US financial news summary | 16 May 2023

Follow us for the latest on finance and economic news. We will bring you the latest on debt ceiling negotiations, shifts in the housing market, and Social Security.

Show key events only

US Finance: Latest News

Headlines | Tuesday, 16 May 2023

- Cities across California begin quartered income pilot programs: how do these compare to universal basic income?

- Inflation has risen 1.4 percent since the 2023 COLA went into effect

- A national debt default could have more severe impacts for some states

- Elon Musk'snew role at Twitter as he names a new CEO

- How does US debt compare to that of other major countries?

Read more from AS USA:

La Estación de Shinjuku es una de las principales estaciones de ferrocarril de la ciudad japonesa de Tokio, situada en el distrito de Shinjuku. Según el Libro Guiness es la estación más concurrida del mundo. / TommL / Getty Images

Consumer spending rebounds in April

US consumer spending rebounded solidly in April after two months of declines. Households were spending more at restaurants and bars as well as shopping online showing signs of resilience in the US economy despite growing headwinds. Also on Tuesday, another report showed that production at factories surged last month and homebuilding sentiment turned positive for first time in a year.

The latest economic data came after a strong jobs report at the end of last week, with 253,000 jobs created. The tight labor market has helped push wages up which has allowed households to continue spending in spite of rising prices. However, consumers are becoming more selective about what they spend their money on and price conscious.

Economist are forecasting that consumer spending will support the economy even as the risk of a recession increases. All in all, they don’t expect the Federal Reserve to increase rates at their next meeting in mid-June.

No serious person – Republican or Democrat – has ever thought defaulting on America's debt was an option.

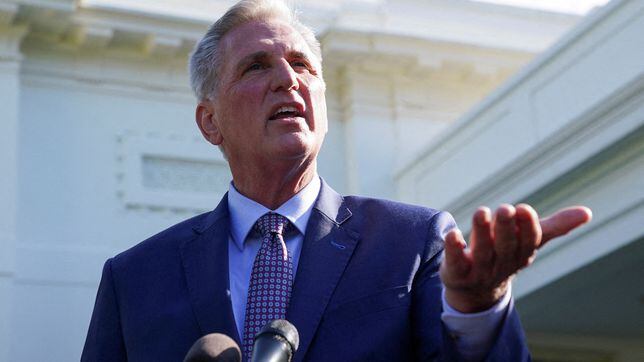

White House and GOP “very far apart” on debt ceiling negotiations

President Biden met with GOP House Speaker Kevin McCarthy at the White House on Tuesday to hash out a deal to raise the debt ceiling. Joining them were Senate Majority Leader Chuck Schumer, Senate Minority Leader Mitch McConnell and top House Democrat Hakeem Jeffries.

After leaving the meeting McCarthy and McConnell told the press that the two sides were very far apart but that a deal could theoretically be reached by the end of the week. The White House for its part is saying that the meeting was “productive and direct” and that progress has been made.

Time is running short to raise the debt ceiling, Treasury Secretary Janet Yellen has warned that the US could run out of money and default on its financial obligations as soon as 1 June. Any deal reached would still need to be passed by Congress and signed by Biden. The President will be travelling to Japan on Wednesday for a meeting of the G7, after which he had been scheduled to visit Australia and Papua Guinea.

However, the later portion of his trip has been canceled and Biden will now return to the US to hammer out details one-on-one with McCarthy to reach a deal after staff negotiators meet again.

Abolish the debt ceiling?

Robert Reich, Berkeley professor and former Secretary of Labor, says the United States needs to “stop the drama” and end the game of chicken and get rid of the debt ceiling.

He argues that it is meaningless as it doesn’t discipline government spending. Furthermore, the failure to lift the debt ceiling would be “so horrific” due to the consequences of defaulting on the nation’s financial obligations.

Two states are sending out checks and refunds of up to $3,000 to their residents. Here are the states which distribute them and who qualify to receive them.

In April, the IRS announced that nearly 1.5 million people nationwide were still eligible to receive a tax refund worth up to $900.

But who? And how can it be claimed? We took a look...

Home Depot is the latest retailer to see its income take a downward turn.

The company missed its quarterly revenue target by the biggest margin in 20 years, and the drop in their stock dragged US markets down.

Walmart has become the largest employer not only in the United States, but globally. However, in recent weeks, the giant retailer announced the closure of various branches around the US due to “lower-than-expected performance”, according to a statement issued by the company.

Despite the closing of some its stores, Walmart continues to rake in the money, and as our coverage relates, the company's daily income amounts to more than a billion dollars.

Gas prices reached record highs last year, breaching the $5 a gallon mark for the first time ever in June. After that, prices slowly went down due to a variety of factors, including concerns about a possible recession, and the release of oil from the US Strategic Petroleum Reserve.

If you’re planning your summer vacation, considering a road trip may be a little more affordable. As this story reports, gas prices are expected to dip in the next few months.

From January 2022 to the same point one year later, the price of eggs increased seventy percent. A morning staple transformed into luxury after prices soared in light of various supply chain issues, rising energy costs, and corporate greed.

The good news is that prices are coming down. Since January of this year, egg prices have fallen by eighteen percent.

Our coverage discusses what drove them up so high, and when they are likely to return to a more recognizable price point.

Ex-CEO of Silicon Valley Bank says he was unaware of bank's problems

Silicon Valley Bank's former CEO Greg Becker told senators at a hearing that he was unaware the bank was in trouble when he sold stock in the months leading up to the company's collapse.

Becker sold SVB shares through the first quarter, weeks before the bank collapsed on March 10, triggering a rout in banking shares globally.

Responding to questions from senators, Becker painted a picture of an unprecedented, unpredictable crisis at the bank. He said the bank took risk management seriously and had liquidity of around $80 billion at the end of last year.

Lawmakers were not convinced.

"Why did you ignore admonitions from regulators?" Ohio Senator Sherrod Brown said in his opening statement.

"There is a simple answer, the same answer we find for most big bank failures -- because the executives were getting rich."

Responding to criticism about the bank lacking a risk officer in the months leading up to its failure, Becker said he had been advised by regulators to look for a more experienced executive for the position. He pledged to cooperate with regulators as they look at executive compensation.

"Mr. Becker you made a really stupid bet that went bad, didn't you," said Louisiana Senator John Kennedy. "And the taxpayers of America had to pick up the tab for your stupidity."

(REUTERS)

Seniors are among the most vulnerable groups if the United States defaults on its debts in early June. Both Social Secuirty and Medicare would be threatened because the government may not have enough money on hand to send monthly payments or health care providers that serve seniors.

Negotiations remain ongoing in Washington, with Republicans demanding cuts to social spending, and the White House only now beginning to soften its position. After being asked this week how he felt about adding work requirements to the eligibility criteria of government aid programs, President Biden responded that he has “voted for tougher aid programs that’s in the law now,” adding that “Medicaid” is “a different story.” He did not say additional requirements were off the table but that he was “waiting to hear what [the GOP’s] extract proposal is.” Members of the Congressional Black Caucus have come out against implementing additional requirements, noting that these barriers could have deadly consequences.

Read more in our full coverage on how a default could impact Medicare members.

Every month, the Social Security Administration issues millions of payments to recipients of the insurance program, which are mostly retired workers or disabled people belonging to SSI or SSDI.

Payments are issued on a weekly basis, based on the date of birth of the beneficiaries. However, for the July payments, recipients could see delays in their deposits if Congress and the White House do not reach an agreement on raising the debt ceiling.

Read more in our full coverage.

The United States Congress is in charge of the nation’s purse strings, and as the decades have gone on, negotiations over spending and debt have become extremely politicized. Currently, the country is two weeks away from defaulting on its debts, which, if allowed to occur, would have catastrophic consequences for the global economy.

There was a time when the Legislative branch exercised great control over how much debt was issued, including specifying what instruments and the parameters the Treasury could use to borrow money.

That, however, changed in 1917 as the US geared up to join World War I. The Second Liberty Bond Act provided the Treasury with more flexibility in managing federal finances but set a limit as to how much debt it could take out on the total amount accumulated through different types of borrowing.

All around the Golden State, families are receiving monthly payments through their participation in guaranteed income pilot programs. Some of the pilots have already started, like the Los Angeles County Guaranteed Income (GI) Demonstration Project, which has been sending 1,000 families $1,000 payments since last spring and will do so through spring 2025.

There are no programs currently enrolling participants, but this could change in the future if the state legislature allocates more funding for these pilots.

Inflation slows with the year-over-year rate clocking it at 4.9 percent in April

The Consumer Price Index reported a fall in the year-over-year inflation rate from 6 percent to 4.9 percent from March to April. This means that while prices are still increasing, on average, the pace at which they are rising is slowing down. A positive sign for consumers.

While last year energy prices, corporate greed, and supply chain constraints sent prices soring, this year we are seeing the housing sector drive inflation. As housing prices tick up due to higher interest rates on their mortgage, purchasing power is falling.

Atlanta Fed President says he doesn’t see interest rate cuts in 2023

The Federal Reserve has raised interest rates 10 times since March 2021, increasing them from near zero to over 5% in just over a year. While those rate hikes appear to be having the desired effect, inflation remains over twice the US central bank’s target of 2%.

Atlanta Fed President Raphael Bostic sat down with CNBC’s Steve Liesman for an interview on Monday where he said that getting a handle on “inflation is job No. 1.” In order to do that interest rates will need to stay high through 2023 and even well into next year as there is “a long way to go” to reach the Fed’s target.

Atlanta Fed President favors interest rate increase, not cuts

What we’ve seen is that inflation has been persistently high, consumers have been really resilient in terms of their spending, and labor markets remain extremely tight. All of those suggests that there’s still going to be upward pressure on prices…

…If there’s going to be a bias to action, for me it would be a bias to increase a little further as opposed to cut.

Speaker Kevin McCarthy says debt ceiling talks “not doing well at all”

Republican House of Representatives Speaker Kevin McCarthy and President Joe Biden will sit down for face-to-face talks on the debt ceiling on Tuesday. They will be joined by Democratic Senate Majority Leader Chuck Schumer, top Senate Republican Mitch McConnell and top House Democrat Hakeem Jeffries to try to make progress on raising the amount the US can borrow to pay its bills.

Time is running out to reach an agreement with the Treasury expected to run out of money by as soon as 1 June. The meeting at the White House comes just one day before Biden is due to go to Japan to attend a Group of Seven nations meeting. McCarthy says that there is little sign of moving forward in the negotiations on federal spending cuts Republicans are demanding in order to get their vote on raising the debt ceiling.

"They're not doing well at all. There's no progress that I see, and it really concerns me with the timeline of where we are," McCarthy told reporters. "We've got big issues to get to, and you've got to get through the House and the Senate, and there's definitely not enough progress to see that."

The rising price of renting continues to slow

Rents were only 0.3% higher in April this year compared with the same time in 2022, the 11th consecutive month that prices have cooled. According to Redfin, the month-over-month the median asking price dropped by 0.2% to $1,967. The real estate brokerage found this notable as rents normally increase this time of year.

So what’s driving down rents? A homebuilding boom has finally helped catch supply up with demand is one of the main factors. However, due to economic uncertainty, many renters are also choosing to stay put.

Rents are falling fastest in the Sun Belt, an area that experienced an explosion of popularity during the pandemic. This is an area of the nation that has also experienced much of the nation’s homebuilding.

Austin, Texas saw the biggest decrease with the median asking rent dropping 14.3% year over year in April followed by Phoenix, Arizona falling 9.6% and Las Vegas, Nevada asking rent down 7.1% compared to this time last year.

Hello and welcome to AS USA's live blog on finance and economic news.

Negotiations in Washington over the debt ceiling will continue this week, with just fifteen days until the United States risks defaulting on its debt. Republicans have demanded cuts to social spending, but so far, the White House has been unwilling to cave on these points. We will bring you the latest on this as the day goes on.

Last week, the Bureau of Labor Statistics reported at 0.4 percent increase in the Consumer Price Index in April, leading to a year-over-year increase of 4.9 percent. Unemployment fell to 3.4 percent in April, providing important data points to the Federal Reserve as officials there evaluate additional rate hikes.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/72PQMEDIS5METOUTUMW77ICUHA.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/7EZURCVDT5KIXBMSIQ7ENOSPFA.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/RSAAM52XN2NYQQWJSIJ6ATXZ5A.jpg)