US financial news summary | 20 May 2023

US Finance News: Latest Updates

Headlines | Saturday, 20 May 2023

- The impact of a default could present greater challenges for some states over others.

- Treasury Secretary Janet Yellen says that the US could hit the debt limit by 1 June. What role has Sec. Yellen played in the negotiations?

- A look at the countries who own most of the US debt

- Can President Bidenuse the Fourteenth Amendment to increase the debt limit?

- GOP push for work requirements for SNAP and Medicaid

Read more from AS USA:

Across the United States there are programs that will provide those who are eligible with monthly payments as part of pilot guaranteed income initiatives.

Having a good credit score comes with several benefits and can save you money. Here everything you need to know about credit scores in the United States.

While going to university can be expensive, the right degree can be a great investment. Here are the best paid college degrees for recent US graduates.

The debt ceiling was born in 1917 as a way to prevent the President Woodrow Wilson from spending too much as the reluctant nation prepared to enter World War I. Since President Herbert Hoover the national debt has increased under every presidential administration and the debt ceiling has been modified 102 times since the end of World War II.

So how many times have recent presidents had to sign offon a debt celing increase by Congress?

According to economists, 8 million Americans could lose their jobs if our nation failed to pay its bills. The consequences would be catastrophic for folks across the country and the globe. Default is not an option.

In April, the IRS announced that nearly 1.5 million people nationwide were still eligible to receive a tax refund worth up to $900.

But who? And how can it be claimed? We took a look...

Yet again, the US is facing a potential default on the nation’s debt as Republicans use a necessary debt ceiling increase as leverage to push through their legislative agenda. This time round, House GOP lawmakers want to extract spending cuts and extend Trump-era tax cuts for the wealthy included in a bill passed along party lines.

As part of the proposed cuts, expanded work requirements would be placed on recipients of SNAP and TANF along with new ones for Medicaid.

Read more on what the changes would be if enacted and just how effective such requirements are.

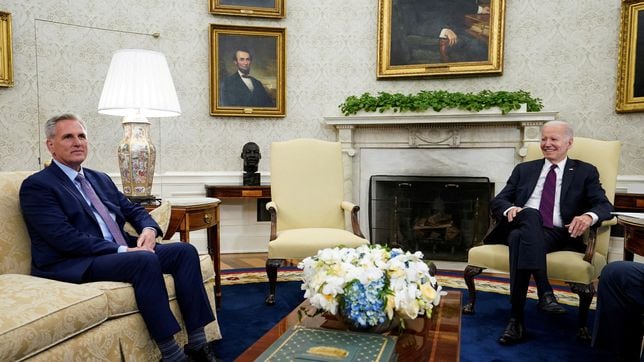

Biden still has hope that default can be avoided and debt ceiling raised

I still believe we'll be able to avoid a default and we'll get something decent done.

ELIZABETH FRANTZ / REUTERS

As the clock ticks down to US default no plan for negotiators to meet

GOP negotiators returned to the White House on Friday after earlier walking out on negotiations to raise the debt ceiling. However, neither of the two meetings resulted in any progress to avoid the US defaulting on its debt, nor were there plans on when negotiators would meet again.

Lawmakers have less than two weeks to reach an agreement before the X-date is reached, the day the Treasury will no longer be able to pay all of the nation’s bills. Secretary Janet Yellen has set that date for 1 June.

Republicans are pushing for deep spending cuts in order to secure their votes to increase the limit set at which the government can borrow. They want to reduce spending to 2022 levels, a bill passed along party lines in the GOP-controlled House would reduce a wide swath of government spending by 8% next year.

Some of the sticking points are caps on spending and new or expanded work requirements on programs like SNAP and Medicaid pushed for by Republicans.

US Representative Patrick McHenry, a Republican negotiator, told reporters at the US Capitol that party leaders were "going to huddle as a team and assess where things stood."

The Social Security Administration in order to handle the tens of millions of payments each month staggers out benefit payments. The schedule is based on three factors: the type of benefit, when a recipient began claiming benefits and a beneficiary's birth date.

The economy of the United States could be facing a crisis very soon if the White House and Congress fail to agree on raising the debt ceiling.

The ceiling refers to the limit of money that the federal government can borrow. While the Biden administration seeks to increase funding, lawmakers- mostly Republicans- refuse to do so unless spending is cut. The last time the ceiling was raised was in December 2021, increasing the total budget to $31.4 trillion.

According to Treasury Secretary Janet Yellen, the federal government may no longer be able to meet its financial responsibilities as of June 1, and would therefore face a default. This would affect a broad range of payments from the military to civil servants, as well as those receiving Social Security.

Initial unemployment claims fell last week

After hitting a high not seen in over a year in early May, initial unemployment claims fell by 22,000 to 242,000 last week.

The states that saw the largest increase for the week ending on 6 May were Massachusetts (+6,420), Missouri (+2,596), California (+1,997), Texas (+1,707), and New York (+1,212). The greatest decreases were picked up in n Kentucky (-3,026), Colorado (-1,526), Georgia (-916), Wisconsin (-494), and New Hampshire (-428).

The US is on the brink of its first-ever default this summer, as Congress and the White House continue its standoff on the issue of raising the debt ceiling.

The country owes trillions of dollars to foreign institutions, including governments, central banks, corporations, and other investors. Foreign governments own a big part of the public debt, which includes treasury bonds and other securities.

Read our full coverage for details on which other countries face a high level of national debt.

According to Treasury Secretary Janet Yellen, the US federal government could run default on its debts as soon as early June. As negotiations between the White House and Republican congressional leaders continue, the Secretary has not played a major role besides providing the parties with details of when the Treasury Department would be unable to pay its debts.

On 15 May, Sec. Yellen wrote another letter to Speaker of the House Kevin McCarthy, updating the Treasuring Department’s estimates on when the country would be unable to pay its bills. The secretary wanted to make clear that there still existed a great risk to the health of the economy if the country moved into default, which could happen “as early as June 1.”

Read more in our full coverage on the role played by Secretary Yellen and her career trajectory that led her to head up the Treasury Department.

Month after month, the Social Security Administration (SSA) sends out monthly benefits to retired workers. In addition, SSA is responsible for sending Supplemental Security Income (SSI) benefits, disability and survivor benefits.

While the May payments continue, it is worth knowing who will receive their money in the first days of June.

Unemployment fell in fourteen states in April

In April, fourteen states saw their unemployment rate fall. The lowest rates were recorded in South Dakota (1.9 percent), Nebraska (2.0 percent), New Hampshire (2.1 percent), and North Dakota (2.1 percent). Oregon saw the greatest decrease in its unemployment right, falling in one month -0.4 percentage points.

The rate remained stable in the remaining 36 states.

Republican debt ceiling negotiators abandon talks with White House

Negotiations to raise the debt ceiling and avoid a default came to an abrupt end on Friday when Republican negotiators walked out on talks with White House. They blamed the Biden negotiators saying they aren’t “willing to have reasonable conversations”.

“We decided to press pause because it’s just not productive,” said Rep. Garret Graves who was appointed by Speaker Kevin McCarthy to head the GOP delegation.

KEVIN LAMARQUE / REUTERS

Talks over raising debt limit resume hours after being paused

Negotiators for the White House and Speaker Kevin McCarthy resumed talks hours after the GOP team walked out on them.

The brief pause rattled markets with the X-date fast approaching when the US will no longer be able to pay its bills. That would mean the first default on the US debt in the nation’s history. Lawmakers have until 1 June to pass an increase to avoid a financial catastrophe.

Hello and welcome to AS USA's live blog on finance and economic news.

Earlier this week, the US Department of Housing and Urban Development reported that new permits for building houses have fallen by over twenty percent compared to April 2022. As interest rates have gone up, interest in constructing new housing units has slowed. With less supply on the way, bringing prices down could become much more challenging.

Negotiations in Washington over the debt ceiling will continue this week, with just fifteen days until the United States risks defaulting on its debt. Republicans have demanded cuts to social spending, but so far, the White House has been unwilling to cave on these points. We will bring you the latest on this as the day goes on.

Last week, the Bureau of Labor Statistics reported a 0.4 percent increase in the Consumer Price Index in April, leading to a year-over-year increase of 4.9 percent. Unemployment fell to 3.4 percent in April, providing important data points to the Federal Reserve as officials there evaluate additional rate hikes.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/I6XFIDY5CNP3BDKPIGYDSTUAEY.jpg)