Why are gas prices going up again in early February 2024?

Fuel prices are lower than they were a year ago but geopolitical tensions are threatening another inflationary spiral.

The threat of war spreading across the world’s largest producers of oil is a serious danger to oil prices, inevitably having a knock-on effect for American consumers at the pump.

At this stage the increase in price is slight and prices have actually fallen by more than half a dollar since the summer. Gas prices have largely recovered from the oil shocks of 2022. The Russian invasion of Ukraine disrupted global oil prices, surging prices to over $5 per gallon in June of that year. Prices are much lower now with the average at $3.154 per gallon. Prices are down 8% from a year ago, but the upwards trend over the last month has experts worried.

“Heightened tensions in the Middle East have the market pricing in a higher probability of a supply disruption,” Andy Lipow, president of Lipow Oil Associates, told Yahoo Finance.

How escalation in the Middle East will put pressure on prices

The Israeli war on Gaza would have been expected to influence global oil prices due to where in the world they are. However, global oil prices have actually decreased since the invasion. It is the escalation in the wider Middle East over the last two months that will really put the squeeze on oil.

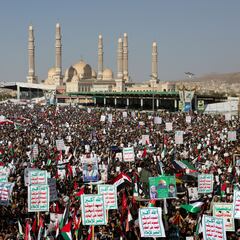

The Yemeni blockade of the Red Sea, without needing a naval fleet of any kind, has been astounding. The US bombing, claimed to be self-defence, has not stopped the Yemeni raids. Now the Red Sea, including the crucial Suez Canal, is off-limits for much of global shipping, which is now taking the longer, more time consuming, and more expensive route around the Cape of Good Hope, South Africa.

An interesting way to measure this is the price of global shipping containers. Before the Yemeni blockade the price of a 40ft container was around $1,300. Now, it is $3,842, nearly three times as much. This time and money spent on transport can only be offset onto consumers.

“Although no oil production has been shut in, tankers avoiding transiting through the Red Sea and Suez Canal have added to logistics cost, and the consumer is seeing that in higher gasoline prices,” Lipow continued.

Related stories

The recent announcement that the US would be attacking Iran-linked military targets in Syria and Iraq The objective is to deter through force but Stephen Collinson, CNN senior reporter, says “the Biden administration’s effort to prevent an escalation is not working.”

BREAKING: Multiple US lawmakers want to directly hit Iran after deadly attack on the US troops in the Middle East pic.twitter.com/YirYWKeJnD

— Insider Paper (@TheInsiderPaper) January 28, 2024

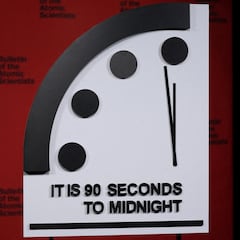

With fighting in Yemen, Palestine, Iraq, Syria, and Pakistan, it is inevitable that an even wider conflict will impact fuel prices.