Student Loan Relief Forgiveness Application: how does it work and how to apply?

The Beta version online application of the Biden-Harris Student Loan Forgiveness program launched on Friday and 8 million borrowers have already signed up.

President Biden announced the official launch of his administration’s Student Loan Relief Forgiveness application. The Beta version of the online form went live on Friday and borrowers flocked to get their requests in. Over 8 million Americans have already signed up to get their federal student loan debt canceled during the short trial period for the online portal.

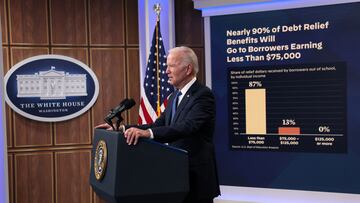

The White House announced in August that Pell Grant recipients could get up to $20,000 discharged on their federal student loans, non-Pell Grant recipients as much as $10,000. The measure applies to individuals that made less than $125,000 and families that earned $250,000 in either 2020 or 2021, roughly 40 million borrowers.

Also see:

Student loan forgiveness applicants will only need to apply once

Millions of eligible Americans can begin applying for the debt forgiveness via the online application form. Those that submitted an application before the full rollout will now have their applications processed which should take a matter of weeks. If you used the Beta form, you will not need to resubmit your application.

Were there any benefits to submitting an Student Loan Forgiveness earlier?

While the Department of Education said there was no advantage to getting your debt forgiveness processed faster by using the Beta version, those applications are already in the possession of the agency and will begin processing. Moving swiftly to submit a debt cancelation request could be in the best interest of borrowers for a couple of reasons. One, loan repayments begin 1 January 2023 after a two-plus year hiatus and two, there are legal challenges to the Biden-Harris Student Loan Forgiveness program.

In the first instance, according to Education Secretary Miguel Cardona it will take around six weeks to process an application from the time it has been submitted. This will be important for borrowers that want to avoid additional accuring interest and having to make payments, or have smaller payments, in the new year.

The second, while it will have to work its way through the courts, should the final decision find that the administration overstepped its purview, that would scuttle the debt relief program. However, “any borrower who has already received forgiveness will likely get to keep it, even if the courts block the President’s plan,” Mark Kantrowitz, a higher education expert, told CNBC. “The courts tend to not claw back benefits that have already been received.”

Just 3 steps and you can see student loan debt relief. pic.twitter.com/2Rw8m6qufp

— Secretary Miguel Cardona (@SecCardona) September 5, 2022

Information needed to apply for Biden-Harris student loan forgiveness

The process for applying is simple, you don’t need to log in nor provide any documents. The Education Department estimates that it will take applicants about 5 minutes to complete the form. You will need to give your full names, date of birth, a phone number and an email address.

You will also be required to give your Social Security number and attest that you earned less than the income limits set for the relief. For those that filed federal income taxes, you can find your adjusted gross income on line 11 of your IRS Form 1040 submitted in either 2020 or 2021.

The Department of Education will determine your eligibility for the debt forgiveness program and will contact you if any further information is needed. Once the Department of Education begins processing an application most qualifying borrowers are expected to receive debt relief within six weeks. Once your student loan debt relief has been processed you will be notified by your loan servicer.

Not all loan balances are eligible for student debt relief

The Biden-Harris student debt relief will only apply to federal student loan balances that borrowers had prior to 30 June 2022. Any new loans disbursed on or after 1 July 2022 do not fall under the purview of the student loan debt forgiveness program. Furthermore, consolidation loans have other applicable rules.

The Biden-Harris Administration’s student debt relief plan will give working and middle-class Americans more breathing room. pic.twitter.com/2g31TgNkiD

— The White House (@WhiteHouse) October 12, 2022

Deadline to apply for student loan forgiveness

There are some important dates to keep in mind with regards to the student loan forgiveness. Those who wish to apply will have until 31 December 2023 to submit their application. Those that want to have their balance partial or completely reduced before repayments and interest accrual restart on 1 January 2023, will want to get their application submitted by 15 November 2022.

Related stories

Most borrowers will have to submit an application to receive the student loan debt relief. However, those that completed a Free Application for Federal Student Aid (FAFSA) form for the 2022–23 school year or are enrolled in an income-driven repayment plan based on your 2020 or 2021 income may be automatically eligible without having to apply.

These borrowers will be contacted via email to notify them that they don’t need to apply. While any amount that a borrower has forgiven won’t be taxed federally, there are some states that will apply state taxes on the amount of the student loan discharged. Borrowers that are worried about being taxed by their state have the option to opt out of the student debt relief program.