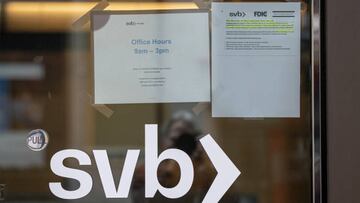

Silicon Valley Bank collapse: What did Biden say about bailing out depositors?

The US government announced a bailout to support the investors, angering many as inflation and interest rates keep putting pressure on everyone else.

Silicon Valley Bank’s collapse on Friday spooked markets, caused by investors hurriedly withdrawing funds after reports of a major loss of funds. It is the largest bank to fail since Lehman Brothers in 2008.

Shares in banks across the world were hit hard by the news with Germany’s Commerzbank falling more than 12%, and Santander down 7%.

The regulators were there until SVB lobbied Congress to remove the guardrails that prevent this kind of crisis in the first place.

— Alexandria Ocasio-Cortez (@AOC) March 11, 2023

Warnings were everywhere. SVB, like many gamblers before them, knew what they were doing. Let the FDIC open the books & see what it’s working with. https://t.co/XCoUCitjJK

However, a rebound occured at the beginning of this week as it was announced the US government would be securing all investments. This overode the usual rules of he government guaranteeing up to $250,000 of investments. This bailout will cost $175 billion.

“SVB’s collapse provides more than a stark illustration of the fact that there are no libertarians during a bank run.

— Grace Blakeley (@graceblakeley) March 14, 2023

It exposes the public-private partnership that lies at the heart of modern financial capitalism.”

Me for @tribunemagazine 1/ https://t.co/uKsDgkkB9z

Who will pay for it?

What has the US government said about the bailout?

President Joe Biden was quick to reassure investors that their money was secure.

“Thanks to the quick action in my administration over the past few days, Americans can have confidence that the banking system is safe,” the president said.

“Your deposits will be there when you need them. Small businesses across the country that deposit accounts at these banks can breathe easier knowing they’ll be able to pay their workers and pay their bills. And their hardworking employees can breathe easier as well.”

“Your deposits will be there when you need them.”

Should the bailout have happened?

While Biden said taxpayers will not be footing the bill, the reality is they will eventually. People already paid out to rescue investors and banks in the 2008 financial crisis, leading to a prolonged period of austerity that devastated public spending in the US and UK.

“If your definition is government intervention to prevent private losses, then this is certainly a bailout,” said Neil Barofsky, who oversaw the programme that saved the banking industry in the 2008 financial crisis.

Unmentioned: @RepBlaine is the #3 recipient of bank cash in the U.S. House & recently joined with Silicon Valley Bank's lobby group to pressure federal regulators to abandon their proposal to shore up the government's depositor insurance fund.

— David Sirota (@davidsirota) March 14, 2023

Receipts: https://t.co/MUypZu4QNb https://t.co/ITqBXENcfZ

Related stories

With an extra tax is unlikely, the way to secure the deposits will be through the Wall Street funded Deposit Insurance Fund. However, Wall Street will be looking to recoup these losses so do not doubt it will incur some financial penalty on those currently unaffected.

It is likely to reopen debate into what support governments should offer the rich for their financial mistakes at the expense of everyone else.