Why are Republicans against student loan forgiveness?

Publicly, the GOP has come out strongly against student debt relief... but some of their written proposals cast a different, more sympathetic story

The US Supreme Court is hearing arguments against the constitutionality of President Biden’s order to forgive up to $20,000 in undergraduate student loan debt for millions of borrowers next month.

Based on the GOP’s reaction, if the program is deemed unlawful, debt relief may be taken off the Democrat’s agenda.

Some Republicans have opposed debt relief because it makes it harder for the army to recruit since a free education motivates many civilians to join the military. The argument falls into its own trap because it implies that receiving a higher education should be earned by some and given to others.

The Supreme Court today will hear arguments in cases against Biden’s student-loan forgiveness plan.

— The Atlantic (@TheAtlantic) February 28, 2023

The question of whether student debt “is bad is actually pretty complicated,” @JerusalemDemsas argued in April 2022. https://t.co/BIPlWu7qLz pic.twitter.com/y2Qa7SkuJR

Others disagreed that there was something exceptional about student loan debt, in particular, that justified forgiveness over other types of debt. Why shouldn’t the government forgive medical debt? credit card? auto-loans?

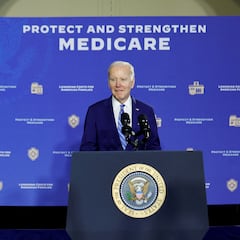

Today, my Administration argues our case for student debt relief in the Supreme Court.

— President Biden (@POTUS) February 28, 2023

This relief is critical to over 40 million Americans as they recover from the economic crisis caused by the pandemic.

We're confident it's legal.

And we're fighting for it in court.

However, the most repeated argument from the GOP centered on why taxpayers who did not attend college should foot the bill for those who did.

A more borrower-friendly GOP?

The central focus of these arguments is personal responsibility. It was the decision of the borrower to take out the loan, so it is their individual obligation to pay back their fellow taxpayers —with interest.

Recently, the Republican Study Caucus released a report whose underlying message runs in direct contradiction to the personal choice narratives listed above.

The RSC said that over the past few decades, the “federal government has [...] perpetuated the myth that a traditional four-year college degree is the only path to success.” The report calls out the predatory nature of the “‘Bachelor’s-or-Bust’ mentality,” which they say “has been costly, especially for the millions of students who have incurred mountains of personal debt in pursuit of diplomas that return to them little value.”

There is truth a lot of truth packed into this statement. It is the same sentiment that motivates Democrats to enact programs to reduce student loan balances.

Over half of student loan borrowers report being concerned about their ability to repay.

A study examining the impact student debt had on the professional choices of millennials found half of those surveyed with loans said they kept them from opening a business.

Republicans are also sensitive to what they see as a disruption in the traditional American way of life caused by student loans, writing that the debt can “often act an impediment to reaching milestones—such as buying a home and starting a family—that have become synonymous with adulthood development in America.” Today, young college graduates flock to urban environments in search of higher-paying professional jobs that will allow them to earn enough to live a decent life while also paying off their debt. Fewer people stay in the communities they were raised in, and this migration disrupts the economies and social dynamics of rural and semi-urban areas.

Imagine that slowly a downtown that used to be made up of small and local businesses sees those same storefronts replaced by national chains.

Opposition to ‘this kind’ of debt forgiveness

The RSC’s proposal doesn’t say that debt forgiveness is off the table. Frankly, the authors spend more time attacking the idea of tuition-free public college.

On forgiveness, the GOP called the “$10,000 in debt cancellations” proposed as a part of an unpassed stimulus package “costly” and argued that it would “drive up the cost of college tuition and send the message that students who make irresponsible borrowing decisions will ultimately be bailed out by the federal government.”

A person who makes an “irresponsible borrowing decision” carries a very different sentiment than the “millions of students who have incurred mountains of personal debt in pursuit of diplomas that return to them little value.” Which is it? Are student loan borrowers victims of government misinformation, or are they trying to rig the system in their favor?

Related stories

It is more than fair for the GOP to say that Biden’s plan is too narrow or that it doesn’t address the root of the problem, but Democrats can, in return, invite them to the negotiating table. A more permanent solution to the student debt crisis is needed.

If the Supreme Court throws out the White House’s plan, will the White House and Democrats keep pushing?