Inflation relief checks summary: 13 November 2022

Crypto markets are collapsing. Inflation is decreasing, but some are still struggling; follow along for updates on financial news and support.

Show key events only

Inflation Relief: Sunday 13 Nov

Headlines: Sunday, 13 November 2022

Market respondspositively to news of Democrats outperforming expectations in 2022 Midterms

- Dow Jones is up 1,293.76 (3.99%) since last week

- NASDAQ is up 806.39 (7.67%) since last week

- S&P500 is up 212.22 (5.61%) since last week

- The Fall of Young Billionaire Sam Bankman-Fried: Bankruptcy at 30

- FTX bankruptcy sent Bitcoin price plummeting, original cryptocoin hovering around $16,500

- While Nevada and Nebraska have not sent relief checks to residents, voters have approved ballot measures to increase the state's minimum wage

The Social Security Administration announced its 2023 COLA and it was a whopper. At 8.7 percent, it is the fourth largest in the history of the annual cost-of-living adjustments and the biggest since 1981. The Social Security Administration will begin sending out notices in the mail to beneficiaries of exactly what their monthly payments will be next year.

Investors shaken by another concerning clerical error at Crypto.com

This has been a rough week for cryptocurrencies, which have been experiencing a rough year. While advocates claim that the digital coins will become assets untethered to the stock market, something akin to gold, as Wall Streets fortunes soured over the year, crypto took a shellacking.

The latest bad news came first with the collapse of the FTX crypto exchange resulting in billions lost. Now Crypto.com has admitted that it made yet another clerical error to the tune of over $400 million.

The exchange sent 320,000 in Ethereum to its corporate account at Gate.io instead of putting it into one of its cold, or offline, wallets. It has since recovered the funds unlike a previous mistake In August. Instead of sending a customer a $68 refund, the individual got $7.2 million which the company is suing to get back.

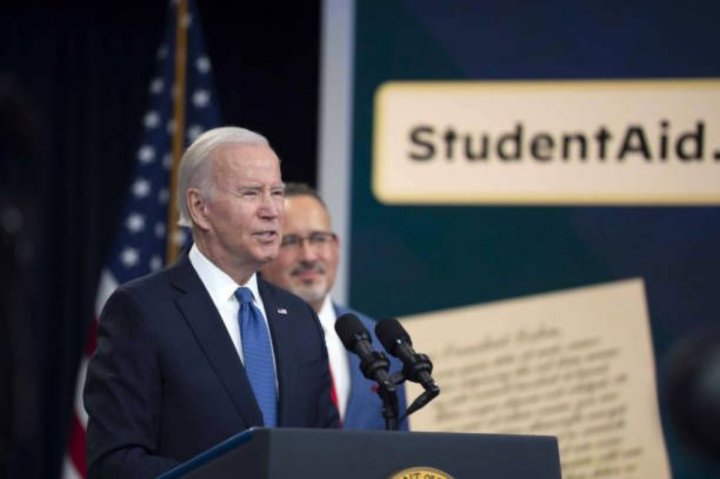

Student Loan Forgiveness Program suspended: What happens now if you already applied?

Student loan borrowers that have applied, or wishing to do so, for forgiveness of their debt under the Biden administration’s program find themselves in limbo after a Texas federal judge declared it illegal. The ruling on Thursday was the second such since the Department of Education launched its online portal for borrowers to submit an application.

However, while the first on 21 October put a pause on processing applications already submitted, this second court decision has prompted the Education Department to stop accepting new applications. Millions have already applied and over half of those have been processed. So, what will happen next?

Get informed on how to weatherize your house before Jack Frost is nipping at your wallet

With a winter approaching that is expected to be a little colder than the last and energy costs higher than last year, households will be facing yet another stress on their finances. Depending on how you heat your home it could be as much as 28% more expesive this winter.

The average cost is estimated to be 18% higher this year, or roughly $1,200 more than last year. While states and localities have programs to help those struggling to keep the furnace running, there are several ways that you can kept the cold out and heat in through weatherization.

Weatherization of your house can make a big difference in how much you pay out of pocket to keep your home warm this winter. Tune in next week for a webinar on what steps you can take to keep down your energy bills this winter.

Fast Facts on the California Middle Class Tax Refund

So far, the California Franchise Tax Board has deposited 6.03 million relief payments into bank accounts directly, with an additional 1.6 million debit cards being sent through the mail. Through direct deposit and debit cards, more than $4.10 billion have been sent back to 13 million residents.

Department of Education ends student loan forgiveness application

After a federal judge in Texas struck down the White House's plan to forgive up to $20,000 in student loan debt, the application has been closed.

This does not mean that it will not be re-opened, but for now, the Department of Education must wait to see what the courts decide.

Interest rates for 30-and-15-year fixed rate mortgages continue to rise

The St. Louis Fed has reported that mortgage interest rates continue to rise:

- 15-year fixed rate mortgage: 6.38%

- 30-year fixed rate mortgage: 7.08%.

Both of these rates have risen rapidly since the Federal Reserve moved to increase rates in an attempt to slow inflation. In the housing market, rate increases have lowered demand as mortgage payments are much higher now than they would have been a year ago.

Compensation down in October

The BLS has reported that real hourly earnings fell in October by 0.1 percent, meaning inflation continues to cut into purchasing power. At a time when the tight labor market is being blamed for inflation, real wages for workers continue to fall...

Struggling cryptocurrency exchange FTX has filed for chapter 11 bankruptcy and its CEO has resigned after a collapse in the value of its linked crypto coin left a $7 billion shortfall in the companies finances.

CEO and founder Sam Bankman-Fried has lost his entire $16 billion fortune overnight according to Bloomberg’s analysis, one of the biggest destructions of wealth of all time. While this was all wealth speculation considering this was all held in seemingly his own cryptocurrency it marks a dramatic fall from grace for a young crypto investor who just this summer was rubbing shoulders with Bill Clinton and Tony Blair, former US president and former UK prime minister respectively.

Hello and welcome to AS USA's live blog covering financial news and bringing you the latest on state initiatives to pass relief directly to their residents.

In October, inflation slowed, increasing only 0.4 percent, brining the year-over-year average down to 7.7 percent. This comes as unemployment increased slightly last month but showed strong signs of job growth, with over 200,000 jobs being added to the economy.

Markets have responded well to the news on inflation as well as the overperforming of Democrats against Trump-backed candidates.

Additionally, crypto-markets are in free-fall as some of the largest exchanges collapse.