When will the Social Security funds run out according to the Congressional Budget Office?

The trust funds for Social Security will be exhausted sooner than expected according to a CBO report if nothing is done to remedy the situation.

Last spring, the Social Security Trustees reported that the Trust Funds that pay part of the benefits to retirees and survivors of contributors would be exhausted by 2034. However, a recent report from the Congressional Budget Office (CBO) shortened that timeline by a year.

Now this doesn’t mean that the Social Security Administration would stop making payments to recipients, but benefits would be reduced. That is unless action is taken to shore up the programs that provide a vital financial lifeline to millions of Americans.

What did the CBO report say about Social Security funds?

The CBO’s report on the Long-Term Projections for Social Security found that if Social Security paid benefits as scheduled the Old-Age and Survivors Insurance Trust Fund would deplete its funds by 2033. The Disability Insurance Trust Fund would hold out a bit longer, but not much, until 2048. These scenarios would pass if nothing is done, and merging the two to buy some time isn’t an option, both would be empty by 2033 if combined.

Social Security would still be able to make payments to beneficiaries doling out funds from the payroll taxes that it collects from workers that contribute to the system. However, those only cover roughly 77 percent of the benefits paid to recipients, meaning a 23 percent reduction in payments. But the story doesn’t end there.

New CBO Report: Social Security’s trust fund runs out ten years from now. Benefits will be automatically cut by 23% in 2033.https://t.co/ia9VWud4lh pic.twitter.com/ZcR4MCkdTt

— Gabriel Noronha (@GLNoronha) January 26, 2023

Those who started claiming benefits before 2034 would see no change to their initial benefits, however because they’ll receive smaller benefits after the Trust Funds exhaustion, they will receive less over their lifetime than under the scheduled-benefits scenario. Beneficiaries in later cohorts, those born in 1969 and later, would see deeper reductions to their benefits.

What changes need to be made to secure Social Security solvency?

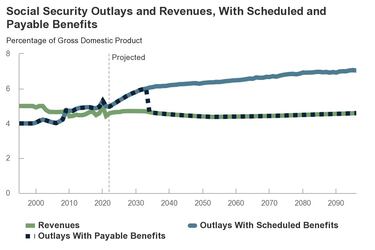

The CBO projects that the Social Security retirement benefits program’s 75-year actuarial deficit is equal to 1.7 percent of GDP. That translates to 4.9 percent of taxable payroll, that is similar to the predictions made last year by the CBO. In order for the federal government to maintain the necessary Trust Fund balances and pay benefits prescribed under current law through 2096 the CBO says that payroll taxes must be raised immediately, and permanently, by about 4.9 percent.

This would raise from 12.4 percent of taxable payroll under current law to 17.3 percent, which is split between the worker and employer, the self-employed pay the full amount but receive a tax break. Alternatively, Social Security benefits could be cut by 4.9 percent or a combination of that and raising payroll taxes equivalent to that amount.

However, that would not be a cure-all for Social Security, creating an annual surplus for two decades but then annual deficits resulting in the program becoming financially unsustainable after 2096.

The CBO states that its projections of spending and revenues for Social Security through 2096 are subject to considerable uncertainty due to potential changes in the population or economy. Over time the differences could be especially large as the underlying projections would compound.

What is being done to save Social Security?

Related stories

Lawmakers are considering proposals to make Social Security solvent into the future, this includes raises the cap on payroll taxable income. Currently, earnings over $160,200 are not taxed. In the previous Congress Democrats proposed a package known as Social Security 2100: A Sacred Trust, which aims to expand upon and boost the funding of Social Security. However, it failed to gain traction as lawmakers struggled with numerous other legislative proposals.

As Congress is at a stalemate over raising the debt ceiling, which if not done would be a clear and present danger to benefits and the US economy as a whole, not to mention the world economy, changes to Social Security have been placed on the table. Republicans, who have a slim majority in the House of Representatives, want cuts to spending before they will approve raising the US borrowing cap to pay for spending previously approved, Social Security and Medicare are considered fair game.