These are the chains that are closing the most stores in the United States in 2024: Family Dollar, 7-Eleven...

The retail industry continues to suffer in the United States. These are the chains that are closing the most stores in the country, according to a new analysis.

The mismanagement, a change in consumer trends and the inevitable rise in inflation have led to the closure of thousands of stores around the country. So far in 2024 alone, About 3,200 physical stores have closed in the United States, according to a new analysis by CoreSight, a retail data provider that tracks store closings and openings in the United States.

According to the aforementioned report, the closure of locations in the United States, so far in 2024, represents an approximate increase of 24% compared to the previous year’s figures. Regarding openings, although some chains have announced expansions, the truth is that the numbers are 4% below last year’s index.

Among the chains that have been most affected by branch closures is Family Dollar, owned by Dollar Tree, which recently announced the closure of nearly 1,000 physical stores in the United States. 600 closures are expected in 2024, while the rest will occur in the coming years. But what about other retailers?

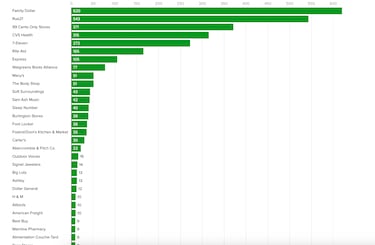

These are the chains that are closing the most stores in the USA

So far in 2024, Family Dollar has closed 620 locations throughout the country. Coming in second is Rue21 with 543 closures, followed by 99 Cents Only Stores with 371 closures and CVS Health, with 315. Below are the chains that are closing the most stores in the US, according to CoreSight.

Table obtained from CBS News*

You may also be interested in: McDonalds $5 dollar menu: What we know about the meal deal

The reason behind the closures

The analysis cites changes in consumer habits, as well as problems with store management, poor performance, increased inflation and increased theft as the main reasons for store closures.

Related stories

“A lot of this year’s closures are related to bankruptcies of chains that have been in trouble for a while, like Rite Aid and Rue21. We’re also seeing several retailers, like Family Dollar, take action to weed out underperforming locations,” explains GlobalData CEO Neil Saunders for CBS Moneywatch.

Despite the Federal Reserve raising interest rates and keeping them high, consumer spending has been remained strong. However, that could be changing with “pockets of softness creeping in, and retailers want to ensure they are in good financial shape to weather any challenges. That means optimizing store portfolios.”

Complete your personal details to comment