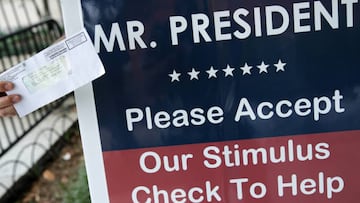

Stimulus check: what to do if payment was sent to the wrong address

Most people have now received their stimulus payment checks but some were mailed out to the wrong address or an old address. Here’s what you have to do.

The majority of Americans have already received their stimulus payments – either through direct deposit into their personal bank accounts, in a paper check or through the new EIP cards. Those who have not received their payments yet will probably be sent an EIP card, which is a prepaid debit card with the stimulus payment charged onto it.

My stimulus check got lost in the post

While the debate is set to continue for a possible second round of stimulus payments in the HEROES Act, some still haven’t received their first stimulus payment. Checks might have gone missing in the post for a number of reasons. If you recently moved house or are living at a different address to the one you were registered at when you filed your last tax return in January 2019, then it is quite possible that your stimulus check has been sent to the wrong address.

Finding out what has happened to your missing stimulus check will take a little bit of personal detective work.

First, if you filed tax returns for the tax years 2018 or 2019, dig out your tax return sheet (Form 1040) for those years and check the address included on it is correct matches your current address. If you have lost your tax return Form 1040 from 2018 or 2019, you can request a transcript online from the Internal Revenue Service (IRS). Transcripts are free and available for the most recent tax year after the IRS has processed the return up to the past three tax years. If you don’t have your copy, you can use the IRS Data Retrieval Tool on the FAFSA website to download your tax return information to your financial aid application without having to request a transcript directly from the IRS.

The alternative is contacting the IRS directly.

- Online. The fastest way to get a Tax Return or Account transcript is through the Get Transcript’ tool available on IRS.gov. Although the IRS temporarily stopped the online viewing and printing of transcripts, Get Transcript still allows you to order your transcript online and receive it by mail. Just click the “Get Transcript by Mail” button to have a paper copy sent to your current address.

- By phone. You can also order by by calling th customer services hotline on: 800-908-9946 and follow the automated instructions.

- By mail. To order your tax return transcript by mail, complete and mail either Form 4506-T or Form 4506T-EZ. Form 4506-T can also be used to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing.

Remember that you only need to check the address – you don’t have to request an actual physical copy of a tax return (which are available for the previous six tax years), as that will cost you $50...

After you have checked the address, next check the status of your stimulus check. On the IRS web page, go to the Get My Payment tool to find out when the check was posted out.

On to the next stage – did you file a tax return for 2019 in January? If you haven’t done so yet, when you do file your tax declaration for last year (this year, the tax deadline has been extended from 15 April to 15 July), you can either choose to set up a direct deposit to your bank account or fill in Form 1040 with your current address when you file it. Remember that to be eligible for the stimulus check, you must make sure you have filed tax returns for 2019 or submit a non-filer form to the IRS.

I haven’t filed my taxes for 2019 yet

If you haven’t got around to filing your taxes for last year – and there was a problem with your registered address, the IRS will be unaware of your new address. One possible solution is to log on to the USPS website and change your address online so that all mail will be forwarded to you at your current address –there is a $1.05 fee to do this.

Nearly 4 million people are being sent their Economic Impact Payment by prepaid debit card, instead of paper check. These cards will be delivered in a plain envelope from Money Network Cardholder Services. Know what to expect: https://t.co/e4k6vLM54z #COVIDreliefIRS pic.twitter.com/tz4PF0QrDP

— IRS Tax Pros (@IRStaxpros) May 30, 2020

If you have moved home during the past 12 months, you could also try contacting an old neighbour, your previous landlord/landlady or the residents now living at your previous address and ask them if any mail has arrived for you.

Lost or stolen mail

Related stories

If your stimulus payment was sent to you on an Economic Impact Payment (EIP) Cards and you have mistakenly thrown out the envelope which contained your EIP Card, or lost the card or had it stolen, you must contact the customer service automated response hotline (1-800-240-8100 )or online at www.eipcard.com.

- $1,200, $2,000 or $6,000 - how much would second stimulus check be?

- Can Trump veto HEROES Act if Senate approves?

- What is a Money Network Card? Is it a scam?

- How California is reopening its economy

- Trump keen on a second stimulus check

- Would a second stimulus check come as a debit card?

You will be charged for a new, replacement card – the fee is $7 for a replacement plus a further $17 in postage and handling costs.