USA finance and payments: summary 1 July

Fed chair Jerome Powell said that the pandemic may have permanently altered the economy, here’s all the latest financial news and information from the US.

Show key events only

US Financial News: Latest Updates

Headlines: 1 July 2022

- The first six months of 2022 represent the worst half year open in decades, with markets down 20 percent since January

- Concerns grow that the overpriced housing market could be creating a bubble

- Federal Reserve provides "no guarantee" that increasing interest rates will not increase unemployment

- Bitcoin has lost half of its value since January, now trading at $18,530.25

- New proposal to increase Social Security benefits by $2,400 a year circulates on Capitol Hill

Helpful links & Information

- Residents in which states and cities are going to receive a stimulus check?

- Where are home pricesexpected to drop in the US over the next year?

Check out some of AS USA's related news articles:

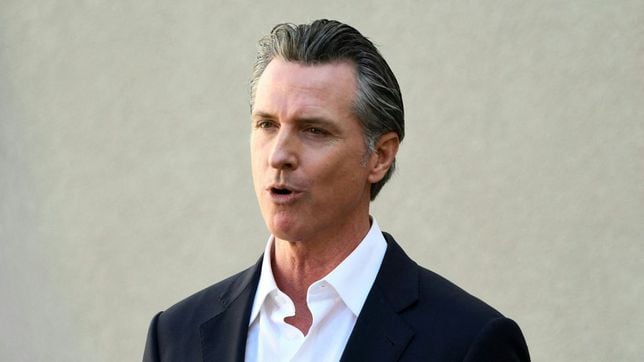

How much is the California gas tax rebate worth?

Last month California Governor Gavin Newsom announced that the state legislature had approved a huge tax rebate, expected to reach some 23 million residents. The effort comes as Californians are struggling with the highest gasoline prices in the country, with some places charging as much as $9 per gallon. Also a major concern is the high price of household essentials like groceries. Critics have argued that the proposed timeframe for the money to arrive, potentially as late as October, offers little relief for those who are struggling desperately now.

Those who depend on Social Security benefits are being hit especially hard by inflation. While, the historic 5.9 percent COLA increase announced last year has helped but inflation has continued to undermine the boost in payments that began in January.

Based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), used to determine the COLA each year has tracked significant increases in prices since the 2023 increase was announced.

As the nation gears up for the Independence Day weekend, scores of well-known restuarants and fast food outlets are offering great deals and fantastic freebies to customers. From free doughnuts to weeks' worth of pre-prepped meals, there are all sorts of offers on for Fourth of July.

Take a look at some of the best discounts on food and drink...

European inflation reaches record height

Consumers in the United States have suffered the consequences of high inflation in recent months but the US is far from the only nation struggling with rapid price rises. The European Central Bank (ECB) has confirmed that continent's inflation rate has soared to 8.6%, the faster ever recorded.

Interestingly the ECB is reacting in a similar way to Federal Reserve, the US central bank, responded to price rises. Raising interest rates discouraging borrowing and incentivises saving, something which is hoped to cool the economy and bring down prices for consumers.

Of the one hundred most populated metro areas all have seen increases in property values over the last year. On average house prices increase between 3.5 and 3.8 percent a year. This year that average has shot up to 18.5 percent, with a median of seventeen percent. Read our full coverage for metro-level details.

Department of Labor releases unemployment claims report

Over the last week, the Department of Labor tracked around 231,000 initial unemployment claims, down 2,000 from last week.

Looking at the total number of claims, the number has fallen by 3,000 to 1,328,000.

States with the largest increase in the number of initial claims include: Michigan (+1,849), Texas (+1,350), New Jersey (+897), Connecticut (+863), and Puerto Rico (+860).

In the first sixth months of this year, the stock market lost a fifth of its value, and inflation increased by three percent.

Gas prices remain high, the remaining impacts of the covid-19 pandemic on global supply chains, and increasing intersts rates have created a tense economic envioronment.

How will the Federal Reserve's action impact inflation and unmeployment? Find out in our full coverage.

Electric vehicle prices going up due to increased costs and high demand

A record number of electric vehicles were sold last year and expectations are that 2022 will be see even more car shoppers opting for EVs. The high cost of gas, topping $5 per gallon on average nationally, has been helping to drive demand.

However, the car industry has been struggling with disrupted supply chains and a semiconductor chip shortage due to the ongoing covid-19 pandemic. This has meant low production numbers of all vehicles and higher costs.

To offset this carmakers are raising prices on all their vehicles, but even more for EVs. This is due to the cost of materials needed to make the batteries, such as lithium, cobalt and nickle, have doubled in price since the pandemic. Likewise, with demand so high manufacturers are looking to cash in on consumers keen on adopting the new technology.

The beginning of Summer holidays?

The volume of travelers we expect to see over Independence Day is a definite sign that summer travel is kicking into high gear. Earlier this year, we started seeing the demand for travel increase and it’s not tapering off. People are ready for a break and despite things costing more, they are finding ways to still take that much needed vacation.

The Fourth of July holiday weekend begins when an expected 48 million people will hit the road to travel to festivities. Despite gas prices being two dollars higher on average than they were before the pandemic, more Americans are choosing to drive to their destination than in 2019.

Today’s national average for regular gas is $4.842 a gallon, down $0.015 from yesterday.

Fed Chair willing to run the risk of recession to bring down inflation

Federal Reserve Chairman Jerome Powell joined European Central Bank President Christine Lagarde and Bank of England Governor Andrew Bailey to exchange views on current policy issues and discuss the longer-term perspective at the ECB Forum on Central Banking Forum in Sintra, Portugal on Wednesday. He told the panel that "The economy is being driven by very different forces." Adding "What we don't know is whether we'll be going back to something that looks like, or a little bit like, what we had before."

Powell said that the Fed's role of securing price stability and maximum employment in light of pandemic-related supply chain disruptions and inflation pressures arising from Russia's invasion of Ukraine is a different ball game than that of the past quarter century.

As the Fed moves aggressively to bring down inflation not seen in four decades by raising rates, the latest was the sharpest increase since 1994, there are worries that policymakers may cause a recession. However, Powell said that allowing inflation to run rampant would be worse.

"Is there a risk that we would go too far? Certainly there's a risk, but I wouldn't agree that that is the biggest risk to the economy. The bigger mistake to make would be to fail to restore price stability," Powell said.

Consumer spending dropped in May

Fast rising food and fuel prices dampened consumer spending in May according to data released Thursday by the Commerce Department.

While personal consumption expenditures (PCE) rose 0.2 percent in May, those gains dropped to negative 0.4 percent when adjusted for inflation. Likewise, inflation reduced a personal income growth of 0.5 percent to negative 0.1 percent once inflation was accounted for.

The year-on-year inflation rate in May was 6.3 percent, in line with April’s. However, once volatile food and energy prices were taken out the annual increase in the PCE fell to 4.7 percent in May, the third month straight that it has declined.

California has become the latest state to take the action of dispensing checks. In a $17 million inflation relief package, more than 23 million Californians will receive checks in the fall.

“Millions of Californians will be receiving up to $1,050 as part of a NEW middle class tax rebate,” Gov. Newsom tweeted on Sunday.

Based on our calculations, if the COLA were to be announced based on the increases seen between October and May would land beneficiaries with a 6.9 percent increase to their benefit amounts. Considering that it is the CPI-W for July, August, and September, the number will likely be higher than seven percent. Inflation increased one percent in May and there are no signs that price increases are going to slow anytime soon. To combat inflation, the US Central Bank, the Federal Reserve, has increased interest rates to slow the flow of money throughout the economy.

White House notes inflationary pressure easing

Tackling sky-high inflation has been one of President Biden's top aims for much of 2022 as rapid price rises have devalued wages and slahed consumers' purchasing power. New figures released by the White House suggest that core inflation has began to decelerate in recent months, a strong sign that the overheated economy is beginning to cool.

Core inflation is a measure of the change in prices of goods and services, but excludes volatile products like food and energy which can otherwise scew the data.

What goes into the cost of gasoline?

The price of a gallon of gasoline has been the forefront of motorists' minds in recent months as the average cost soared to new heights, surpassing the $5-per-gallon national average for the first time. President Biden is trying to bring down the cost but the price you see at the pump is actually a combination of many different factors; local, national and international.

In this report, CBS News breaks down the factors affecting the price of gas...

Welcome to AS USA!

Good morning and welcome to AS USA! We'll be bringing you all the latest economic news and information right here, in our dedicated finances live feed.