Which is the most affordable student loan repayment plan?

Is the SAVE plan the “most affordable repayment plan ever” as it has been purported to be? Not for everyone paying off their student debt.

1 September, the day all people with students debts have been dreading; mandatory monthly debt repayments have resumed. The moratorium in place since the beginning of the covid-19 pandemic has ended.

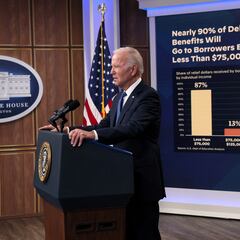

The Biden Administration has put forward the SAVE plan; an income-driven repayment (IDR) plan. It has been touted as the “most affordable repayment plan ever”, but that isn’t true for all borrowers.

We are unapologetically fixing a broken student loan system.

— Secretary Miguel Cardona (@SecCardona) August 30, 2023

The #SAVE plan is the most affordable student loan repayment plan in history – and it only takes 10 minutes to apply. https://t.co/XvhXvcbPVm pic.twitter.com/sjZ16JTk3G

What does the SAVE plan do?

The plan willl increase the amount of income protected from repayment from 150 percent of the Federal poverty guidelines to 225 percent. That level is roughly the equivalent of a $15 hourly wage based upon the 2022 guidelines for a single borrower working fulltime.

So, a single borrower earning less than $32,800 would have their monthly payments reduced to zero dollars.

Starting today student loans will start to accrue interest and we’re only 1 month out from the end of the #studentdebt repayment pause.

— NAACP (@NAACP) September 1, 2023

Learn more about the Saving on a Valuable Education (SAVE) Plan and how it can help you set up manageable payments: https://t.co/fER4RzBkf2 pic.twitter.com/ndK5ELSYGp

Undergraduate loans will have their monthly repayments cut in half from 10% to 5% of discretionary income. Interest is also capped.

SAVE is aimed at protecting borrowers with lower incomes. Another way it does this is by forgiving debt for those with principal loan balances of $12,000 or less. You’ll need to make payments for an additional year for every $1,000 you borrowed above $12,000 up to 20 or 25 years for this.

What other options are there?

For many the standard income plan may still be the best option. As the SAVE plan is income driven, monthly payments can be higher that normal plans, which aim to pay off your balance in ten years.

For example, from a students average debt when they leave college of around $27,000, monthly payments on standard plans are $272. You will be paying more in your repayment in your SAVE plan if you are earning $65,000 or more annually.

Related stories

Parents who took loans out on behalf of their children are not eligible for any IDR plans, including SAVE. These will need to use the standard income plan.

To find which loan is best for you, it is advised to use the Loan Simulator from the studentaid website. It is true that SAVE can be the most affordable plan, but not everyone leaving college may want affordable; they may just want it to be paid off.