Relief checks news summary | 1 February 2023

The Federal Reserve is expected to increase interest rates later today, follow along for updates on that, inflation and student debt relief, and much more.

Show key events only

US Financial News: Latest Updates

Headlines | Wednesday, 1 February 2023

- Federal Reserve increases rates by 0.25 percent

- How high could the Fed raise interest rates in 2023?

- December jobs openings data show US labor market remains tight with listed positions rising to 11 million

- Speaker McCarthy heads to the White House to negotiate debt ceiling deal

- Haven't received your Middle-Class Tax Refund?Here is what you can do.

- Aid is now available to Californians who need assistance paying their gas bill

- Republicans circulate a proposal to replace federal income tax with a massive sales tax

- What will the standard deduction be for 2023?

- SNAP benefit checks expected to decrease next month

Read more from AS USA:

You can save thousands of dollars by taking advantage of the various deductions and tax credits that are available to filers. They are sometimes referred to interchangeably, but deductions and credits are completely different.

We take a look at the two, and outline some of the differences between the two...

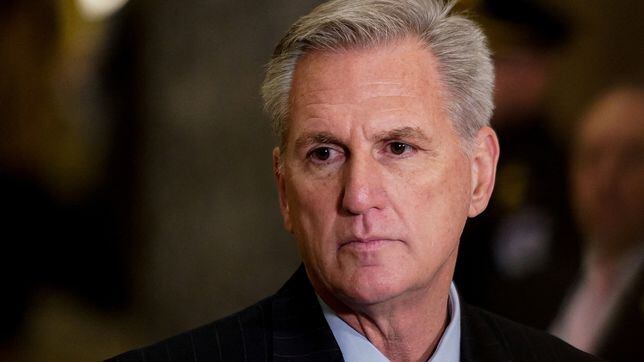

McCarthy tells Biden he will not accept clean debt ceiling bill

President Biden met with newly-installed Speaker of the House Rep. Kevin McCarthy today to discuss raising the debt ceiling. The US reached the statutory debt limit last month and now stands just months away from a catastrophic first ever default.

McCarthy is insisting that the GOP-majority House will not pass a clean debt ceiling bill. What does a 'clean' bill mean? In recent years Congress has approved legislation with the sole purpose of raising the debt ceiling, with no other bipartisan issues brought into the agreement. This time, however, McCarthy wants guarantees of future spending cuts to be included in the legislation.

For much of the past three years the United States has been under a state of national emergency to combat the covid-19 pandemic. This has allowed extra fderal resource to be spent on the effort.

One part of that was an expansion of Medicare and Medicaid eligibility to ensure that people weren't being left without coverage. Now, with the Biden Administation poised to remove the state of emergency, that will soon change.

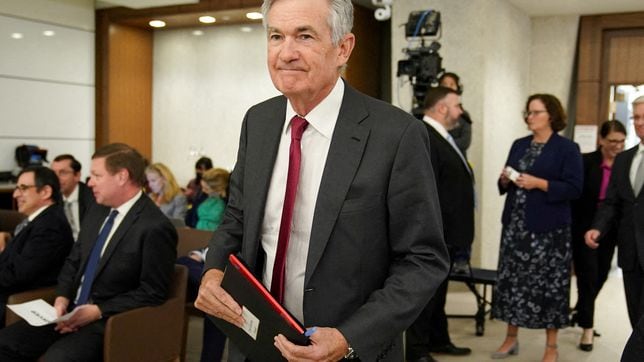

Why is the Fed raising interest rates again?

Interest rate hikes have been the principle tool used by the Federal Reserve to combat inflation in the United States. Raising rates - essentially making borrowing more expensive - has helped to slow the rate of price increases but has caused problems for millions of Americans, particularly those with mortgages.

There had been hopes that the Fed would be able to start lowering rates this year, but today announced another 0.25-percentage point raise. This takes the base rate to the highest level since 2007.

Owners of electric vehicles could be in for a significant windfall when they come to file taxes, benefitting from a new tax credit that is worth up to $7,500. The credit is part of the Inflation Reduction Act passed by President Joe Biden last year.

This legislation provides more than $370 billion in subsidies for solar, wind and electrical industries. The law went into effect on 1 January; here's everything you need to know...

After a near-record number of workers quit their jobs last year in search of higher wages and better conditions, many may have to report their income to the IRS using more than one W-2.

Legally, employers are required to send out W-2s to all current and former workers and they are nearly out of time to send the forms for the 2023 tax season. If you have not received yours, here is what you can do.

Several utility providers in California have warned that natural gas bills will be much higher than usual. Pacific Gas and Electric Company (PG&E) projects residential energy bills to be 32% higher from November to March, compared to the same period last year, according to a statement shared by the company.

Faced with high natural gas bills, the California Public Utilities Commission is considering doling out aid for Californians through so-called Climate Credits, which are part of efforts to fight climate change climate.

“We’ll stay the course until the job is done.”

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 4-1/2 to 4-3/4 percent.

Despite a Labor Department report on Wednesday showing that job openings ticked up, even though the policymakers are working to soften the strong demand, the Fed followed through with a quarter percentage point hike. In a statement, the central bank signaled that further rates will be coming saying “anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

Confronted by high turnover within the Texas state government, lawmakers are looking to pass a bill that would provide a $10,000 salary increase for state workers to increase retention. The bill, HB202, has been filed but has not been voted on by any committee or the chamber at large.

US labor market remains tight as Federal Reserve weighs rate hike

The US labor market is still running strong according to Labor Department data released on Wednesday. Job openings increased to 11 million at the end of December when it had been expected to drop. That raised the number of jobs available to 1.9 for every person unemployed.

This may bode ill for those hoping that the Federal Reserve continues to slow or even stop interest rate hikes as the central bank is trying to soften demand in the labor market as part of their efforts to tame inflation. Policymakers will conclude a two-day meeting on Wednesday to determine what will be the next steps in the ongoing struggle to rein in rising prices.

Republicans have said they do not want the debt ceiling cap lifted but are instead going to force the government to cut spending. Where these savings will be found is not to be social security it seems, if a new interview with McCarthy is to be believed.

“If you read our Commitment to America, all we talk about is strengthening Medicare and Social Security,” McCarthy told CBS’s Face the Nation.

But will Republicans keep to their word in future negotiations?

How much will the Federal Reserve increase rates this month?

In the economic forecast released by the Federal Reserve in December, a majority of the members of the bank’s Federal Open Market Committee believed that a Federal Funds Rate (FFR) of 5.1 percent would be necessary for 2023 to bring inflation back under control. In 2022, most members believed that a 4.4 percent FFR would put the economy on a track to cool prices across markets.

Last month, the central bank raised rates by half a percent, to 4.25-4.5 percent.

Financial markets fell this week as investors anxiously awaited the Fed’s announcement as well as responding to quarterly reports from major corporations, including Meta, Alphabet, McDonald’s, and many others.

Expect the announcement some time this afternoon.

Each year the IRS issues a standard mileage rate, which is used by taxpayers who need to drive their own car for business reasons. The rate is used to calculate the deductible costs associated with operating an automobile for business.

For those whose work demands a lot of miles on the road the mileage rate is always important. But after the price of gasoline soared to record highs in 2022 the rate is even more crucial than ever, and can be worth thousands of dollars in tax deductions.

We’re coming to the end of the California Middle Class Tax Refund. So far more than $9 billion has been issued to more than 7 million people since the middle of 2022. Very few are left to receive it.

For anyone who has not yet received their payment, the final payment will be sent by 22 February 2023. By this point, all eligible residents should have had the support as this payment should only be sent to people who changed their banking information since their 2020 tax return.

There is no way to track the refund.

Read our full coverage for information on how to contact the California Franchise Tax Board.

Real earnings fell in 2022

The Bureau of Labor Statistics reported yesterday that employee compensation costs rose 5.1 percent in 2022. However, in real terms, earnings fell by -1.2 percent. Meaning that while firms paid out on average 5.1 percent in wages, the real impact was a decrease of 1.2 percent in purchasing power.

Additionally, when looking at the average weekly income of workers from December 2021 to December 2022, there was an increase of around three percent. Any increase, in real terms, was erased by inflation, which over the same period hit 6.5 percent.

This comes after the Federal Reserve has confirmed the suspicion of many economists that a "wage-price spiral" is not driving inflation. Instead, the central bank has called the current situation a "price-price spiral," which increases inflation because of supply chain constraints. As those conditions improve, inflation is expected to subside.

Later today, the Chairman of the Federal Reserve, Jerome Powell, is expected to announce further increases to the Federal Funds Rate (FFR).

After December’s Employment and Consumer Price Index reports showed both a slowdown in hiring and inflation, the Federal Reserve is likely to respond with a softer rate hike than those seen in 2022. Last month, the central bank raised rates by half a percent, to 4.25-4.5 percent. It would be a surprise to many if the bank chose to increase rates to 5.1 percent in February; more likely is a rate hike of a quarter of a percent is implemented.

Read our full coverage for details on how the Fed decides which rate would be appropriate and how high rates could go in 2023.

Debt situation a peril but an unlikely one

The debt ceiling has never been exceeded. In history it has been raised 78 times to ensure the US does not default on its debt obligations. With the dollar the world’s currency in 2023 such a move would cripple the US’s role as a reliant bank while damaging economies around the globe. Indeed, economists estimate that the US would lose 6 million jobs, $12 trillion in household wealth and 4% of gross domestic product. The unemployment rate would double to 7%.

Biden criticised for debt ceiling stance

President Biden has maintained that he will not negotiate with Congressional Republicans over the debt ceiling, insisting that they must raise the limit without seeking concessions. The raising of the debt ceiling is, normally, a formality but on occasion bipartisan struggles can flare up.

Most notably in 2011 the debt ceiling crisis saw the United States go within a few days of a disastrous first-ever default on its debt obligations.

However Biden's stance has been criticised by Rep. Virginia Foxx, who said that the GOP were committed to finding a "responsible" solution to the debt situation.

Speaker McCarthy takes shot at President Biden.... from Twitter

The White House has made clear to GOP leaders that they are not willing to negotiate cuts to Social Security and Medicare.

Speaker McCarthy has reportedly received a memo from the White House describing their terms for the talks over the debt ceiling scheduled to take place in the coming weeks.

The Speaker responded on Twitter, saying he is "not interested in political games." Instead, he is prepared to negotiate for the American people, who across polls have categorically rejected the idea of increasing the retirement age to 70 or privatizing the federal pension program.

Can I get an IRS disaster extension?

Filers across the country are getting their tax affairs in order to get their 2022 tax return filed before the 18 April deadline. Failure to do so on time can result in penalty fines, but filers in some areas may have been given extra time if they have been the victim of the winter storms.

The Social Security Administration (SSA) has begun sending out increased monthly payments for retired workers and Supplemental Security Income (SSI).

Thanks to the 8.7% cost-of-living adjustment (COLA) increase, retiree payments will increase to more than $140 per month on average. According to SSA, average payments in January 2023 are $1,827. On the other hand, Supplemental Security Income (SSI) recipient payments will increase to approximately $650.

Hello and welcome to AS USA's live blog on financial relief and other economic news as the US recovers from pandemic related disruptions.

Today, the Federal Reserve is expected to increase interest rates by 0.25 percent. A smaller increase is projected in light of the December inflation and employment reports that showed both a decrease in prices and unemployment.

For those who have not yet received their W-2 from their employer, the deadline for them to be sent has now passed. Be sure to get in touch with the IRS for guidanceon what to do if your current or past employer has not sent this important form.

The White House plans to sit down with Congressional Republicans and has asked them to provide a budget that details the cuts they would like to make. Both President Biden and President Trump have warned these leaders that cuts to Social Security and Medicare should not be offered as a means to balance the budget. With such high-level opposition in both parties, it seems unlikely that cuts to these popular programs be implemented.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/MMO2TWUIZN4CUTE2OB4DRG3E6Q.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/APCAM4T3NLPTVUFRLMROYSYLZA.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/27HJQWCQXNAG5CYQGU2M3PO3E4.jpg)