What is college tuition insurance? How does it work?

College tuition insurance can help you deal with financial costs in case you are forced to drop out of school before you can complete the semester or year.

College education is often costly, and sometimes it can turn out to be even more expensive when unexpected circumstances force a student to withdraw from school before the term or the school year is over.

Getting an insurance policy to specifically address this could help cushion the loss. College tuition insurance, also known as tuition refund insurance or tuition protection insurance, is a type of policy designed to help students and their families mitigate the financial loss associated with unexpected events that might force a student to stop college studies.

READ ALSO: Which is the most affordable student loan repayment plan?

Opinion by George F. Will: Academia loves to play the moral tutor, especially by deploring unsavory capitalism. How to account, then, for its own practices regarding college costs? https://t.co/yO32BULEfu

— The Washington Post (@washingtonpost) August 31, 2023

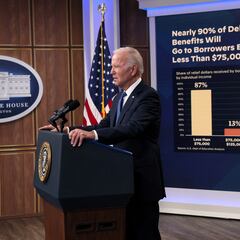

READ ALSO: Biden’s new plans for widespread student loan forgiveness

These situations can include medical emergencies, accidents, or other unforeseen circumstances. According to insurance provider GradGuard, tuition insurance can also cover serious injury or illness, mental health conditions, and chronic illness. They can also include coverage for certain losses related to covid-19 and any future epidemic.

Here’s how college tuition insurance generally works:

Purchase of the policy

Students or their families should typically purchase college tuition insurance before the start of the academic term. This insurance can be purchased for a single semester or for the entire academic year. They can inquire about a policy at the school where they are enrolling, as universities sometimes have partnerships with insurance agencies.

Coverage period

The policy covers a specific period, such as a semester or a year. Like other policies, it begins on the effective date and ends on the expiration date, which is often the last day of classes for that term.

Covered events

College tuition insurance usually covers a range of unforeseen circumstances that may result in a student’s inability to proceed with their studies. Common covered events may include:

- Serious illness or injury of the student;

- Family emergencies that require the student’s presence;

- Mental health issues or psychological conditions that necessitate withdrawal;

- Death of a close family member; or

- Certain academic reasons, like a medical leave recommended by a doctor.

Claim process

If a covered event occurs, the policyholder (usually the student or their family) must file a claim with the insurance provider. This would involve providing documentation and supporting evidence of the event that led to the withdrawal.

Reimbursement

If the claim is approved, the insurance company reimburses a portion of the tuition and other eligible educational expenses paid for that term. The amount reimbursed varies depending on the terms of the policy, but it’s normally a percentage of the total costs, often minus a deductible.

Exclusions

Tuition insurance policies may have exclusions and limitations, so it’s essential to carefully review the policy documents to understand what is covered and what is not. Pre-existing medical conditions, voluntary withdrawal, flunking out, and certain non-academic reasons may not be covered.

Cost

The cost of college tuition insurance varies depending on factors such as the student’s age, health history, the duration of coverage, and the school’s tuition and fees. Policies are usually offered through insurance companies or third-party providers.

Deciding if tuition insurance for you

Not all colleges or universities require or endorse tuition insurance, and it is often an optional purchase. Families should weigh the cost of the insurance premiums against the potential financial risk of unexpected withdrawals when deciding whether to buy a policy.

Related stories

Before signing up for this type of insurance, or any other insurance for that matter, students and/or their parents should carefully read the policy terms and conditions, understand what is covered, and consider their individual circumstances and needs to determine if it provides valuable protection and is worth the extra dollars.

It’s also a good idea to consult with the college’s financial aid office for guidance and to see if there are any existing refund policies in place.