest rates to near zero level was followed by a series of rapid increases to bring high inflation under control.

On Wednesday, New York Fed President John Williams speaking at a Wall Street Journal event said that moving to a rate between 5.00%-5.25% "seems a very reasonable view of what we'll need to do this year in order to get the supply and demand imbalances down." While the “extraordinarily strong” January jobs report that came out two days after the pace of interest rate rises were slowed “surprised” Fed Chair Jerome Powell, it doesn’t seem to be affecting much the longer term thinking of policymakers.

Williams didn’t signal that the 517,000 jobs added, more than double the prior three-month average and well above expectations, nor the unemployment rate dropping to 3.4%, its lowest since 1969, would necessarily change the outlook for modest increases. Since the Fed is "likely to be closer to where the peak interest rate is going to be this year, we can take smaller steps still to get to whatever we need to get to," he said.

From January 23 to April 18, the IRS will be receiving federal tax returns from individuals and businesses , corresponding to the fiscal year 2022.

According to official estimates from the government agency in charge of tax collection, it is expected that around 168 million Americans will file their respective tax returns this year.

Here’s the quickest way to get your tax refund for your 2022 income tax declaration, according to the IRS.

Residents of the Evergreen State now have a new annual tax credit available to them that could be worth up to $1,200. On 1 February the Washington State Department of Revenue launched the Working Families Tax Credit (WFTC) which refunds residents a portion of sales tax paid each year.

The WFTC is targeted at low-to-moderate-income households to help provide financial stability. Up to 400,00 eligible Washington workers and their families may receive money back this year. The credit is modeled after the federal Earned Income Tax Credit (EITC) program, considered one of the best tools for reducing poverty nationwide.

The United States is in full tax season for the 2022 fiscal year.

When filing your taxes, you may be able to apply for any of the tax credits offered by the tax collection agency, including the Earned Income Tax Credit (EITC), which is aimed at low-income individuals and families.

If you live in a state that offered tax rebates to residents during 2022, the IRS is advising that you delay filing your federal tax return for a few more days. States like California and Colorado passed legislation providing one-off payments in the form of tax refunds to residents to help deal with high inflation.

Are you looking for more support with your taxes from the Internal Revenue Service? Well you are in luck, as new measures are being brought in, with the IRS announcing special Saturday hours for the following four months. These will be available at Taxpayer Assistance Centers (TACs) across the nation as part of an ongoing effort to improve service during current tax season.

The surprisingly strong employment figures for January could be a flash in the pan. The extra 517,000 jobs added are unlikely to be repeated any time soon, especially while wholesale sackings continue at some of America’s largest companies and employers. Disney has announced the imminent firing of 7,000 staff members as part of yet another restructuring in a bid to save billions of dollars.

The media empire is just the latest company to announce job cuts in response to a demand from investors to cut costs as companies anticipate a sluggish 2023.

When you take out an insurance policy you might chose the deductible, the amount you cover. Whether it’s higher or lower may or may not save you money.

Gas prices tick up slightly

Still down from their record high a year ago, gas prices are on the rise. On Monday, the average price for a gallon of gas was $3.44, a $0.35 increase from late December.

Heating requires a lot of energy, which means that often gasoline consumption increases, and if similar boosts in supply are not made, prices will rise.

BRENDAN MCDERMID / REUTERS

Biden’s claim on the creation of 800,000 manufacturing jobs

President Biden claimed at his State of the Union address that 800,000 manufacturing jobs have been created since he took office. While true, the message is a bit misleading.

The pandemic decimated the US manufacturing sector, so when President Biden took office, only 12.19 million workers remained employed in the industry. The 800,000 figure represents the difference between the month Biden took office and today.

During Donald Trump’s tenure, 400,000 manufacturing jobs were added to the economy until the pandemic hit and erased these gains. Last year, the economy added 382,000 jobs to the sector, and at that pace, Biden will surpass President Trump’s tally.

In January 2020, there were 12.79 million workers employed in the manufacturing sector. In January 2023, that figure was 12.99 million. The difference between these two numbers is 200,000, not 800,000.

In January, there were 1.38 million jobs available in the accommodation (hotels, motels, resorts, bed and breakfast, etc,.) and food service industry. This figure has come down from the 1.54 million figure in April 2022.

There are currently 1.86 million employees working in hotels and other types of lodging in the United States; down from 2.11 million in early 2020. In part, this gap relates to the unwillingness of major corporations to pay the wages and salaries necessary to attract and retain workers.

Read our full coverage for details on the jobs available and the average salaries provided for that work.

Hello and welcome to AS USA

Hello and welcome to AS USA's live feed on financial news for Thursday, 9 February.

Fears of a recession have receded for now as the US economy continues to power forward. However, inflation still remains uncomfortably higher than policymakers would like who have signaled that interest rate hikes will continue.

Wall Street stocks traded significantly lower on Wednesday weighed down by lingering concerns about inflation and interest rate hikes despite Federal Reserve Chairman Jerome Powell sounding dovish in public statements on Tuesday. Allthough he was surprised by the "extraoridinarily strong" jobs report for January, Powell said that he expects 2023 to be a year of "significant declines in inflation."

We'll keep you up to date on what is happening in the markets and what's being done to help Americans cope with inflation along with other financial news.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/ATYILUM64ZM2QJIUYOXRLHSAMI.jpg)