US Financial News: news summary | 15 July 2023

Stay up to date with the latest on IRS refunds, SNAP benefits, and Social Security as well as what Fed policy on interest rates to tackle inflation.

Show key events only

US financial news live updates

Headlines | Saturday, 15 July 2023

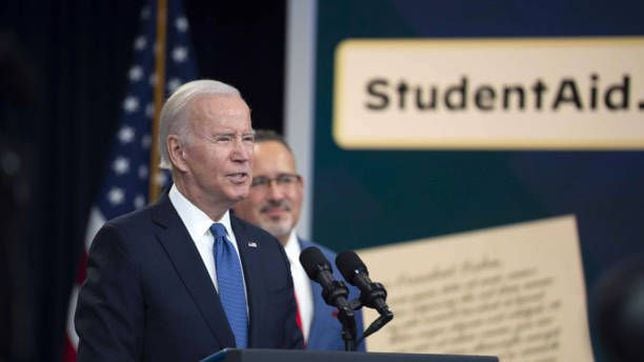

- Biden administration cancels $39bn in student loan debt for 800k borrowers

- Inflation in the US dropped to 3% in June,lower than forecast

- June jobs report: Economy added 209,000 jobs in June as labor market cools

- Federal Reserve expected to raise interest rates later in July

- Layoffs fall to seven-month low in June

- The White House announces the SAVE planto help student loan borrowers

- When do student loan repayments restart?

- When to expect SNAP benefitsthis month

- Dates for Social Security payments in July

Dozens of cities around the nation have implemented guaranteed income programs. The idea behind them is that they will help decrease poverty by giving beneficiaries a set amount of money each month regardless of whether they are working or not.

California is home to a number of these programs. Last year, Los Angeles County launched the Breathe Program, a monthly financial aid for low-income people, which provides chosen qualifying participants with $1,000 per month.

The Consumer Financial Protection Bureau (CFPB) took action against Bank of America for violating a number of laws dating back to 2012. America’s second largest bank, which has around 68 million individual and small business clients, will have to pay $250 million in fines and compensation to settle claims.

The CFPB and the Comptroller of the Currency (OCC) said that the bank harvested junk fees, withheld credit card rewards and that employees opened unauthorized customer accounts. Bank of America has agreed to pay affected customers $100 million in restitution.

The Department of Education is implementing its payment count adjustment for student loan borrowers on IDR payment plans, 800K will have debts canceled.

After inflation reached historic levels last year, several entities in the US approved the sending of stimulus checks or tax refunds to help those who were most affected.

Although inflation has fallen considerably in recent months, some states across the country continue to send out checks to help their residents.

Here are the states that are sending financial assistance in July and how much they will be giving out.

The IRS is reminding taxpayers not to leave money on the table, perhaps as much as $6,557.

Here’s who’s eligible, how to request payment, and the deadline.

So that Social Security benefits keep pace with inflation an annual adjustment is applied.

What is COLA and how will it affect checks issued in 2024?

The United States provides various financial aid payments for residents who could use the help. In many cases, these payments are aimed at those who present a tax return to the Internal Revenue Service.

But what about residents who can’t file taxes because they don’t have enough income to do so? Well, in New Mexico a new form of financial aid has been approved for low-income people who cannot file taxes for this reason.

Some Pennsylvania residents may receive up to $975 through the Rental/Property Tax Refund Program, which is a bonus refund of property taxes or rent paid in the prior year.

This program is for Pennsylvanians age 65 and older, widows and widowers age 50 and older, as well as people with disabilities ages 18 and older.

Spouses, personal representatives, or heirs may also apply on behalf of claimants who lived at least one day in the year in which the refund will be claimed and met all other eligibility criteria.

Inflation in the US is on the way down. Perhaps as a response to the Federal Reserve’s brutal interest rate hikes that have been killing purchasing power and getting many workers sacked, the Consumer Price Index measuring inflation is tumbling down.

Core inflation, which doesn’t include the oft volatile food and energy prices, was 0.2 percent last month, the smallest single month increase since August 2021. Year-on-year inflation in 3%, rapidly closing in on the Federal Reserve’s target of 2%.

Good news for everyone right?Well, not if you are living in Florida.

Mortgage rates jump 30-Yr FRM approaches 7%

The average weekly mortgage rate climbed for a third straight week with the 30-year fixed-rate just shy of 7% at 6.96%. The average weekly 15-year fixed-rate rose to 6.30% from 6.24% the prior week according to Freddie Mac data.

When purchasing a house, you’ll most likely have to take out a loan.

Before going to a lender to apply, one of the key elements to keep in mind is the interest you will have to pay on your mortgage.

Medicaid provides health coverage to tens of millions of Americans but the income thresholds to participate in the program vary from state to state.

Medicare and Medicaid are the two largest federal health insurance programs in the United States, but are not the only ones. The US also has a popular program that provides medical coverage to infants, it is the Children’s Health Insurance Program.

Since its inception in 1997, CHIP has played a crucial role in reducing the uninsured rate among children in the United States. It has helped millions of children gain access to affordable healthcare services and improve their overall well-being.

Americans who borrowed money for their higher education and are carrying a debt should start preparing for the resumption of payments on their federal student loans. After more than three years of a moratorium, interest will begin accruing once again in September and the first payments will come due in October.

However, there is some relief in sight. Starting in 2024, it will be easier for employers to match contributions to 401(k) accounts when employees make payments on their student loan debt.

Severe weather has been affecting various states in the US, and as a result, some areas have chosen to offer financial assistance to those who need it most. Some US residents will be able to apply for an emergency benefit for SNAP coupons. Who qualifies for the extra food assistance?

The Bureau of Labor Statistics (BLS) reported a headline 0.2 percent increase in the Consumer Price Index for June. Core inflation, minus volatile food and energy prices, was 0.2 percent last month, the smallest single month increase since August 2021.

Based on the data from June, the year-over-year inflation rate tracked by the CPI stands at three percent for all items, economists had expected a 3.1 percent increase. The CPI has dropped for 12 straight months.

Hello and welcome to AS USA's live blog

The US economy added 209,000 jobs in June, missing Wall Street estimates and reflecting a slowdown from the previous month, according to data from the Bureau of Labor Statistics.

The report marks the first time in 15 months that non-farm payrolls have come in lower than Wall Street expected. The June unemployment rate was 3.6%, what economists had expected, down from 3.7% in May.

Meanwhile, inflation report for June showed price increases slowing faster than predicted. However, wage growth still sticky. Investors banking on the Federal Reserve pausing rate hikes after expected 25 basis point increase when policymakers meet next in the last week of July.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/QENICZ7TUGPKVQIPUIQBZD7AKA.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/LOT6BXPXQBBXRNDO753YL4VQ3Q.png)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/OL3CWCCD6VM3FJAAD5YXMA46VA.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/5R4X3UYMRRKV3KUJD2VZFGJW3I.jpg)