Stimulus checks news summary | 28 February 2023

US Finance Feed: Latest Updates

Headlines: Tuesday, 28 February 2023

- US Supreme Court hears oral arguements on legality of Student Loan Forgiveness plan

- Janet Yellen in interview on the economy and inflation battle says: "So far, so good”

- US GDP grew 2.7% in the fourth quarter of 2022

- Personal income in the US rose 0.6% in January

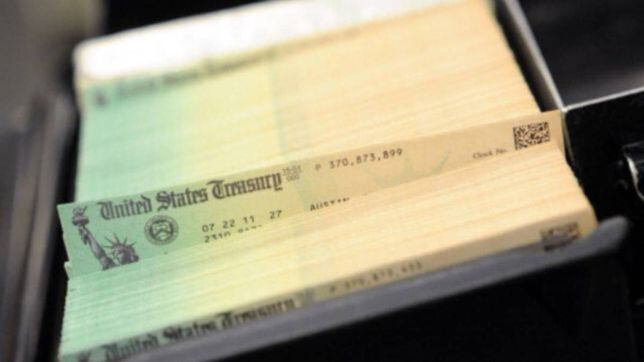

- Differences between a stimulus checkand a disaster relief check

- Federal government pushes to enroll seniors in SNAP benefits

- Austin, Texas leads US capitals in terms of falling home prices: where else are prices falling?

2023 Tax Season

- The way to access IRS transcripts to ensure a faster tax refund

- Did you receive a state stimulus check? No need to report the payment as income to the IRS.

Read more from AS USA:

When will the Supreme Court decide on Student Loan Forgiveness?

The Court has heard arguments on two separate lawsuits brought against Biden’s debt relief plan, but that does not necessarily mean borrowers will need to wait for two decisions. The Supreme Court could issue a ruling on both in a single decision, particularly considering the similarities between the two cases.

However even if they choose to issue a single ruling, it will take around three months for the process of draft opinions to be authored, distributed and amended within the Court. Typically, the Supreme Court delivers rulings on the biggest cases in late June.

What did Justices Roberts and Kavanaugh say about Student Loan Forgiveness?

If you’re talking about this in the abstract, I think most casual observers would say if you’re going to give up that much ... money, if you’re going to affect the obligations of that many Americans on a subject that’s of great controversy, they would think that’s something for Congress to act on.

Some of the biggest mistakes in the court’s history were deferring to assertions of executive emergency power. Some of the finest moments in the court’s history were pushing back against presidential assertions of emergency power.

The Supreme Court has begun hearing arguments on the legality of President Biden’s Student Loan Forgiveness plan, his flagship program to eliminate hundreds of billions of dollars in student debt.

Tuesday was the first day of oral arguments and it looks like the Court’s conservative majority are likely to side with the blocks imposed by GOP-appointed judges on lower courts.

Watch out for tax refund scams

The majority of filers are expected to receive a tax refund this year and the IRS is working around the clock to get those payments out promptly. But while the tax agency is committed to getting refund money into your pocket, unscruplous scammers are eager to part your hard-earned refund from you.

The Federal Trade Commission warns filers to look our for tax messages claiming to offer a tax refund or rebate if you follow the link. Do not click, it's a scam.

Consumers across the country have been subject to the changing tides of the US economy in recent years, with a sudden pandemic-enforced downturn followed by a period of rampant growth. The economic recovery has been good for the jobs market but disastrous to consumers, who have had to contend with rapid inflation pushing up prices.

With that in mind, it was no surprise to see consumer confidence fall in February...

When will the Fed lower interest rates?

The Federal Reserve is eager to ensure a 'soft landing' for the United States economy as it looks to address the high inflation recorded over the past year. Peter Kraus, Aperture Investors chairman and CEO, tells CNBC 'Squawk Box' that the Fed's interest rates will likely stay at this level or higher for 18 months as the central bank looks to bring down inflation.

Credit card debt rose as inflation soared

Inflation has been the biggest economic factor facing Americans for much of the past year and new figures suggest that the consequences of the price rises could be long-term financial issues. Credit card debt has soared to record levels in the past few months, suggesting that outpriced consumers have been forced to lumber themselves with unsustainable amount of credit card debt.

Federal and state authority have attempted to soften the blow with a series of relief payments, but that may not have been enough.

The Supreme Court has been called upon to rule on the legality of President Biden's sweeping Student Loan Forgiveness program, which has been the subject of countless court challenges from Republican states. But why are the GOP so opposed to offering financial relief to borrowers?

Bernie Sanders promotes Student Loan Forgiveness

As the Supreme Court begins hearing arguments on the fate of Biden's Student Loan Forgiveness program, Sen. Bernie Sanders has appeared outside the court to push for full cancellation of student debt. The progressive Senator has long supported free education for all and believes that Biden's $10,000/$20,000 in forgiveness does not go far enough.

When will the Student Loan Forgiveness decision be made?

Today the Supreme Court began hearing arguments on the fate of President Biden's flagship Student Loan Forgiveness program, a key part of his 2020 campaign. The initiative has faced numerous legal challenges from Republican lawmakers and GOP-led states and the White House is currently unable to action the support.

The Supreme Court is expected to release a final verdict in the early summer.

Universal basic income (UBI), sometimes known as guaranteed income, would provide a regular payment to citizens whether they were in work or not.

The idea behind it is that it would decrease poverty and allow people to have a level of money without any dictation from salary or benefits. Outside of raw economics it would give people the chance to work less and live more fulfilling lives in being able to choose jobs they want to do rather than what they have to do to survive.

Here are the US cities invovled in UBI programmes.

Musk and Lopez Obrador reach agreement for new Tesla factory in Mexico

President Andres Manuel Lopez Obrador said at a news conference on Tuesday that a proposed Tesla manufacturing plant would go forward. There had been worries that the Mexican president would block the project, which will be located in the northern Mexican city of Monterrey, over concerns about water scarcity in the arid region.

However, after speaking with Elon Musk directly, Lopez Obrador said that in a call with the Tesla CEO the two sides have reached agreement. Details of the deal will be presented by Musk on Wednesday when he is slated to hold an "Investor Day" during which he will outline his "Master Plan Part Three."

The US Supreme Court will rule over the constitutionality of President Biden’s order to forgive up to $20,000 in undergraduate student loan debt for millions of borrowers.

Publicly, the GOP has come out strongly against student debt relief... but some of their written proposals cast a different, more sympathetic story.

Read more about what has been said about student loan forgiveness.

The battle over Medicare funding has both sides claiming the other wants to make cuts to the program. The latest against the Biden administration revolves around new Centers for Medicare and Medicaid Services (CMS) rule changes. Experts who have looked at the proposals find that to call them “cuts” is inaccurate, while fact checkers say it is false. Here’s a breakdown of what is being proposed.

Homebuyers jumped at opportunity to secure lower mortgage rates in January

January saw the largest monthly home sales increase since June 2020 according to data from the National Association of Realtors (NAR). Existing home sales jumped by 8.1%, far outpacing the 1% predictions by economists, as consumers jumped at the opportunity to secure a lower mortgage rate.

The preferred home loan, a 30-year fixed rate mortgage, dipped to around 6% in January after topping 7% late last year. “Buyers responded to better affordability from falling mortgage rates in December and January,” said Lawrence Yun, chief economist at NAR.

Additionally, affordability was aided by the national average price of a home coming down in recent months. However, it isn’t expected to drop significantly nationwide as a shortage of supply and steady, albeit weak, demand buoys prices.

When filing your taxes, you may be able to apply for any of the tax credits offered by the tax collection agency, including the Earned Income Tax Credit (EITC), which is aimed at low-income individuals and families.

EITC recipients can receive up to $6,935, almost $7,000. However, the exact amount will depend on the situation of each family or individual applying, such as the number of children one has or annual income.

Tax refund over $10,000: Who Is Eligible & How To Apply

Individuals who are eligible for the Earned Income Tax Credit (EITC) and the California Earned Income Tax Credit (CalEITC) may be able to receive a refund of more than $10,000.

If you are eligible to collect both credits, you will need to claim them through your prospective tax return. The exact amount depends on the total number of qualifying children, as well as your annual income.

A bill to provide a stimulus check worth up to $500 for those who filed their 2021 and 2022 tax return has passed the Georgia House of Representatives. This renewal of a tax credit enacted last year kicked in when both 2020 and 2021 tax returns were submitted.

Now, it is up to the Georgia Senate to determine whether millions will see between $250 and $500 tacked onto their tax refund. The bill passed in the House by a huge margin, 170 to 2, which indicates a high chance of passing in the upper chamber.

The extension of this credit was a key pillar of Republican Governor Brain Kemp’s re-election campaign that he won in November. With Georgia voters delivering him the victory, Gov. Kemp is working to make good on these commitments.

Read more on who qualifies and the amounts would be distributed in our full coverage.

According to the National Council On Aging (NCOA) there were more than 5 million older adults did not have access to healthy food in 2019. More than 10% of over 65s live in poverty.

Supplemental Nutrition Assistance Program (SNAP) is a lifeline for these people. The average SNAP benefit for a one-person senior household is $104 per month.

”We have the resources to ensure that all people can live without the threat of deprivation,” said NCOA’s Ramsey Alwin. “But we need the political will to use them.”

Janet Yellen: “I would say, ‘So far, so good’”

Obviously there are risks, and the global situation we face is very uncertain. There can be shocks from it. But look, inflation still is too high, but generally if you look over the last year, inflation has been coming down. And I know the Fed is committed to continuing the process of bringing it down to more normal levels, and I believe they’ll be successful with it.

Will Federal Reserve interest rate hikes spark a recession? Investors divided

The Federal Reserve over the past year has been increasing interest rates at the fastest pace since the 1980s to curb inflation not seen in four decades. While at the start of the aggressive monetary tightening policy caused many to fear that a recession would be forthcoming, the US economy has continued to show signs of robustness.

However, the specter of a recession has not completely faded as that same strength has brought with it the expectation that policymakers will continue to raise interest rates into the summer and keep them higher longer than previously wished for. Investors are now split on whether the economy will have a "hard landing", i.e. recession or a "soft landing" where it avoids mass job layoffs but inflation is brought to bear.

Earlier this month the IRS confirmed that the various types of state-funded relief payments distributed in 2022 will not be subject to federal taxes. Because the Middle-Class Tax Refund is classified as a “payment [...] made for the promotion of the general welfare or as a disaster relief payment,” the checks will not be taxed at the federal level.

In their statement the IRS cited the pandemic emergency declaration that the White House as a justification for these payments to be treated as a relief program. We take a look at what you should do if you had already paid taxes on those payments...

Federal and state officials implemented a number of financial relief programs designed to support Americans through a tumultuous few years for the US economy. The three rounds of federal stimulus checks were the most well-known of these efforts but there were countless other examples throughout the pandemic emergency declaration.

Under the emergency declaration, most recipients will not be taxed on the payments that they received. But there are still some major difference between two popular forms of tax-exempt support: disaster distribution and stimulus checks.

We take a look...

Median house prices fell in January

The median price of a home sold in the United States fell 8.2 percent to $427,000 in January.

This dramatic decrease was not seen in the average home price, meaning that more expensive properties may be maintaining a higher price point.

As interest rates increase, some buyers, particularly those with fewer resources, can be priced out of the market. As demand falls and supply remains constant, prices fall. This trend is expected to continue over the coming months as higher interest rates increase the price of mortgages for many buyers.

Has the housing market hit the bottom?

The US housing market has been in decline for much of the past year, following a period of price rises during parts of the pandemic. High interest rates, a consequence of historically high inflation, have increased the price of mortgages and reduced demand for homes. However analysts now believe that the housing market may be starting to level out, good news for those looking to sell in 2023.

Can a spouse inherit a 401(k) plan?

If the account owner is married and the spouse is named as the primary beneficiary of the 401(k) then the spouse has several options for withdrawing the funds:

Roll over the funds into their own 401(k) plan.

Leave the funds in the 401(k) plan and take distributions over time with annual required distributions, though this is limited if the account owner died in 2020 or later.

Withdraw all funds within 5 years after the owners death, if they died before 2020.

Withdraw all funds within 10 years after the owners death if the owner died in 2020 or later.

Or take a lump sum distribution.

The rules regarding who can inherit a 401(k) and how the funds can be withdrawn depend on a few different factors, such as the account owner’s age, the beneficiary designation on the account, and the specific provisions of the 401(k) plan.

It’s important to note that there are also generally tax implications associated with withdrawing funds from a 401(k) plan, regardless of who inherits the account.

In the case of the death of an account holder there are lots of options for spouses and other family members to receive the plan.

After several natural disasters and severe storms have battered parts of Alabama, California, and Georgia, federal and state tax authorities have extended the tax filing deadline. However, residents of these states should be aware that the extension may not all apply to all counties.

AS USA's live blog covering financial news and economic relief

Welcome to AS USA's live feed covering the latest financial news out of Washington DC and Wall Street, along with measures around the nation to help families cope with inflation.

We will bring you updates on student debt relief, the 2023 tax season, news from the Federal Reserve, and much more.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/XPMJAHR7K5EJF2QEOU7KORRMB4.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/VX7LA3SEKJIG7ANO5X6H35M7VE.jpg)