US financial news summary | 19 May 2023

US Finance News: Latest Updates

Headlines | Friday, 19 May 2023

- A growing number of lawmakers are encouraging Presidnet Biden to use the 14th Amendment to bypass Congressional Republicans to increase the debt limit.

- Unemployment claims drop 22,000, there were 242,000 initial claims for the week ending 13 May

- AOC says Speaker McCarthy doesn't have the votes and may look to Democrats to pass a debt ceiling increase

- Mortgage rates are expected to stay around 6.5%

- Housing construction continues to slow as interest rates hikes turn off investors

- Inflation has risen 1.4 percent since the 2023 COLA went into effect

- A national debt default could have more severe impacts for some states

- How does US debt compare to that of other major countries?

Read more from AS USA:

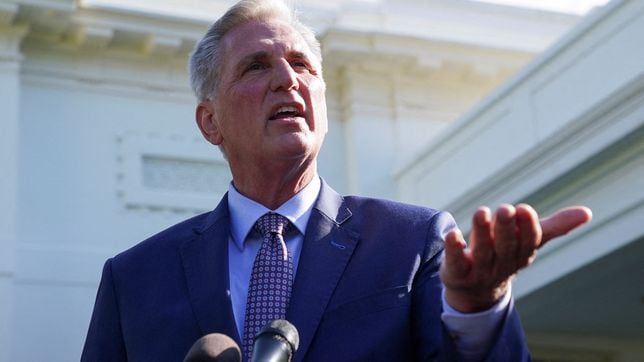

KEVIN LAMARQUE / REUTERS

Talks over raising debt limit resume hours after being paused

Negotiators for the White House and Speaker Kevin McCarthy resumed talks hours after the GOP team walked out on them.

The brief pause rattled markets with the X-date fast approaching when the US will no longer be able to pay its bills. That would mean the first default on the US debt in the nation’s history. Lawmakers have until 1 June to pass an increase to avoid a financial catastrophe.

The US is on the brink of its first-ever default this summer, as Congress and the White House continue its standoff on the issue of raising the debt ceiling.

The country owes trillions of dollars to foreign institutions, including governments, central banks, corporations, and other investors. Foreign governments own a big part of the public debt, which includes treasury bonds and other securities.

The Social Security Administration in order to handle the tens of millions of payments each month staggers out benefit payments. The schedule is based on three factors: the type of benefit, when a recipient began claiming benefits and a beneficiary's birth date.

Yet again, the US is facing a potential default on the nation’s debt as Republicans use a necessary debt ceiling increase as leverage to push through their legislative agenda. This time round, House GOP lawmakers want to extract spending cuts and extend Trump-era tax cuts for the wealthy included in a bill passed along party lines.

As part of the proposed cuts, expanded work requirements would be placed on recipients of SNAP and TANF along with new ones for Medicaid.

Read more on what the changes would be if enacted and just how effective such requirements are.

Republican debt ceiling negotiators abandon talks with White House

Negotiations to raise the debt ceiling and avoid a default came to an abrupt end on Friday when Republican negotiators walked out on talks with White House. They blamed the Biden negotiators saying they aren’t “willing to have reasonable conversations”.

“We decided to press pause because it’s just not productive,” said Rep. Garret Graves who was appointed by Speaker Kevin McCarthy to head the GOP delegation.

The economy of the United States could be facing a crisis very soon if the White House and Congress fail to agree on raising the debt ceiling.

The ceiling refers to the limit of money that the federal government can borrow. While the Biden administration seeks to increase funding, lawmakers- mostly Republicans- refuse to do so unless spending is cut. The last time the ceiling was raised was in December 2021, increasing the total budget to $31.4 trillion.

According to Treasury Secretary Janet Yellen, the federal government may no longer be able to meet its financial responsibilities as of June 1, and would therefore face a default. This would affect a broad range of payments from the military to civil servants, as well as those receiving Social Security.

In April, the IRS announced that nearly 1.5 million people nationwide were still eligible to receive a tax refund worth up to $900.

But who? And how can it be claimed? We took a look...

Certain residents in California will be awarded a one-time $4,000 payment to help with the consequences of the covid-19 pandemic. Here’s how to request it.

The failure to raise the debt ceiling which would cause the US to default on its financial obligations could do serious harm to American retirement savings.

Unemployment fell in fourteen states in April

In April, fourteen states saw their unemployment rate fall. The lowest rates were recorded in South Dakota (1.9 percent), Nebraska (2.0 percent), New Hampshire (2.1 percent), and North Dakota (2.1 percent). Oregon saw the greatest decrease in its unemployment right, falling in one month -0.4 percentage points.

The rate remained stable in the remaining 36 states.

Vice President Harris speaks to what is motivating the GOP during the debt ceiling negociations

Okay, so let’s be clear: For Republicans in Congress, this issue is not really about lowering our nation’s debt, because if they really cared about lowering our debt, they would not — they would not also fight to protect trillions of dollars in Trump tax cuts for the wealthiest Americans and the biggest corporations, tax cuts that would add three and a half trillion dollars —

A growing number of officials on Capitol Hill believe that the president has the power to use the Fourteenth Amendment of the US Constitution to avert a debt default. However, this move is not without its legal skeptics who point to the spending powers the legal document extends to Congress over the executive branch.

During a press conference hosted by Senator Bernie Sanders (VT-I) on the status of the negotiations, Senator John Fetterman (PA-D) described the ongoing talks as “a sad charade” and urged President Biden to consider using the Fourteenth Amendment to avert an economic crisis.

Read more in our full coverage on the details of the text and the response to the proposal from the White House.

Senate Majority Leader Chuck Schumer held onto his position in the Senate after Republicans failed to flip the chamber during the 2022 mid-term elections. Senator Schumer stepped into the role of majority leader in 2021 when President Biden took office. However, Schumer’s days in the Senate first began in 1999, after having represented New York as a member of Congress starting in 1981.

Senator Schumer’s current position earns him a spot at the table over the national debt ceiling negotiations. The Majority Leader has stayed quiet during these negotiations, with the White House and Speaker of the House, Kevin McCarthy playing a much more substantive role. Speaker McCarthy is in a much more difficult position because he has to reach an agreement with the White House that will be approved by at least 218 of his 222-member caucus that will also be approved by sixty Senators. This means that the Speaker has to balance the demands of the GOP members with a piece of legislation that Leader Schumer would be willing to bring to the floor of the Senate.

Read more in our full coverage on the position and role Senator Chuck Schumer has played during the negotiations.

Month after month, the Social Security Administration (SSA) sends out monthly benefits to retired workers. In addition, SSA is responsible for sending Supplemental Security Income (SSI) benefits, disability and survivor benefits.

While the May payments continue, it is worth knowing who will receive their money in the first days of June.

New Mexicans in line for big tax refund

In-state residents can still receive a refund of $500 for single filers and $1,000 for joint filers. Residents have until 31 May 2023 to file their income tax return for 2021 and qualify for a rebate. The state expects to make the payments in mid-June either by direct deposit or paper check in the mail.

Weekly 30-yr fixed mortgage rate ticks up, daily average hits 2-month high

The weekly average 30-year fixed mortgage rate ticked up to 6.39% for the week ending on Thursday 18 May after dropping slightly over the previous two weeks. The daily average though hit a two-month high of 6.82%. Despite the fluctuations, the National Association of Realtors is forecasting rates to hover around 6.5% in the near term and dropping to around 6% in the second half of the year.

Initial unemployment claims drop by 22,000, beating expectations

More strong economic data was released on Thursday, showing that the US labor market remains tight. Currently, there are 1.6 jobs for every person unemployed in the nation. That is well above the 1.0-1.2 range which would indicate that there isn’t too much inflation being generated by the jobs market.

The US Labor Department released unemployment data for the previous week which showed 242,000 initial claims for the week ending 13 May, a decrease of 22,000 from the prior week. Economists had predicted 254,000 new unemployment claims. The data is the largest drop since November 2021.

The 4-week moving average was 244,250, a decrease of 1,000 from the week before.

Hello and welcome to AS USA's live blog on finance and economic news.

Earlier this week, the US Department of Housing and Urban Development reported that new permits for building houses have fallen by over twenty percent compared to April 2022. As interest rates have gone up, interest in constructing new housing units has slowed. With less supply on the way, bringing prices down could become much more challenging.

Negotiations in Washington over the debt ceiling will continue this week, with just fifteen days until the United States risks defaulting on its debt. Republicans have demanded cuts to social spending, but so far, the White House has been unwilling to cave on these points. We will bring you the latest on this as the day goes on.

Last week, the Bureau of Labor Statistics reported a 0.4 percent increase in the Consumer Price Index in April, leading to a year-over-year increase of 4.9 percent. Unemployment fell to 3.4 percent in April, providing important data points to the Federal Reserve as officials there evaluate additional rate hikes.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/U3GUE5L4U5OHPFVVNEIRIQF5DE.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/I6XFIDY5CNP3BDKPIGYDSTUAEY.jpg)