Jeff Bezos, one of the world’s richest people, has a net worth around $223.5 billion, most of which he accumulated during his tenure as Amazon CEO.

What is Jeff Bezos’ net worth? How much money does he make?

Jeff Bezos, one of the wealthiest individuals in the world, has a net worth of around $223.5 billion, according to Forbes.

Bezos garnered the majority of his wealth as the CEO and founder of Amazon. Like many billionaires, Bezos’ wealth was not derived from his annual income resulting from his labor.

Bezos’ ‘low income’

From 1998 to 2021, Bezos earned a base salary of $88,840, with additional compensation bringing the total to more than $1.6 million each year. While a much higher salary than most people in the United States could dream of, it does not come close to totaling over $223.5 billion.

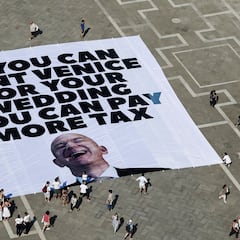

By keeping his income relatively low, Bezos has been able to evade paying taxes on his wealth, which in the United States is taxed differently than income. When he stepped down as CEO of Amazon, he owned 10.3 percent of the company’s stock which is where the majority of his wealth is held.

Around the world, many governments remain unable or unwilling to tax the wealthy. ProPublica had reported that from 2008 to 2018, Bezos’ wealth increased by more than $127 billion, yet he only “reported a total of $6.5 billion in income.” Over that period, he paid $1.4 billion in federal taxes or around 1.1 percent of his total wealth. In 2011, Bezos actually reported a loss in income and was able to claim a tax credit which resulted in him being given an additional $4,000 on his tax refund.

While Jeff Bezos is worth $230 billion, Amazon pays wages so low that thousands of his workers are forced to survive on food stamps, Medicaid & public housing.

— Warren Gunnels (@GunnelsWarren) June 24, 2025

In other words, your taxpayer dollars subsidized his $500 million yacht.

Yes. Jeff Bezos is the real welfare queen: pic.twitter.com/4vDaYiODzB

When was Amazon founded?

In 1994, Amazon was launched as an online bookstore after Bezos read about the projected growth in the online commerce sector. The founder’s parents gave him $225,000 as an investment in the start-up which in 2021 had a total income of more than $21 billion.

The company went public in 1997 selling its first shares for $18 apiece. Today, a share of the company is worth around $150.

In 1998, the company expanded the products it sold to computer games and music. However, even after adding these products and more and expanding their services to Germany and the United Kingdom, reports show that the company did not turn a profit until 2001.

How did Amazon become profitable?

Like many tech startups, Amazon did not turn a profit for many years after its founding. However, by expanding the services they offered and some morally questionable moves to limit competition it has been able to become more profitable over the years.

Amazon Web Services

In 2002, the company launched Amazon Web Services, adding a cloud computing service in 2006. The majority of Amazon’s revenue now comes from AWS and its market share is enormous. Within the cloud computing sector alone, AWS occupies around a third of the total market share.

Major companies like Netflix and even governments like the United States and the United Kingdom use AWS to host content.

Undermining of competitors

Many leaders and activists have highlighted the detrimental impact Amazon has had on local businesses. One reason many consumers have moved online is that they can find products for a lower price than what may be offered by a local retailer. Amazon as a multinational company is often able to cut the profits on each individual sale because their total volume is so large that it offsets the potential loss. Smaller businesses, with lower total sale volumes, are unable to compete with these prices and many have closed their doors.

Related stories

The Institute for Local Reliance conducted various studies examining the impact Amazon has had on local economies and found that between 2007 and 2017 more than 65,000 small businesses closed. Around forty percent of this mass closure came from local apparel, book, and toy stores.

Not only small businesses have been taken out by Amazon. One of the main ways Amazon has been able to grow is through the purchasing of other online retailers. A notable case of this occurred in the mid-2010s when a new e-commerce upstart Diapers.com began gaining traction. After being unable to convince the founders of Quidsi, Diapers.com’s parent company. After declining the bid, Amazon retaliated by lowering the price of diapers on their site to undercut their competitor. Diapers.com could not keep up with this movie and later ended up selling to Amazon.

Complete your personal details to comment