Stimulus check: how the government creates stimulus payment

The government does not just print money but rather issues bonds in order to keep the economy afloat during times when millions of Americans are out of work.

The coronavirus caused the United States’ economy to screech to a halt. Business closed down, people were let go from their jobs and the country was effectively in lockdown — even if that is not the term that was always used. As cases increased and the government realised this was going to take a number of months to resolve, they started to consider ways to help the most vulnerable.

With over 40 million people in the United States out of work, the government introduced the CARES ACT. Passed in March, the $2.2 trillion CARES Act has seen millions of eligible Americans receive an Economic Impact Payment (EIP) of up to $1,200 to help them cope with the effects of the coronavirus pandemic.

There has been talk of another stimulus payment with 84% of respondents who took part in a recent survey carried out by MarketWatch saying they would need further help. It has been passed by the Democrat-controlled House but now has to go to the Senate where the Republicans are not as keen to send money to struggling citizens.

Whether or not that new bill, the HEROES Act, gets passed, it is interesting to consider where the money comes from to deliver these stimulus payments. The Wall Street Journal has put together an interesting explainer video, which is summarised below.

- $4,000 Travel Tax Credit: proposal published for coronavirus aid package for tourism industry

- Stimulus check: how do I know it is not a fraudulent call?

- Coronavirus: What states require quarantine after flying into?

- Stimulus Check vs $4,000 Travel Tax Credit: what is the difference?

- Stimulus check calculator: how much would my HEROES Act payment be?

- $4,000 tax credit: what Trump says about stimulus scheme

Where does the money come from for stimulus checks?

It is tax-payers funds? Or is the government just printing money? These are common misconceptions about the stimulus money. In reality, it is a complex situation involving the buying and selling of government bonds, which are like coupons with a promise of interest.

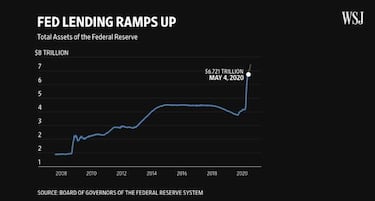

As WSJ explain, the money is raised through borrowing. The government is expecting to borrow a record 4.5 trillion dollars this year, which is more than the 1.28 trillion dollars borrowed last year.

The treasury department sells bonds in order to raise the money and they sell them to three groups; the public sector, private sector and foreign entities.

Essentially, the government is backing itself to come out of this. They sell the bonds and those bonds are worth what was paid for them plus a little bit of interest. The government then uses that money to send stimulus checks to struggling and out of work Americans. With that money, it helps the economy get back on its feet because people can continue to live their lives to an extent and the business loans the stimulus package sends out means they can keep their employees.

Related stories

This is based on John Maynard Keynes' economic theories where, to avoid stagnation and inflation, the government runs at a deficit in order to encourage spending and so people can save more and then invest in even more government bonds potentially.

One problem with the Federal Reserve selling bonds to raise funds is when they start printing money, which they aren’t actually doing. The problem then is that the money exceeds the actually goods and services in the economy and it essentially makes money worthless. This kind of thing happened in Venezuela when inflation rises. The WSJ video says inflation has not started to rise yet, which would be tell-tale sign of the devaluation of the dollar.