Relief checks: 6 february summary news

Welcome to AS USA’s live feed covering inflation relief, the debate over social security, troubles in the housing market, 2023 tax season and more.

Show key events only

Inflation Relief: Latest Updates

Headlines: 6 February 2023

- Tech layoffs continue, Dell announces 5,000 job cuts

- Wall Street starts lower on Monday on fears of more Fed rate hikes after strong jobs report Friday

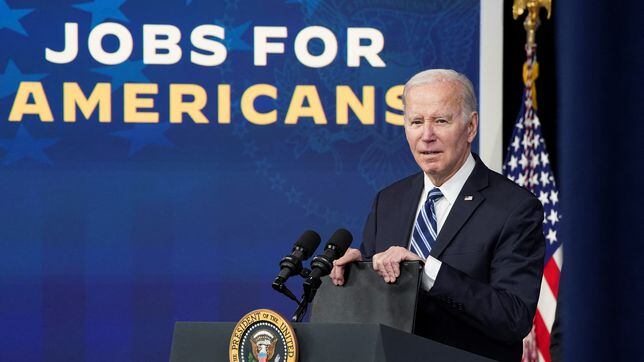

- President Biden touts record low unemployment after two years in office.

- Federal Reserve pushes up federal funds rate by twenty-five basis points to 4.5 to 4.75 percent

- 1.6 million workers in the US are currently receiving unemployment benefits.

- Federal stimulus checks ended long ago, but this month some states will send their own payments

- Inflation cut into the purchasing power of remittances sent to foreign countries from the US in 2022

- The price of many food staples continues to rise, most notably eggs due to worst bird flu in US history.

As part of the proposed Lowering MI Costs plan, Michigan Governor Gretchen Whitmer has proposed repaying income tax-paying residents with a rebate from state funds. The state in the Great Lakes is anticipating a huge budget surplus with billions dollars left unspent, hence the plan to give back.

The “inflationary rebate check” means everyone who filed an tax return for the last fiscal year would be eligible to receive the money. There are scant details but it has been supposed that those filing as couples would only receive one check. There is no information about how dependents relate to the funds.

Michigan statement on the Lowering MI Cost Plan

Inflation has driven the cost up on everyday goods, which is squeezing household budgets and forcing families to forego necessities. That’s why they sent us to Lansing to lower costs and put more money back into people’s pockets. We heard Michiganders loud and clear.

Michigan’s government has a dilemma. It is expected to produce a budget surplus of nearly $9 billion by the end of the budget year of 30 September. $6 billion of that will need to be spent this year and the state government has been considering its options.

The Democrat governor, Gretchen Whitmer, announced on Monday that she intends to get a $180 check to Michigan residents. As a part of the ‘Lowering MI Cost Plan,’ the checks would need to be agreed through the upper and lower legislative houses. At present these are both controlled by Democrats which could make negotiations a formality.

What did the treasury secretary say?

You don't have a recession when you have 500,000 jobs and the lowest unemployment rate in more than 50 years. What I see is a path in which inflation is declining significantly and the economy is remaining strong.

Treasury Secretary sees way out of inflation problems without recession

Treasury Secretary Janet Yellen on Monday said she saw a path for avoiding a recession, with inflation coming down significantly and the economy remaining strong

The Labor Department confirmed on Friday that nonfarm payroll jobs had increased by 517,000; nearly trebling the Dow Jones’ estimate of 187,000. This huge gain has pushed down the rate of unemployment to a 54-year low of 3.4%. This also beat estimates of a 3.6% rate.

BLS provides insights into which job markets are expected to increase

Over the coming decade, the various sectors that makeup the US economy will see fluctuations in the number of jobs available in that industry. Major gains are expected in the healthcare industry, jobs that relate to computers and mathematics, and personal care services. The last group includes hairstylists, child care workers, animal groomers, fitness trainers, and many others. Sectors that are likely to see a decreases is office and administrative support, and production.

Check out more on these labor market shifts from the Bureau of Labor Statistics.

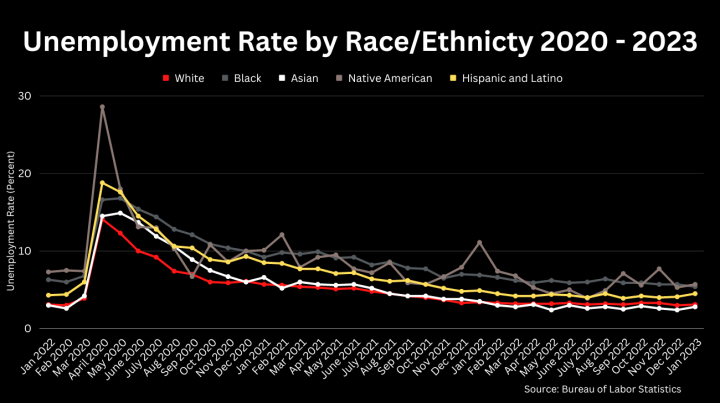

Unemployment continues to differ across racial and ethnic groups

Late last week, the Bureau of Labor Statistics reported that the US economy added over half a million jobs in January. The news shocked many economists who had assumed that no more than 200,000 workers would have been added to the payroll.

The addition of these workers has brought the unemployment rate to 3.4 percent, the lowest recorded figure in over four decades.

However, not all racial and ethnic groups have seen the same dramatic decreases in unemployment since the outbreak of the covid-19 pandemic. Further, the inequalities in unemployment before the pandemic, which led to millions of layoffs, made it harder for some groups to benefit from the tightness of the labor market during the recovery.

While all groups have lower unemployment rates today, compared to February 2020, the rates for Black, Native American, Hispanic and Latino workers remain a few points higher than the national average.

Last Wednesday, Federal Reserve Chairmen Jerome Powell said that the impact of interest rate increases has yet to affect the economy overall. Some economists worry that when they begin to be felt, unemployment could increase rapidly for racial and ethnic minorities, erasing many of the gains made over the last three two years.

Bank of American CEO says that everyone should get ready for US debt default

Janet Yellen announced that the Treasury Department had begun “extraordinary measures” as the US has reached its debt ceiling limit. These accounting maneuvers will keep the nation from defaulting on its financial obligations until early June while lawmakers work on agreeing to an increase to the borrowing cap.

GOP lawmakers in the House of Representatives want to use the negotiations to exact spending cuts from the budget. However, the game of chicken that has become terribly common in recent years could bring dire consequences should the US hit the “X Date” when the US goes off the financial cliff.

The CEO of Bank of America, Brian Moynihan, told CNN that such a possibility which might happen cannot be ignored. “We have to be prepared for that, not only in this country but in other countries around the world. You hope it doesn’t happen, but hope is not a strategy — so you prepare for it,” he said on ‘CNN This Morning’.

After the 2021 American Resuce Plan, families were able to claim a larger Child Tax Credit. While there are still some in Washington, on both sides of the aisle, who would like to see the program extended, no bills have been introduced. The impact of this inaction means that taxpayers with dependents will receive a smaller credit valued at $2,000.

Read our full coverage for details on how the value of the credit is determined.

After a near-record number of workers quit their jobs last year in search of higher wages and better conditions, many may have to report their income to the IRS using more than one W-2.

Legally, employers are required to send out W-2s to all current and former workers and they are nearly out of time to send the forms for the 2023 tax season. If you have not received yours, here is what you can do.

You can save thousands of dollars by taking advantage of the various deductions and tax credits that are available to filers. They are sometimes referred to interchangeably, but deductions and credits are completely different.

We take a look at the two, and outline some of the differences between the two...

Requirements to receive up to $7,000 for the Earned Income Tax Credit

The United States is in full tax season for the 2022 fiscal year.

When filing your taxes, you may be able to apply for any of the tax credits offered by the tax collection agency, including the Earned Income Tax Credit (EITC), which is aimed at low-income individuals and families.

We’re coming to the end of the California Middle Class Tax Refund. So far more than $9 billion has been issued to more than 7 million people since the middle of 2022. Very few are left to receive it.

For anyone who has not yet received their payment, the final payment will be sent by 22 February 2023. By this point, all eligible residents should have had the support as this payment should only be sent to people who changed their banking information since their 2020 tax return.

There is no way to track the refund.

Read our full coverage for information on how to contact the California Franchise Tax Board.

The state began distributing the Middle-Class Tax Refund in late October and to date 7.1 million have been sent out via through direct deposit, with an additional 9.4 million on pre-paid debit cards.

The California Franchise Tax Board (CFTB) estimates that in total more than 31 million residents have benefited from the tax credit and that the program cost the state just over $9 billion. If you are yet to receive yours, there is one more batch of payments to be sent.

Here's when that money could arrive...

What the experts are saying about the housing market in 2023

The housing market is down from its peak in the summer of 2022 cooled by rising borrowing rates and many previously red-hot markets being overvalued. But will the US see a housing market crash in 2023?

While the general downturn is expected to continue, it depends on which market, with four potentially set for a major correction. Other markets though could come through with but a scratch and some even seeing slight gains.

Last year, inflation in the United States reached historic levels.

Given the rising prices, particularly of staple goods, a number of government institutions approved sending stimulus checks or tax refunds as inflation relief for hard working Americans. Although inflation has fallen in recent months, support continues to be sent.

Here are the states sending checks or refunds in February and what the amounts are.

Stimulus checks feel like a long distant memory, the thought drifting away like trying to remember last night’s dream.

While there are no federal financial support plans announced, especially with most ending definitively with the expected announcement of the ‘end’ of the pandemic coming in May, individual states and cities are. These range from tax refund to trials of universal basic income. Many of these programmes is no longer accepting applications.

However, at the state level, relief remains available.Check out our full coverage for the details.

The Social Security Administration (SSA) has begun sending out increased monthly payments for retired workers and Supplemental Security Income (SSI).

Thanks to the 8.7% cost-of-living adjustment (COLA) increase, retiree payments will increase to more than $140 per month on average. According to SSA, average payments starting in January 2023 are $1,827 dollars. On the other hand, Supplemental Security Income (SSI) recipient payments will increase to approximately $650.

Unemployment claims fell last week

Initial unemployment claims fell by 3,000 to 183,000 claims for the week ending on 28 January. This has brought down the four-week moving average to 191,750.

Which states have seen the largest increases and decreases in initial claims?

For the previous week ending on 21 January, the states with the highest increase in initial claims came from Arkansas (+419) and the Virgin Islands (+5). On the other hand, the largest decreases were seen in California (-15,582), New York (-4,957), Ohio (-4,396), Georgia (-3,921), and Pennsylvania (-2,700).

KEVIN LAMARQUE / REUTERS

Which states have the highest unemployment benefits?

Currently, around 1.6 million workers in the United States are receiving unemployment benefits, with around 180,000 workers claiming benefits for the first time last week.

These figures are down significantly from 2020 and early 2021, when the pandemic led to a massive wave of layoffs.

Throughout the pandemic, Congress passed stimulus bills that increased the amount paid to workers receiving these benefits. However, in September 2021, those programs ended, and the regular amounts kicked back in.

Today, the highest average weekly unemployment benefits are distributed in Massachusetts ($645.52), Washington ($643.55), Hawaii ($583.49), New Jersey ($551.97), and Minnesota ($550.76). Even these benefits, which are on the high end of the spectrum, are a far cry from those given out during the pandemic. From March to June 2020, claimees would have seen a $600 bonus tacked onto their checks, nearly doubling the amount in most of these cases.

On Wednesday, when Federal Reserve Chairmen Jerome Powell announced a 0.25 percent increase in the federal funds rate, he said that the impacts of the central bank's rate hikes remain to be seen. One of the impacts he and many economist expect to materialize over the coming months is an increase in the unemployment rate, which in January hit a historic low. An unemployment rate of 3.4 percent has not been seen in decades and could quickly fall from view. If the rate of workers without employment does begin to increase, laboradvocates would like to remind the public of the dismal unemployment insurance coverage offered to many workers. There are a total of six states and one territory where the average weekly benefit that is distributed to those in dire need of financial assistance does not even reach the equivalent of forty hours of work at the federal minimum wage of $7.25:

- Puerto Rico: $202.36

- Mississippi: $232.00

- Louisiana: $239.18

- Tennessee: $244.21

- Alabama: $250.00

- Florida: $255.54

- Missouri: $282.33.

Eligibility and claiming unemployment benefits in California

While one can only hope that the optimists predicting a soft landing and not a full-on contraction of the economy are right, should you find yourself out of work, here’s what the state requires of you in order to apply for unemployment benefits to hold you over until you find a new job.

As part of the Inflation Reduction Act, the IRS is offering a $7,500 credit when you file, but who is it for and how do you apply? Find out how to apply for the tax credit...

Updated vehicle classification standard for $7,500 EV tax credit

As part of the Inflation Reduction Act, the rules for the $7,500 tax credit to encourage Americans to buy electric vehicles were modified. The new rules took effect 1 January 2023 and expanded the number of cars that would qualify for the clean vehicle tax credit.

However, there were interdepartmental discrepancies as to which cars qualified due to their classification based on the manufacturer’s suggested retail price (MSRP) limits. Some crossover vehicles were considered in some cases as a car, subject to the $55,000 limit, but in other cases an SUV, subject to the $80,000 limit.

The Treasury Department has announced that it has updated the vehicle classification standard to make it easier for consumers to know which vehicles qualify under the applicable MSRP cap. The consumer-facing EPA Fuel Economy Labeling standard will be used instead of the EPA CAFE standard.

Consumers who have purchased and placed in service vehicles since the beginning of the year that meet the new standards put in place and meet the other requirements can claim the credit.

Further guidance regarding critical minerals and battery components will be issued in March.

After 2022 bear market, signals are getting Wall Street investors bullish

Last year the major indexes took a beating experiencing the worst losses since 2008 ending a three-year winning streak. The S&P 500 dropped 19.4%, but entered bear territory going 20% below its record high. The tech-heavy Nasdaq plunged 33.1% over 2022. By comparison, the Dow Jones came out fairly good slipping 8.8%.

However, a new year, new starts. January has seen equities make impressive gains despite gloom that the Federal Reserve’s aggressive rate hikes could plunge the economy into recession. While the signals are not foolproof, the results over the past month have checked the boxes for investment strategists that Wall Street could be set for a bull market run in 2023. These include the more stocks making new highs rather than new lows and a "golden cross" chart pattern on the S&P 500.

Protect your money in 2023 from scammers

Scammers are not going away anytime soon. 2022 saw a continuation in thieves moving from using the phone to targeting people online.

The Better Business Bureau reported last year that online scams were 55% more prevalent than other methods of delivery. They are especially targeting people between 18 and 24, the group that reported the biggest spike in average dollar amount loss.

However, they still operate offline too. One of the new ways scammers are finding victims is through impersonations and text messaging.

Bloomberg Quicktale anchor Madison Mills talks through the five main fraud threats to be on the lookout for in 2023.

Having a good credit score comes with several benefits, such as lower interest rates on loans or other credit cards and it can even affect whether a landlord rejects you when you are looking to rent. That is why keeping it high is essential.

Hello and welcome to AS USA's live feed on financial news for Monday, 6 February.

Fears of a recession have receded for now as the US economy continues to power forward. However, inflation still remains uncomfortably higher than policymakers would like who have signaled that interest rate hikes will continue.

Despite the Fed raising borrowing costs again last week, less hawkish tone gave encouragement to markets. But much-better-than-expected jobs report showing 517,000 jobs added in Decemeber raised specter that tougher measures may be implemented to loosen tight labor market sent stocks down on Friday.

We'll keep you up to date on what is happening in the markets and what's being done to help Americans cope with inflation along with other financial news. Follow along!

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/CD4KX4U7CZMSXDIHCGPOI37QLM.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/MMO2TWUIZN4CUTE2OB4DRG3E6Q.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/7EZURCVDT5KIXBMSIQ7ENOSPFA.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/27HJQWCQXNAG5CYQGU2M3PO3E4.jpg)