US financial news summary | Sept. 1, 2023

The latest updates on Social Security and SNAP payments, student loan forgiveness, minimum wage increases, and other financial news affecting Americans.

Show key events only

Headlines: Friday 1 September 2023

- Job openings fell in July to a more than 2-year low, pointing to slowdown

- September SNAP benefits brought forward in Floridadue to Hurricane Idalia

- US quarterly growth slower than expected in Q2

- Existing-home sales fell in July, prices rose for first time in five months

- Minimum wage in Florida set to increase in September

- Minimum wage in Californiato go up in 2024

- New requirements to receive SNAP benefits in 2024 to take effect soon

- 20% of student loan borrowers to pay $500 monthly when payments resume, according to study

How does "quiet cutting" work in practice?

[Workers] recounted getting a phone call or an email from a manager basically telling them your job has been reassigned and you will be doing this from now on, and basically take it or leave... It’s sort of like pushing you into this corner and saying if you don’t take it, you have to leave.

What is "quiet cutting?"

“Quiet cutting”, as it has been called, is a process in which companies aim get workers out without firing them. Restructuring of workforces, simply eliminating your jon and moving people around sectors, often for lower pay, are examples of this.

Recipients of Supplemental Security Income (SSI) will receive two payments in September. Those people who receive their Social Security payments, whether retirees, survivors or SSDI, and are eligible for SSI also receive two payments.

SSI payments are sent on the first day of each month. However, if the first day is Saturday or Sunday, payments are sent forward to the last Friday of the previous month.

1 September, the day all people with students debts have been dreading; mandatory monthly debt repayments have resumed. The moratorium in place since the beginning of the covid-19 pandemic has ended.

The Biden Administration has put forward the SAVE plan; an income-driven repayment (IDR) plan. It has been touted as the “most affordable repayment plan ever”, but that isn’t true for all borrowers.

What does the SAVE plan do?

The student debt repayment plan would increase the amount of income protected from repayment from 150 percent of the Federal poverty guidelines to 225 percent.

Undergraduate loans will have their monthly repayments cut in half from 10% to 5% of discretionary income. Interest is also capped.

US economy adds 187,000 jobs in August

Total non-farm payroll employment increased by 187,000 in August, and the unemployment rate rose to 3.8 percent, according to the Bureau of Labor Statistic.

Employment continued to trend up in health care, leisure and hospitality, social assistance, and construction. Employment in transportation and warehousing declined.

US Consumer spending on the upswing

Consumer spending in the US increased by the most in six months in July as Americans bought more goods and services, but slowing monthly inflation rates cemented expectations that the Federal Reserve would keep interest rates unchanged next month.

The report from the Commerce Department on Thursday, together with other data showing an unexpected decline in first-time applications for unemployment benefits last week, further diminished the risks of a recession this year.

The United States Department of Labor has launched a new proposal where nearly three million workers would have the right to receive overtime pay when they work more than 40 hours a week.

Through the measure, the Biden Administration intends to extend the protection of time-and-a-half pay to a greater number of workers through the modification of the exemptions of the Reasonable Labor Standards Act.

For decades, Medicare has offered health insurance programs to adults aged 65 and older, as well as other eligible people in specific medical situations or with some disability.

The rates for different plans vary and are determined based on the income of those who are eligible, so beneficiaries with higher incomes have to pay surcharges on their Medicare premiums. However, in some situations you may be eligible for a refund of these fees.

Hollywood strike, Yellow bankruptcy likely restrained August job growth

Job growth likely slowed in August, partly reflecting striking Hollywood actors and the bankruptcy of a major trucking company, but the unemployment rate probably held at more than 50-year lows as labor market conditions remain tight.

There is a tendency for the initial nonfarm payrolls count to be weaker in August. As such, economists are cautioning against reading too much into any sharp deceleration in job gains when the Labor Department's publishes its closely watched employment report on Friday.

Regardless of whether you are single or not, the amount you would need to earn to make ends meet in the United States can vary significantly based on various factors, including location, lifestyle, and individual preferences.

The cost of living also varies widely across different states and cities, with urban areas generally having higher living expenses compared to rural areas.

However, single people face certain challenges that are born of their civil status.

Medicaid is a health insurance program that is funded jointly by federal and state governments which strives to help low-income individuals have access to healthcare. It was established to provide medical coverage to children, parents, pregnant women, the elderly and the disabled who have limited income.

Although the federal government sets some basic ground rules, each state can choose whether to offer more healthcare services than those mandated.

Data from jobs market points to slowdown

In August, private employers added 177,000 jobs, as reported by ADP, a human-resources company. This figure marked a decrease from the 371,000 jobs added in July and fell short of the 200,000 new jobs that economists had anticipated ADP would report for the month.

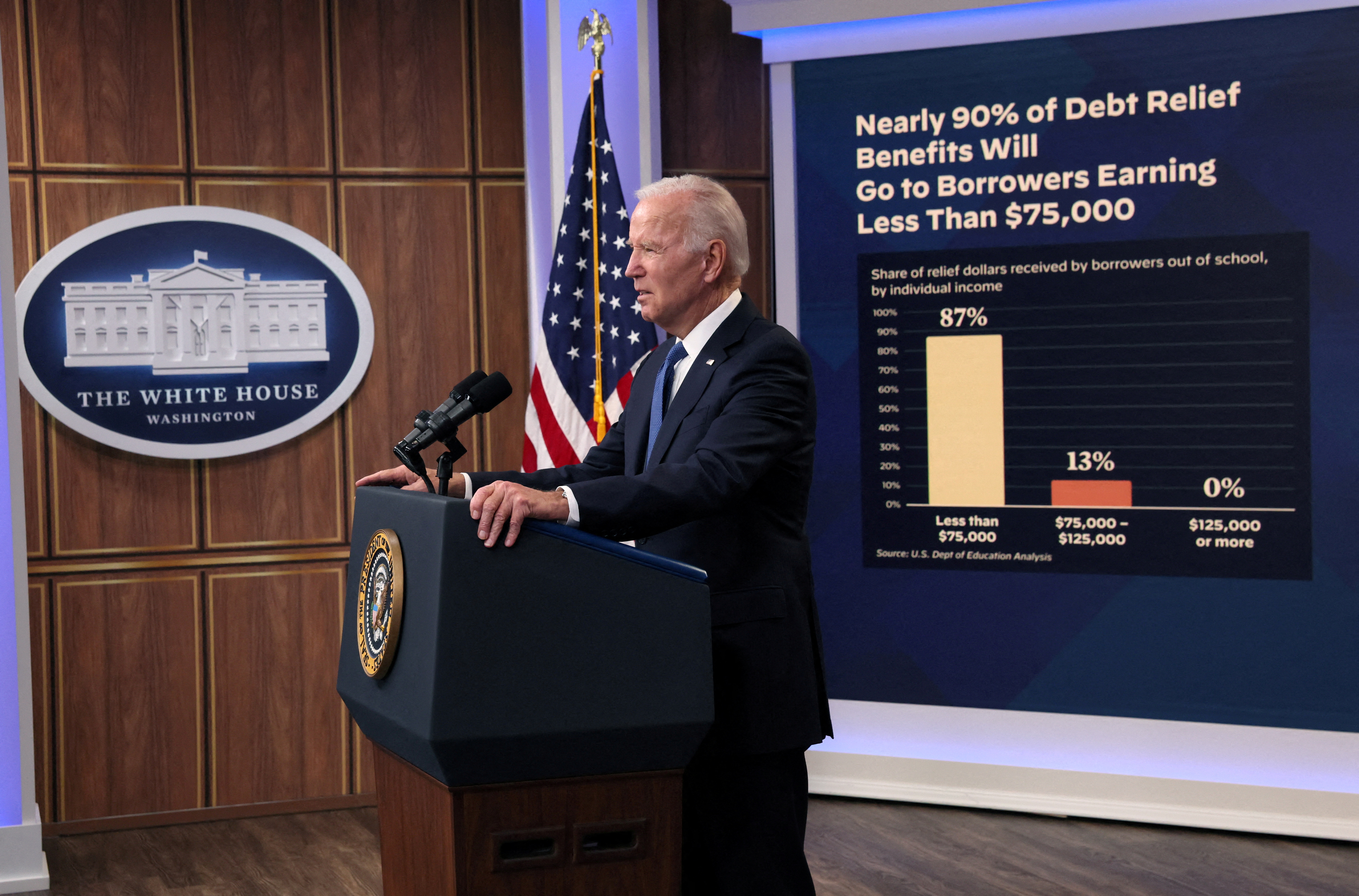

The original plans for student debt cancellation may be dead but don’t rule it out of the future. At least, those are the sounds coming out of President Biden’s camp.

Using a process called negotiated rule-making, the Education Department will bring together a wide range of voices to craft its new policy.

However, this will take a long time.

Interest rate hikes could be over, for now. There is evidence that the US labor market is weakening as interest rates take their toll on companies.

It remains to be seen what the data will show when the Bureau of Labor Statistics releases its employment situation document on 1 September. There is more data that will be released before the Fed makes its decision.

Good morning and welcome to AS USA's live financial blog!

As September begins, follow along as we bring you the latest news on SNAP benefits, Social Security updates and student loan repayment plans, as well as other financial news affecting US consumers as the job market cools and the government continues working to bring down inflation.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/DXECHX4MWVGHNK427QRIUWW3VE.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/GLX5SETJ4ZCSHBECHSTOUL2EKY.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/6UW55VKVY5PHXL4PX3MLMSMCO4.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/TTJVDOWQ3IFHUFJE7ZHY3U5KLM.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/N3NIJSI475PMJH5V5KMFIFQOYU.jpg)