Second stimulus check: What is my AGI and where can I find it?

Adjusted Gross Income (AGI) is used by the IRS for the stimulus check thresholds - here's how to find out your AGI.

As the coronavirus pandemic continues through the summer, hard-hit Americans are anxiously waiting for lawmakers to move forward with the next stimulus package, which would include a second round of stimulus checks.

At the moment the Republican proposed HEALS Act appears most likely to become law, after it is likely adjusted in tough negotiations with Democrats (who passed their own stimulus package, the HEROES Act, through the House, only for Republicans to refuse to debate it in the Senate).

Check out the difference between the HEALS Act and the HEROES Act.

While the exact details of the second round of stimulus checks is still to be worked out, the broad mechanics are almost certain to be the same as those passed in the first round under the CARES Act. That, first, stimulus package, provided for $1,200 checks per individual earning up to an Adjusted Gross Income (AGI) of $75,000, with the amount of the payment tapering down to zero with an AGI above $99,000.

For joint filers those figures were $2,400 of stimulus payment up to $125,000 tapering down to zero above $198,000.

For head of household filers the full payment is made up to $112,500, reducing to zero at $136,500.

How is Adjusted Gross Income calculated?

Adjusted Gross Income is a tax concept used by the Internal Revenue Service to calculate how much available income you have that can then be taxed.

It's calculated by taking all the money you earn in a year to calculate your gross income:

Wages, dividends, capital gains, business income, pension income, alimony, interest income, royalties, rental income and other income including, for example, gambling and lottery winnings.

Note that the stimulus check is not included as income for tax purposes.

From that total you can then deduct a range of items which include:

Student loan interest, alimony payments, contributions to a retirement account, educator expenses, healthcare savings account (HSA) deductions, certain capital losses and other deductions.

- Second stimulus check: is a deal possible if not settled by Friday?

- Second stimulus check: when will the money arrive?

- $100 million coronavirus fraud losses after multiple scams

- Unemployment benefits: what is White House considering?

- Stimulus check: CARES vs HEALS vs HEROES Acts

- $1,000 stimulus check: how much money for children and adults?

Where to find your AGI on your Form 1040 tax return

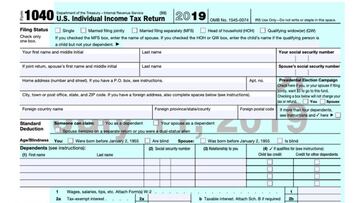

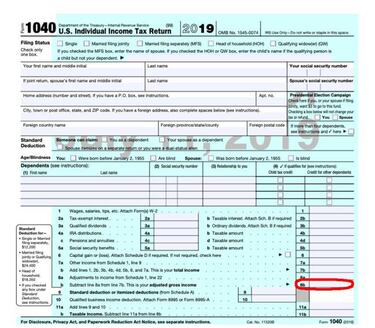

AGI on 2019 tax return

The AGI is found on line 8b of the 2019 federal tax form 1040.

The 2019 tax return (covering the year to 31 December 2019) filing and payment deadline was extended from April 15 to July 15, due to the Covid-19 pandemic.

The IRS then allowed for an automatic filing extension to October 15, though the application had to be filed by July 15. Note that that extension did not cover payments, with taxpayers expected to estimate what was due and pay that over to avoid interest and penalties.

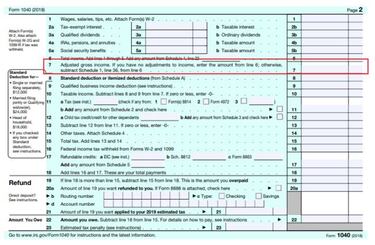

AGI on 2018 tax return

If you haven't filed a 2019, the IRS will use your 2018 return. On the 2018 Form 1040 tax return the AGI is on line 7.

Stimulus payments: a 2020 tax rebate

Note that the stimulus payments are in reality non-taxable rebates on 2020 taxes, meaning that if your income in 2020 ends up being below the threshold you should be able to claim a stimulus check when you file your 2020 tax return (in the first quarter of 2021), even where your AGI was over the thresholds in 2018 and/or 2019.

Even better, even if your AGI in 2020 is over the limits, but you received a stimulus check based on 2018 or 2019 figures, the IRS will not claim any amount of the stimulus check back (check out question 65 on the IRS website).

I can't find my tax return - how do I get my AGI?

If you can't find your tax return, you can use the IRS's Get Transcript website.

You can request it online, for which you'll need a whole series of personal information from your latest tax return including social security number, date of birth, filing status and mailing address, plus an email account to which you have access; your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or car loan; and a mobile phone account in your name.

Related stories

Alternatively you can request it by mail, for which you'll only need your Social Security Number or Individual Tax Identification Number, your date of birth and the mailing address from your latest tax return.

The transcript should arrive within five to 10 calendar days.