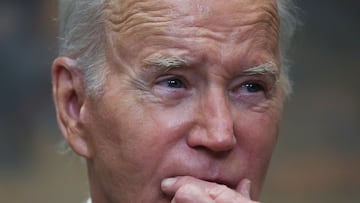

What do we know about Biden’s ‘new path’ to student loan relief so far?

The president was quick to announce alternate plans for student debt relief declaring “No President has fought harder for student debt relief.”

The White House was not slow in publishing its updated plans on the announcement that the Supreme Court had struck down student debt forgiveness plans. Despite being a sensible contigency measure, the speed in which new plans were announced on Friday do belie the lack of belief in the administration that the Supreme Court was to vote in President Biden’s favour.

“No President has fought harder for student debt relief than President Biden, and he’s not done yet,” proudly announced a White House fact sheet. “President Biden and Vice President Harris will not let Republican elected officials succeed in denying hardworking Americans the relief they need.”

This is, in fact, wrong. Biden is not doing everything possible. To be honest, this action is perfectly designed to be the worst case scenario. He is resuming interest and payments voluntarily. And as for relief? This "rulemaking" process will take—at a minimum—several months. https://t.co/goZIHZueaq

— The Debt Collective 🟥 (@StrikeDebt) June 30, 2023

So what are the new plans?

Not debt forgiveness by another name

The Department of Education has initiated rulemaking aimed at opening an alternative path to debt relief for as many borrowers as possible, using the Secretary of Education’s authority under the Higher Education Act.

The Department issued a notice, which is the first step in the process of issuing new regulations under this so-called “negotiated rulemaking” process. The notice announces a virtual public hearing on 18 July and solicits written comments from stakeholders on topics to consider.

BREAKING: Joe Biden says he is launching a new student debt relief plan using his authority under the Higher Education Act.

— More Perfect Union (@MorePerfectUS) June 30, 2023

He says the Education Secretary initiated this new approach today, aiming to forgive debt for "as many borrowers as possible, as quickly as possible." pic.twitter.com/PDtAG5gAi9

Related stories

Another move was the finalisation of the Saving on a Valuable Education (SAVE) plan. This income-driven repayment plan aims to cut borrowers’ monthly payments in half, allow many borrowers to make $0 monthly payments, save all other borrowers at least $1,000 per year, and ensure borrowers don’t see their balances grow from unpaid interest.

The Saving on a Valuable Education (SAVE) plan

- For undergraduate loans, cut in half the amount that borrowers have to pay each month from 10% to 5% of discretionary income.

- Guarantee that no borrower earning under 225% of the federal poverty level, about the annual equivalent of a $15 minimum wage for a single borrower, will have to make a monthly payment.

- Forgive loan balances after 10 years of payments, instead of 20 years, for borrowers with original loan balances of $12,000 or less.

- Not charge borrowers with unpaid monthly interest, even when that monthly payment is $0 because their income is low.

The Department of Education will complete these measures as soon as possible.