Relief checks summary news: 3 January

2023 is well and truly underway as changes to the COLA kick in, increasing the size social security payments for millions of Americans.

Show key events only

Financial news: Latest updates

Headlines: Tuesday, 3 January 2023

- Cost of living adjustment (COLA) comes into effect, increasing benefits by 8.7%.

- Last Friday, Congress passed a $1.7 trillion spending bill to fund government through September

- Supreme Court to hear two challenges to student loan forgiveness plan in February

- Medicaid eligibility to be slashed later this year after pandemic-era expansion

- US inflation slowed to 7.1% in November

- Fed continues to raise interest rates as inflation starts to ease

- Minimum wage to rise in several US states in 2023

Related news stories:

What next for interest rates in 2023?

The Federal Reserve was on a mission throughout much of 2022 to bring down high inflation. There were fairly few tools at the Fed's disposal to help with this effort and it resorted to a number of interest rate hikes to make borrowing more expensive and cool the overheated economy. But, as those with mortgages will have felt, interest rate increases can have wider consequences...

The most well known change to the 401k retirement plan at this stage is the increase of the contribution limits. The IRS will increase the thresholds in 2023, allowing workers to contirbute more towards their retirement.

However, it isn’t just the contributions limits that are increasing. Plans inside the latest yearly spending bill for 2023 set to make a few key changes to the retirement plan that look set to make it easier for workers to save money for their future life.

Here's everything you need to know...

Auto industry projected to have a strong 2023

The automobile industry has been hampered by a number of factors since the start of the pandemic, but it was the supply chain issues that proved the most difficult to resolve. There was a severe shortage of semi-conductor chips which are essential for the production of modern cars. Now that those problems have largely been resolved, experts suggest further groth for the manufacturing industry.

How to claim a tax credit with an electric vehicle

The Biden Administration's Inflation Reduction Act was heralded as a key legislative achievement when it was signed into law last year, but not everyone is aware of the programs included in the package. One such measure is a significant tax credit for anyone who buys a new electric car, worth up to $7,500..

A statement from the White House reads: "The Inflation Reduction Act lowers energy costs for consumers and small businesses while creating good-paying jobs as America’s clean energy economy and manufacturing sectors grow."

The Social Security Administration (SSA) announced an historic increase for beneficiaries in 2023, reflecting the damaging effects that covid-19 has had on the economy. Each year the SSA implements a cost-of-living adjustment (COLA), which is designed to increase benefits in line with inflation.

Starting this month an 8.7% increase will be applied to monthly payments. Here's what that means for Veterans Affairs recipients...

Housing market slows as stock backs up

Instability has been the characterising trend of the past few years, and one that is rarely a recipe for economic strength. The housing market has broadly favoured the seller in recent years, but this could change in 2023 with experts expecting homes to stay on the market for longer before a buyer is found.

Here's how that could affect the housing market in 2023...

Historic scenes in the House of Representatives right now as a number of Republican members have refused to cast their vote for Rep. Kevin McCarthy as Speaker of the House. McCarthy will not win a majority in this first vote, meaning that multiple votes will be needed for the first time in 100 years.

You can follow all the coverage here with our dedicated live feed...

The housing market has been characterised by instability in recent years. At first the economic shutdown left interest rates, and therefore mortgage rates, on the floor. However to address sustained high inflation during 2022 the Federal Reserve instituted a number of interest rate hikes, making borrowing especially expensive.

After this fluctuation it is difficult to predict where the housing market will go in 2023, but Forbes spoke to a number of real estate experts to get their take on the outlook for the year ahead…

Which states' insurance is getting much more expensive?

Two states, Wyoming and West Virginia, have healthcare costs that are 50% more expensive compared to the national average, with both having annual costs of over $10,000 a year on the silver plan alone.

Three states have silver plans that cost less than half of this crazy figure: New Hampshire, Maryland, and Minnesota.

Healthcare costs are increasing for most Americans in 2023. Without a public healthcare system price rises in some states may put thousands onto worse coverage plans and potentially leave them staring at financial ruin for a problem that was not their fault.

According to valuepenguin.com, the average monthly cost of health insurance in the United States is $560, a 4% increase on 2022′s $531. This is based upon the average silver plan cost for a 40-year old applicant.

States with scheduled minimum wage increases

Delaware: $10.50 to $11.75

Illinois: $12 to $13

Maryland: $12.50 to $13.25

Massachusetts: $14.25 to $15

Michigan: $9.87 to $10.10

Missouri: $11.15 to $12

Nebraska: $9 to $10.50

New Jersey: $13 to $14.13

New Mexico: $11.50 to $12

New York: $13.20 to $14.20 in Upstate New York; $15 in and around NYC

Rhode Island: $12.25 to $13

Virginia: $11 to $12

The New Year has got off to a positive start for workers in the 23 states have announced increases to the minimum wage from 1 January 2023. While the federal minimum wage remains a paltry $7.25 per hour, most states have implemented their own regulations, often raising that figure considerably.

Increases in the minimum wage are considered vital in many areas due to the rampant inflation experienced during 2022. Recipients of Social Security support are receiving a 8.7% boost to their payments from January to help deal with inflation, and those on minimum wage in 23 states will also get a modest increase.

Minimum wage boosts go into effect across the country

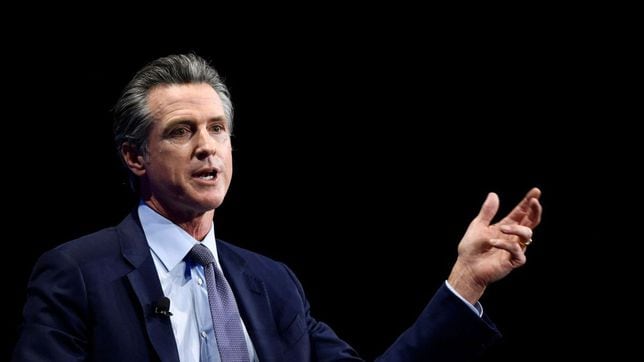

Workers in California will now receive at least $15.50 per hour after the state's employment laws upped the minimum wage. The Golden State was one of 23 states to introduce a minimum wage increase at the start of 2023, with another four set to impose a boost later on this year.

When will I get Student Loan Forgiveness?

The much-debated Student Loan Forgiveness program President Biden introduced last year will wipe up to $20,000 from the debt burdens of millions of borrowers. But it is one of four initiatives in the works that will offer financial relief to student debt borrowers.

Here's what you need to know about the four programs...

Americans don’t need to be reminded that prices have been rising, they just need to go to their local supermarket. However, on the bright side, the high inflation over the past year meant that the income thresholds for the seven federal tax brackets got a generous increase. As well the standard deduction that taxpayers can claim when filing.

The maximum retirement benefit one could receive in 2022 is $4,558 per month. However, this is only for people who retire at 70 beyond the full retirement age of 67. For the majority of Americans, the maximum retirement payment will be $3,636, which will apply to those people retiring at the full retirement age of 65 - 67, depending on the year they were born.

What have experts said about the housing market?

We expect home sales to be dramatically lower, down 14.1% compared to 2022 as both buyers and sellers pull back from a housing market and economy in transition.

The Millennial home buyers, who make up a huge demographic, are primed to make their move [in 2023].

Slowing inflation and the hope of the Fed easing rate hikes in the New Year are likely to bring mortgage rates down further and thereby improve homebuying demand.

Housing market slows as stock piles up

The past few years have seen great upheaval in the United States’ housing market, a period of instability parked by the covid-19 pandemic.

At first the economic shutdown left interest rates, and therefore mortgage rates, on the floor. However to address sustained high inflation during 2022 the Federal Reserve instituted a number of interest rate hikes, making borrowing especially expensive.

This has led to a considerable slowdown in sales and the number of homes on the market has swelled.

Food bank usage is on the rise

Across the country food banks are being stretched to the limit as households are struggling to cover the cost of essentials. Inflation was running extremely hot throughout much of 2022 and wages have largely failed to keep up with price rises. This has left millions of Americans forced to rely on food banks for their groceries.

The California Franchise Tax Board (CFTB) has sent payments for the Middle Class Tax Refund to over 17 million Californians. The inflation relief support, which range from $200 to $1,050, has been sent as either direct deposit or debit card.

While most of those receiving the support should have seen the money deposited in their bank account by 14 November, the mailing of debit cards follows a separate schedule. Debit cards are sent to those for whom the CFTB does not have a bank account on file.

Here's when the remaining payments will be sent out...

Wages aren't keeping up with inflation in the United States

Americans suffered with high inflation throughout 2022, seeing the price of essentials like grocery and gasoline soar and not receiving adequate pay increases to cover the extra cost. So why don't wages go up in line with inflation in most cases? This report from CNBC explains why consumers in the US are feeling the pinch of inflation...

Corporation tax increase goes live

Last year President Biden signed into law the Inflation Reduction Act, which comprised a variety of measures designed to help redistribute from the wealthy. One element of the package were changes to the corporation tax system which will see the biggest companies hit with a 15% tax rate which went live on 1 January 2023.

After signing the legislation, Biden said that it would help to cut the federal deficit "by having the wealthy and big corporations finally begin to pay part of their fair share," while "no one earning less than $400,000 a year will pay a penny more in federal taxes."

Welcome to AS USA

Welcome to our daily financial news feed, bringing you all the latest from the United States.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/UAN5RE5OPBFCXDKCJIUHQQMJWI.jpg)