The 'Beckham Law' in reverse

Alfredo Relaño takes a look at some of the new rules which have been introduced in the tax system - it's the 'Beckham Law' but the other way around...

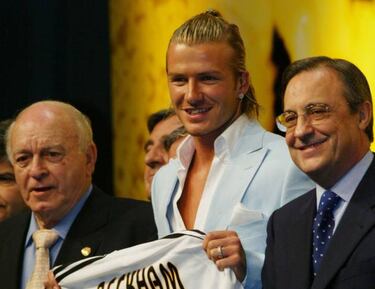

Remember the so-called Beckham Law? I’m sure you do. It was a ruling made by the government in 2005 designed to attract talent to our country. High-earning and highly qualified workers would only be taxed at 24.75% on all of their income earned in Spain during the first five years working here. Football was an industry which benefitted the most even though it was not introduced with sport in mind and for that reason it became known as the Beckham Law, because it was brought in at the same time as his arrival. It gave out clubs a competitive advantage which has since faded. The Beckham Law is no longer available to professionals in sport, but it’s still in use for highly-skilled workers in other sectors.

Tax situation for footballers across Europe

Related stories

But now we have another problem. All of a sudden, footballers in Italy who come in from abroad will be exempt from paying tax on 50% of their income. So in other words, a player who earns 6 million euros after tax in Spain will cost their club 12 million, while in Italy, a player who takes home the same salary will cost their club less than 8 million. And in France, 30% of all income is exempt, so a player earning the same wage (6 million) will cost their club less than 9 million. In England, there are no favourable tax breaks for players’ in terms of their salaries but there is a huge advantage in the opportunities of making money through sponsorships deals offshore – that’s what Cristiano did when he was at Manchester United only to discover the same rules don’t apply here.

Less incentives for players to come to Spain

To all of that we also add the changes to the guidelines which [Spanish Finance Minister] Cristóbal Montoro set out back in the day; it has caused a strong feeling of insecurity in the sector – on top of the decision to consider any commissions paid to agents as part of the salary (here in Spain, Estate Agencies receive more beneficial treatment). All of that together means that our league will be made weaker. As Javier Tebas noted in an interview with Expansión yesterday, the professional football industry generates the equivalent of 1.37% of GDP in Spain - that produces 4,100 million euros in tax per year and gives employment to 185,000 people. With so many obstacles, those figures will fall. And if the top players move to other countries (or stop coming altogether), with them, we will lose their tax contributions.