Relief checks: 11 February summary news

While the economy at large remains strong, a “rolling recession” may be hitting sectors one-by-one and Americans continue to grapple with inflation.

Show key events only

Financial news: Live updates

Headlines: 10 February 2023

- Yahoo announces 20% cut to workforce, 1,000 workers to be laid off this week

- Wall Street indexes trade negative on Thursday, losing overnight gains

- Last week, initial unemployment claimsincreasedby 13,000 to 196,000

- More taxes on the rich, Biden’s formula against inequality

- Michigan to send $180 inflation relief checks: who qualifies and when will they arrive?

- Debt ceiling negotiations continue with cuts to Social Security and Medicare off the table after confrontation at the State of the Union

- US trade deficit grew to $67.4 billion in December up from $61 billion a month earlier

2023 Tax Season

- A look at the most undervalued housing markets in the United States

- Tax season is here: top tips to avoid errors when filing your return

- Actions that can be taken if your tax refund is stolen or never arrives

Read more from AS USA:

IRS benefits from Inflation Reduction Act funding

Last year President Biden passed a massive package known as the Inflation Reduction Act, which was designed to help guide the US economy through a tricky period of rampant price rises. The legislation included varous programs and policies but, for those who are in the process of filing their tax returns, the additional funding for the IRS may be the most useful in the short term.

The tax agency has faced an impossible task in recent years; continuing to operate through the pandemic while also overseeing new programs like the expanded Child Tax Credit and multiple rounds of stimulus checks. There is now hope that this extra funding will help clear the tax return backlog and get refunds out as swiftly as possible.

What are the debt ceiling 'extraordinary measures'?

The United States has hit the statutory debt limit, also known as debt ceiling, and will soon be unable to fulfil its financial obligations unless Congress raises the limit. To buy lawmakers some extra time Treasury Secretary Janet Yellen has utilised a series of 'extraordinary measures' to extent the nation's borrowing abilities.

In a letter published last month, Yellen warned that "the period of time that extraordinary measures may last is subject to considerable uncertainty, including the challenges of forecasting the payments and receipts of the U.S. Government months into the future."

During the pandemic SNAP benefits, also known as food stamps, became a crucial form of financial support for millions of families. The federal government introduced Emergency Allotments (EA) in March 2020 to increase the amount on offer to recipients.

The program has gradually been rolled back in the past year and February 2023 will be the final month in which recipients in certain states, those still offering the boost, can benefit from the EA. The Center on Budget and Policy Priorities (CBPP) reports that 35 states and territories are still paying EAs this month...

Madison Wisconsin reported the lowest unemployment rate of any city in December

The Bureau of Labor Statistics publishes national, state, and metropolitan-level data on unemployment.

The metropolitan data is helpful because it can help to identify disparities in unemployment within a state or region.

In December, the city with the lowest unemployment rate in the US was Madison, Wisconsin, where only 1.6 percent of those looking for a job couldn't find one. In second place at 1.7 percent was Columbia, Missouri.

On the other end of the spectrum, the highest rates were recorded in El Centro, California (14.8 percent) and Yuma, Arizona (13.7 percent).

When Congress enacted various economic relief programs during the pandemic, it took time for the Internal Revanue Service (IRS) to adjust their programs to ensure taxpayers were refunded the correct amount.

This year, after more than a dozen states have sent inflation relief checks to their residents, the IRS is struggling to determine if these payments count as taxable income. On 3 February, the tax authority reported an increased number of questions “involving special tax refunds or payments made by states in 2022.” The confusion apparently caught the IRS by surprise, and they are “working with state tax officials as quickly as possible to provide additional information and clarity for taxpayers.”

Biden on GOP dream to cut Social Security and Medicare: "I'm your nightmare"

I know a lot of Republicans, their dream is to cut Social Security and Medicare.

Well, let me say this: If that's your dream, I'm your nightmare.

Biden takes his economic message to Florida, touts successes, warns against cuts

President Biden and his administration are touring the nation after his State of the Union address on Tuesday. They will visit 20 states with Biden kicking off the tour visiting first Wisconsin and on Friday, Florida.

He is touting successes that his administration has been able to acheive and warning Republicans not to make cuts to to Social Security or Medicare.

The United States is in the midst of tax season. From January 23 to April 18, the Internal Revenue Service (IRS) will receive and process more than one hundred and sixty million tax returns this year.

The agency typically tasks around twenty-one days to issue a refund if the return was filed electronically and direct deposit information was provided. If you submitted a paper return and are expecting a refund in a paper check via the mail, the time frame may be extended to six to twelve weeks.

If your refund has been stolen, you do have a few options. Here is the guidance from the IRS.

The saying goes “sharing is caring” and Uncle Sam will look the other way up to a point. Should you cross the thresholds of the Gift Tax exemption you could face a tax rate of 18 percent to 40 percent.

The Tax Cut and Jobs Act passed in 2017 increased the lifetime limit that Americans are allowed to gift in the form of money or property to family and friends for nothing in return. The changes will revert to pre-2018 levels in 2026 which will be half of the lifetime exclusion that increases with inflation, it is currently $12.06 million in 2022.

Should you surpass the annual gift tax limit you will eat away at your lifetime exclusion. Here’s a look at the amounts you can give without getting taxed.

From January 23 to April 18, the IRS will be receiving federal tax returns from individuals and businesses , corresponding to the fiscal year 2022.

According to official estimates from the government agency in charge of tax collection, it is expected that around 168 million Americans will file their respective tax returns this year.

Here’s the quickest way to get your tax refund for your 2022 income tax declaration, according to the IRS.

"Out-of-the-box" ideas to avoid debt ceiling default and the economic fallout

Janet Yellen announced that the Treasury Department had begun “extraordinary measures” as the US has reached its debt ceiling limit. These accounting maneuvers will keep the nation from defaulting on its financial obligations until early June while lawmakers work on agreeing to an increase to the borrowing cap.

GOP lawmakers in the House of Representatives want to use the negotiations to exact spending cuts from the budget. However, the game of chicken that has become terribly common in recent years could bring dire consequences should the US hit the “X Date” when the US goes off the financial cliff.

Mehdi Hasan has a couple "out-of-the-box" ideas that he thinks should be considered to avoid from minting a $1 trillion coin to just ignoring the limit altogether declaring it unconstitutional. Have a gander...

The Social Security Administration sent out payments to over 71 million Americans as of January 2023. Due to the monumental nature of issuing so many payments, the agency spreads out when they are sent depending on date of birth, type of benefit and when a recipient first signed up for Social Security.

This creates a situation where every so often certain beneficiaries receive more than one payment in a calendar month. March will be one of those months.

Alphabet, Google’s parent company, has seen its stock price fall by over seven percent this week.

A set of factors help explain the decline in the stock’s performance, one of which relates to the competition brewing with chatbots that use artificial intelligence.

The 2023 Child Tax Credit is available to parents with dependents under 17 as of 31 December 2022 and who meet certain eligibility requirements. In 2021, the American Rescue Plan made big changes to the credit for one year that helped many families by allowing them to receive half of the value of the credit over six months rather than as a bulk sum when they file their taxes.

We take a look at the Child Tax Credit for this year, and who is eligible to receive the support...

The United States is in full tax season for the 2022 fiscal year.

When filing your taxes, you may be able to apply for any of the tax credits offered by the tax collection agency, including the Earned Income Tax Credit (EITC), which is aimed at low-income individuals and families.

EITC could provide a nearly $7,000 tax credit boosting IRS refund

The Earned Income Tax Credit (EITC) is targeted at low-to-moderate income households. The credit is refundable, meaning that any amount that exceeds what you owe in taxes, even if you owe none, will be tacked onto your tax refund. The credit can be worth up to $6,935 if you qualify.

Housing prices that soared over the past two years are cooling, but the increase in values wasn’t uniform across the nation. Some markets are undervalued.

Mortgage rates tick up slightly for first time in a month

Freddie Mac reported that the average weekly 30-year fixed mortgage rate moved up slightly from 6.09% to 6.12% for the week ending 8 February. Mortgage rates had fallen for four consecutive weeks prior with the average rate briefly dropping below 6% last week, the first time since September.

The lowered borrowing costs and cooling home prices have begun to lure would-be homebuyers back into the market just in time for the spring homebuying season.

Entitlements may be involved in debt ceiling negotiations

Expect to hear a lot more about the debt ceiling in the coming months as the Democrats and Republicans search for a solution that will stop a first ever US national default. Failing to fulfil debt obligations would be an absolute catastrophe for the global economy, but the two sides have very different ideas on how an agreement can be reached.

President Biden is insisting that a clean bill be passed by Congress, allowing for the debt ceiling to be raised without any other conditions. However many Republican lawmakers are eager to extract some concessions from the White House in return for passing the legislation in the GOP-held House.

Tax season 2023 is now well underway, but the IRS is advising that recipients of the various state-organised relief checks should hold off on their submission for now.

The tax agency is yet to decide whether these relief programs – like California’s Middle Class Tax Refund – should be subject to taxation. The IRS released a statement earlier this month telling filers who received a payment during 2022 to delay their tax return filing for now:

“The IRS is aware of questions involving special tax refunds or payments made by states in 2022; we are working with state tax officials as quickly as possible to provide additional information and clarity for taxpayers."

Read more on the IRS' decision-making process in our full coverage.

Last year, inflation in the United States reached historic levels.

Given the rising prices, particularly of staple goods, a number of government institutions approved sending stimulus checks or tax refunds as inflation relief for hard working Americans. Although inflation has fallen in recent months, support continues to be sent.

Here are the states sending checks or refunds in February and what the amounts are.

White House calls out Sen. Johnson for wanting to privatize Social Security

President Biden didn't name names at the State of the Union when he said that "some Republicans want Medicare and Social Security to sunset." That statement got members of the GOP out of their seats claiming it was a lie.

Since his address to the nation on Tuesday evening Biden has taken to the road to show off what his legislative agenda is doing. He has targeted two states in particular, Wisconsin and Florida, home to Senators Ron Johnson and Rick Scott respectively, it looks for a specific reason.

Scott, who put forward a "12 Point Plan to Save America" which would have "all federal legislation sunsets in 5 years" which could include Social Security and Medicare. Johnson for his part called for programs like Social Security to be made "discretionary spending" last year. On Thursday he called the program a "Ponzi Scheme" saying that it should've been privatized.

Having a retirement plan is essential. Millions of workers in the US have a 401(k) plan. However, when changing jobs and being fired, a worker must know what happens or what to do with it. We share the options and some tips.

Month after month, the Social Security Administration (SSA) sends monthly benefits to retired workers. The administration recommends that workers claim their payments at their full retirement age. People born after 1960 must wait until they are 67 to reach full retirement age and receive maximum benefits.

However, workers can retire and start receiving benefits at age 62, or delay their claim until age 70 to receive more money each month.

The Democrats are a big-tent party dominated by liberal centrists but home to a growing number of progressives seeking to disrupt Washington’s status quo.

President Biden has worked in Washington since the early 1970s and has historically taken a moderate and emphatically capitalist position. For the Biden administration to bring all of the factions of his party together, he has had to move to the left without abandoning more moderate members of the caucus.

One of the most controversial topics within the party is taxation, particularly the question of what tax rates should be applied to the super-rich and corporations. During the campaign, then candidate-Biden, proposed a review of the US tax law to guarantee a fairer distribution of wealth. There is a strong desire to see reforms passed in Washington that decrease income and wealth inequality in the country.

Read our full coverage of President Biden's proposal and an explanation of why is it unlikely to pass.

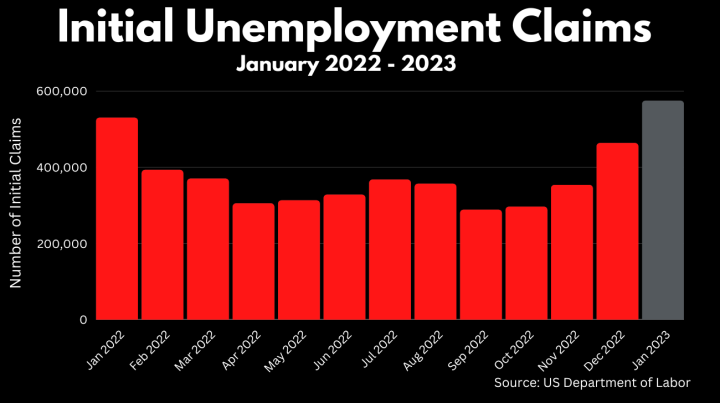

Initial Unemployment claims increase in early February

The first week of February saw more 196,000 people workers claim unemployment benefits. This is an increase of 13,000 over the week prior.

Additionally, while more than half a million workers got added to the payroll last month, a similar number began receiving unemployment benefits. The number of initial claims in January surpassed any level seen in 2022. However, the total number of workers receiving benefits fell from 2.23 million to 1.68 million from December to Janaury.

Unemployment applications rise but remain historically low

Last week the White House celebrated an incredible January jobs report, which had found that the United States had added more than 500,000 jobs in a single month. Unemployment fell to a 70-year low and the US economy appeared to be staying strong. That trend continued this week as first-time unemployment applications were at just 196,000, albeit slightly higher than economists' projections.

The housing market has endured a tumultuous few years. Economic uncertainty put a halt on purchases during the early months of the pandemic, before a period of low interest rates made borrowing more affordable and convinced more people to take the plunge into home ownership.

Currently the market is down from its peak in the summer of 2022, cooled by rising borrowing rates, and many previously red-hot markets being overvalued. But will the US see a housing market crash in 2023?

More layoffs in tech sector, Yahoo plans to cut 20% of workforce

The tech industry began major reductions to their workforces late last year which have continued into 2023. So far, over 100,000 workers have been sacked.

The latest announcement came from Yahoo, with plans to shrink its staff by 20%, or some 1,600 positions. Around 50% of the cuts will impact Yahoo's ad tech department. Nearly 1,000 workers will receive pink slips this week.

General recession fears ease but US could be experiencing a "rolling recession"

President Joe Biden touted the strength of the US economy at his State of the Union address on Tuesday evening. He could feel good with the Labor Department reporting outsized job growth in January with 517,000 new hires, much larger than had been predicted.

As well, unemployment dropped to its lowest level since 1969. That despite the Federal Reserve raising interest rates to loosen the tight labor market through aggressive rate hikes to bring down four-decade high inflation at its peak.

The pace of rising prices has slowed but economists are baffled by the US economy at the moment. The common wisdom was that the US was heading for a recession but the gloom has turned to optimism that the policymakers at the central bank will pull off a soft landing.

However, Sung Won Sohn, professor of finance and economics at Loyola Marymount University and chief economist of SS Economics, says there may not be either a hard, soft or any landing, so to say. Last experienced in the 1980s, he says that the US is experiencing a “rolling recession” where instead of a general downturn, the slump sweeps slowly across different segments of the economy.

Hello and welcome to AS USA

Hello and welcome to AS USA's live feed on financial news for Friday, 10 February.

Fears of a general recession have receded for now as the US economy continues to power forward. But economists think the nation may be in the grip of a phenomenon seen before in the 1980s, a “rolling recession”, where an economic downturn sweeps through sectors one-by-one.

Additionally, inflation still remains uncomfortably higher than policymakers would like who have signaled that interest rate hikes will continue. Although he was surprised by the "extraoridinarily strong" jobs report for January, Fed Chair Jerome Powell said that he expects 2023 to be a year of "significant declines in inflation."

We'll keep you up to date on what is happening in the markets and what's being done to help Americans cope with inflation along with updates for the 2023 tax season underway and other financial news.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/FQXZHYDDINEHLMHSFUR3V4AH6Q.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/GLX5SETJ4ZCSHBECHSTOUL2EKY.jpg)