Who was the first U.S. president to release his tax returns?

Almost every U.S. president has voluntarily released his annual tax return under the Freedom of Information Act since the mid-70s but Donald Trump refuses to.

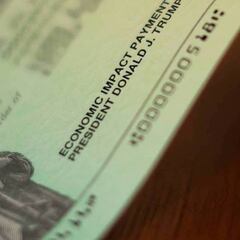

On Thursday, the Supreme Court in Washington ruled that Donald Trump cannot withhold his tax returns from Manhattan District Attorney Cyrus Vance and will at some point, be obliged to hand over his financial documents – whether he does so before November’s presidential elections is another matter… Vance is investigating Trump's business dealings and alleged hush-money paid to two women who allegedly had affairs with the president in 2016.

Donald Trump has been under pressure to reveal his tax returns since he was elected in 2016 but despite saying on record that he would make his tax information publicly available, he has regularly skirted the issue or made promises that he hasn’t kept.

Nixon's tax irregularities

Income tax returns are considered confidential information and are protected from public disclosure by law. However, in the United States, successive presidents have elected to voluntarily release their tax information under the Freedom of Information Act since the late-1960s. Richard Nixon filed his tax returns for the first four tax years during his time in office – 1969-1972, and on examination, it was discovered that he had been paying an unusually low rate of income tax, around 7% - much lower than many ordinary citizens who were earning far less. Despite earning a salary of over $200,000, Nixon had paid just $800 and $900 for the tax years 1970 and 1971.

Since Nixon’s books were audited in the early 1970s and up to 2012, each successive U.S. president had opted to voluntarily release his tax returns as a show of transparency and to restore trust in government. The American public and media were eager to know that presidents were not benefiting from preferential treatment from the IRS so all of suddenly, everything was out in the open.

Until recently, only Gerald Ford, Nixon’s successor, did not do reveal his complete tax returns, instead he offered a 10-year summary which included gross income and federal tax deductions. The tradition of presidents voluntarily providing income and tax information stopped in 2017 when Trump declined to do so, stating he will not release his fiscal information while his tax returns are being audited by the IRS – a practice which has been compulsory since 1977.