Second stimulus check: how to avoid covid-19 payment scams

Some typical scams that have emerged taking advantage of the new stimulus checks finally being rolled out and top tips on how you can avoid them.

We reported back in May 2020 when the CARES Act sent stimulus checks to the accounts of around 160 million Americans that scams were emerging to target recipients of stimulus checks. this time round there remain those looking to take advantage of an opportunity to abuse the system.

Americans lost over $211 million to coronavirus-related scams and stimulus payment fraud, according to the Federal Trade Commission. Since January 2020, the agency has received over 275,600 complaints.

Now that a new stimulus check of up to $600 is in the post for many needy Americans, a similar crop of scams have reared their ugly heads once again. Provisions in the bill also include a further $600 for every child dependent under the age of 16.

The IRS has confirmed that checks are already being sent out automatically to those who qualify and that no action is needed from recipients.

#IRS is issuing a 2nd round of Economic Impact Payments. No action needed on your end. https://t.co/VY0F1xzGPl #COVIDreliefIRS pic.twitter.com/SrTPhBg7t5

— IRSnews (@IRSnews) January 3, 2021

How to spot a stimulus check scam

Many stimulus check scams can be very sophisticated and may be difficult to spot. Here are some warning signs that something’s not right:

Iowa AG Miller warns of stimulus check scams https://t.co/slyBw1sqEt

— KCRG-TV9 (@KCRG) January 1, 2021

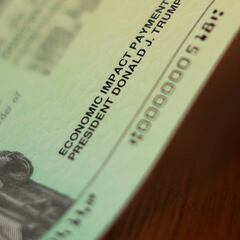

Wording: Economic Impact Payments not Stimulus Checks

If anyone contacts you using the words "Stimulus Check" or "Stimulus Payment", asking for personal information. The official term is “Economic Impact Payment” and official government payments and communications will use this term instead.

Beware of phone calls from “IRS”

According to Today, clever technology allows scammers to control caller ID displays or SMS senders, making them read "IRS" as the number or make emails look like they are from an official government agency, as Florida Attorney General Ashley Moody noted in a release 28 December. You should only ever use the IRS web page to submit information to the IRS.

Pressure tactics

If you end up on the phone and a person claims you will lose your payment or suffer a financial loss if you don't take immediate action, it's a scam too. Hang up.

IRS won’t ask you to pay a penny

If you get asked to pay a fee by anyone claiming to be dealing with stimulus checks. A common scam that cropped up during the last round of stimulus checks was fraudsters offering payments faster, or even additional funds, for a small “processing fee” — typically using a prepaid debit or gift card, according to the BBB Scam Tracker.

Social media contact: sure-fire scam

If you receive a phone call, email, text or other social media avenue to “verify your personal and/or banking information”. These scams might claim that the information is needed to speed up receiving your payment, but official government agencies will never ask for your confidential information this way.

Faster payment or more money

Related stories

Any communication offering faster payment or tax refund should be regarded as suspicious. These scams are likely to claim to work on the taxpayer's behalf and may be proposed by social media or in person. Again, any contact through social media should be regarded as a scam.

Fake checks

If you’re mailed a false check, perhaps in an amount that doesn’t make sense for your income level, then tells the taxpayer to call a number or verify information online in order to cash it - disengage and report any details to the Federal Trade Commission.