What is the Fair Tax Act? Republicans propose national sales tax

Members of the GOP in the House are pushing for a chamber debate on radical new tax proposals that would slash funding to the IRS.

A group of Republicans in the House of Representatives are looking to reignite the debate on federal taxation, calling for the decentralisation of the IRS and introduction of a national sales tax.

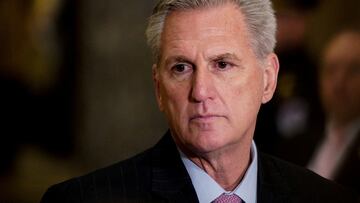

Similar proposals were first tabled in 1999 but they have never made it to the floor in either House of Congress. However the Republicans now hold a slim lead in the House and Speaker Rep. Kevin McCarthy may feel he needs to allow the bill to be debated to help appease elements of his fragmented caucus.

The legislation, entitled the Fair Tax Act, would eliminate all federal income, payroll, estate and gift taxes. In its place, the bill calls for the introduction of a flat national sales tax at rate of 30%.

What is the national sales tax?

A national sales tax would replace the incremental tax system currently in place, and levy a flat rate of tax on all purchases. Advocates for the proposal say it will simplify the tax system and make a fairer taxation system.

It would be applied automatically on all payments, meaning that they would be no need to the IRS’ vast tax recording procedures. As part of the proposal the tax agency’s budget would be slashed and its responsibilities greatly reduced.

But the notion of a single national sales tax would still be considered a radical move and one that overturns decades of federal taxation practices. At a time when low-income households have been disproportionately struck with high inflation these plans would likely exacerbate their financial worries.

It would replace the existing system of tax brackets, whereby higher earners pay tax at a higher rate. Lower-income households use a much larger proportion of their earnings to pay for essential goods and services, so removing the tiered taxation system would unduly place the tax burden on poorer groups.

GOP remains split on tax reform

The Democrats are unified in their opposition to the proposals and the vast majority of Republicans are unwilling to countenance such sweeping change to the tax system. However a right-wing group with the Republican Party appears in intent on pushing for a debate on its merits.

Speaker McCarthy is thought to have made significant concessions to his party’s Freedom Caucus-aligned members. This may include allowing them to bring fringe legislation that would not gain the support of a majority of the party, let alone the House.

McCarthy has said publically that he does not support the changes outlined in the Fair Tax Act. However he will need to ensure that his members who do want a national sales tax feel heard within the party.

In a press conference on Wednesday, Senate Majority Leader Chuck Schumer and House Minority Leader Hakeem Jeffries painted the proposal as an extreme attempt to tear down the established tax system.