Third stimulus check news summary: 12 April 2021

Information on the third stimulus check included in President Biden's American Rescue Plan and news on a possible fourth direct payment.

Show key events only

US stimulus checks news

What you need to know about the enhanced Child Tax Credit

What might be one of the most consequential features of President Joe Biden’s $1.9 trillion covid-19 relief bill enacted in March could be the changes to the Child Tax Credit. The changes are currently only applicable to the 2021 fiscal year but Democrats are looking to make the revamped provision permanent later this year.

The American Rescue Plan made the Child Tax Credit available to more Americans and increased the amount, some of which will be sent as direct payments.

Is paid family leave good for employers as well as employees?

President Joe Biden is expected to propose paid family leave as part of a revamp of the nation’s “care infrastructure.” Polls have shown that a majority of Americans support paid family leave, and more than 200 businesses last month formally urged Congress to enact it. While several states have either passed or implemented paid family leave legislation, the United States is the only high-income country without a policy at the federal level.

A new Stanford study has answers to a key question at the heart of the debate: Are businesses hurt when workers take time off with pay to care for a child or ailing family member?

What are the markets watching this week

A quick look at what will be driving the market this week with the Dow hit a 19th record high for the year and the S&P 500 hit a 20th high for the year at the close of last week.

The Fed continues to do its best to keep the financial markets liquid and to support the stock market and the economy, and this seems to be the main factor behind the market rise.

Would the fourth stimulus check be taxed by IRS?

The federal government has sent out $3,200 in stimulus payments over three different rounds to eligible adult Americans since the pandemic began. Even as payments in the third round haven’t finished going out there are calls for additional stimulus payments.

The first two rounds of Economic Impact Payments (EIP) were advanced payments on tax credits for 2020, while the third EIP is a tax credit for the 2021 fiscal year.

Little is known about the exact details around the proposal for a fourth stimulus check, would it be recurring, how much would it be, will it be taxed?

Did you buy Bitcoin with your stimulus checks?

Bitcoin has seen its value skyrocket during the pandemic, partially on the back of spare money from stimulus checks over the year. However, that investment will need to be reported to Uncle Sam for tax purposes.

Even though you can buy things with bitcoin, it's not the same as cash. At least not in the eyes of the IRS. Virtual currencies are taxed as property, or as an investment, when you sell them. And using them to buy something counts as selling. If you're paid in bitcoin, on the other hand, that will be treated as taxable income to you.

American households still struggling after stimulus payments

While the number of Americans struggling to put food on the table and pay bills fell last month, new data shows that millions are still feeling the financial effects of the covid-19 pandemic.

The third round of stimulus payments started landing in bank accounts mid-March, so it’s not surprising that the number of Americans who sometimes or often do not have enough to eat on a weekly basis fell, from 10.7% to 8.8% at the end of March.

But that still leaves about 18 million adults who are going hungry, a figure that is much higher than the number of Americans who said they didn’t have enough to eat prior to the start of the pandemic in 2019, according to the Center on Budget and Policy Priorities.

Biden to meet with lawmakers about next stimulus plan

Biden and Vice President Kamala Harris are meeting with four Republicans and four Democrats on Monday afternoon to discuss his American Jobs Plan. The meeting will be the first time Biden sits down with lawmakers to discuss his proposal that aimed at improving the nation's infrastructure and shifting to greener energy over the next eight years.

The group is made up of lesser-known but influential lawmakers from both parties who have a history of working on infrastructure and sit on the committees that will shape the proposal as it moves through Congress. White House press secretary Jen Psaki said Monday the President is willing to negotiate on the scope and price tag of the proposal as well as how to pay for it.

Millions still haven't claimed stimulus checks

The IRS reached out to locate millions of taxpayers whose income is below the threshold requiring them to file a tax return during the fall. The IRS still hasn’t located around 8 million people who were eligible for the first two rounds of stimulus checks, and foreseeable the third.

Many of these “Non-Filers” are homeless or low-income households who can only claim their stimulus money by filing a tax return in 2020.

FEMA accepting applications for covid-19 funeral reimbursement

Families who lost loved ones to covid-19 can now apply to receive $9,000 to retroactively reimburse them for funeral costs. That relief maxes out at $9,000 per funeral and $35,500 per applicant if they were responsible for multiple funerals, but FEMA says not everyone will receive the maximum amount.

The federal agency is budgeting $2 billion for the program with money from the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 and the American Rescue Plan Act of 2021. If you’re eligible, FEMA says the money will either get sent by a check in the mail or by direct deposit.

For more information you can check the dedicated FEMA website

When must states decide to offer tax break on unemployment benefits?

Federal government has implemented a waiver on taxing the first $10,200 in unemployment benefits. As states grapple with the need to collect revenue while supporting their residents who have been hardest hit by the economic fallout.

All but 12 states have now waived taxes on the first $10,200 of unemployment compensation. Is there a deadline to follow suit?

6 in 10 will need fourth stimulus before summer

So far, the federal response to the economic crisis caused by the covid-19 pandemic has delivered $3,200 to each eligible adult: $1,200 via the Coronavirus Aid Relief and Economic Security Act in March 2020; $600 in a December relief measure; and $1,400 under the American Rescue Plan signed in March by President Joe Biden.

Despite those stimulus payments and federal pandemic unemployment benefits many Americans are still struggling. 21 Senators are pushing for recurring stimulus payments stating the Almost 6 in 10 people say the $1,400 payments set to be included in the rescue package will last them less than three months."

More than just $1,400 stimulus checks

The third round of stimulus payments that saw eligible households getting $1,400 per person is one of the most talked about features of the $1.9 trillion covid-19 relief is However, the American Rescue Plan Act also contains a whole slew of measures to help American families recover from the fallout of the coronavirus pandemic. Included are important updates and tax breaks for medical care and health insurance that could benefit your family.

Some of those benefits can be claimed on income tax filings this year. Check below to find out more.

The IRS is contacting taxpayers about missing stimulus funds

A year into the pandemic, some Americans are still confused as to why they received less stimulus check money than they anticipated and, in some cases, no money at all. If that’s you, there’s good news: A recovery rebate credit on this year’s tax return will let you submit your claim for those funds.

The three rounds of stimulus checks are tax credits paid out in advance. You can claim any money missing from the first two rounds for up to $1,200 and $600 per eligible American on your tax return for the 2020 fiscal year. The current $1,400 stimulus checks are an advance payment for the 2021 fiscal year.

Beware that the IRS has the final word on how much you will receive.

The most expensive maintenance is no maintenance. That's why we need big, bold investments in the American Jobs Plan - so we can rethink, rebuild, and modernize our crumbling infrastructure to create good paying jobs & turbocharge our global competitiveness.

White House keeping an eye on inflation

The Council of Economic Advisers posted their assessment of inflation for the month and years ahead. Here is a brief excerpt:

The COVID-19 pandemic has caused an unconventional recession, and we do not expect the recovery will be typical either. While the paramount policy goals are to control the virus, get to full employment, and make the necessary investments for a more resilient and inclusive recovery, economic uncertainties and risks demand careful attention going forward. One risk the Administration is monitoring closely is inflation.

Pandemics of the magnitude of COVID-19 are, thankfully, rare, but that also means few historical parallels exist to inform policymakers. The United States experienced short bursts of inflation in some prior periods of pandemics or large-scale reallocations of economic resources, such as in 1918—driven by the Spanish Flu and demobilization from World War I—as well as the demobilization from World War II after 1945 and the resurgence in defense spending due to the Korean War. But history is not a perfect guide here. The 1957 pandemic, for example, which coincided with a nine-month recession, saw inflation weaken, with no large resurgence even when the pandemic was over and the economy was growing again.

Third stimulus check: who is getting extra money, why and how much?

Over 130 million third stimulus checks have been sent out but depending on what changed between your 2019 and 2020 tax return, you may be eligible for an additional 'plus-up' payment from the IRS.

According to the IRS, another 25 million stimulus checks, worth $36 billion, were sent out in the most recent tranche of direct stimulus payments. Roughly 24 million of those payments were sent as direct deposit with the remainder sent as paper checks.

The IRS is sending supplemental 'plus-up' payments to the stimulus checks already sent out for taxpayers that are newly eligible or that were due a larger stimulus check.

The prospect of a fourth stimulus check?

There have been growing calls in recent weeks for a fourth stimulus check, which many suggest should provide recurring monthly payments to ensure long-term support until the end of the pandemic. But who is in support of these proposals, and who is against?

On 30 March a group of 21 senators, all Democrats, signed a letter to President Biden in support of recurring stimulus checks. They argued that the $1,400 included in the American Rescue Plan was insufficient and would not last long for the poorest recipients.

The letter reads: "Almost 6 in 10 people say the $1,400 payments set to be included in the rescue package will last them less than three months.”

It goes on to demonstrate considerable support for the proposal, saying: “recurring direct payments have wide support from both the general public and economic experts. Polling shows 65 percent of Americans support recurring cash payments ‘for the duration of the pandemic.’”

A number of leading Republicans in Congress have argued that federal spending on the level of Biden’s proposals is unnecessary, and are therefore extremely unlikely to support more spending so soon after the last burst.

“We’re about to have a boom,” said Mitch McConnell, the majority leader. “And if we do have a boom, it will have absolutely nothing to do with this $1.9 trillion.”

Currencies muted as U.S. inflation takes centrestage

Currencies in emerging markets recovered from initial losses, but traded flat on Monday as focus turned to U.S. inflation data due later in the week, while investors pulled out of equities ahead of the corporate earnings season.

The MSCI's index of emerging market currencies was muted after falling as much as 0.2%, with the U.S. dollar and Treasury yields retreating as investors awaited inflation data due on Tuesday.

Investors feared that a bigger-than-expected spike in inflation could spark another rally in the greenback.

But dollar bulls were also on the fence, given that any signs of a pullback in inflation could hurt hopes of early tapering by the Federal Reserve, and make the greenback less attractive.

Powell: 'Economy would have been 'so much worse' without relief bills'

Federal Reserve Chair Jerome Powell says the economy would have been “so much worse” if the covid-19 relief bills were never passed by Congress.

Via The Hill

When will the IRS send unemployment tax refunds in May?

When will the IRS send unemployment tax refunds in May?

The IRS plans to start sending automatic refunds to those who paid taxes on unemployment compensation in 2020 before Congress passed a $10,200 tax break.

White House seeks bipartisan infrastructure push; Republicans wary

President Joe Biden could find himself under pressure on Monday to prove his much-touted interest in working with Republicans in Congress, as lawmakers return from their spring break to grapple with his $2.3 trillion proposal to improve U.S. infrastructure.

The Democratic president appears to be losing political capital with a group of Senate Republicans, including Susan Collins and Mitt Romney, who may represent his best chance of enacting legislation garnering the support of both parties.

Biden's party holds slim majorities in both the House of Representatives and Senate, meaning he can ill afford to lose Democratic votes. That has empowered and emboldened Democratic moderates such as Senator Joe Manchin who have outsize influence over the fate of Biden's ambitious legislative priorities including the infrastructure package, gun control and others.

Biden, who previously served for 36 years in the Senate, has repeated since becoming president in January his interest in collaborating with Republicans. He is expected to host Republicans and Democrats from both chambers of Congress at the White House on Monday to discuss a way forward on infrastructure.

Global economy recovering from pandemic maintain IMF

The steering committee of the International Monetary Fund said the global economy is recovering faster than expected from the covid-19 crisis, but warned that a spike in interest rates could be especially painful for emerging economies.

In its communique, the International Monetary and Financial Committee stressed the importance of accelerating distribution of covid-19 vaccines around the world, and pledged to strengthen international cooperation.

"Elevated financial vulnerabilities could pose risks, should global financial conditions tighten swiftly," the 24-member committee said. "The crisis may cause extended scarring and exacerbate poverty and inequalities, while climate change and other shared challenges are becoming more pressing."

IMF Managing Director Kristalina Georgieva told a news conference that all IMFC members had strongly endorsed a $650 billion expansion of the Fund's Special Drawing Rights monetary reserves, especially those representing middle-income countries. The distribution of the reserves would especially help these countries to bolster their financial resources, which remain strained by the year-long pandemic, she said.

Biden's budget meets criticism from right and left on Pentagon spending

U.S. President Joe Biden asked Congress to sharply hike spending on climate change, cancer and underperforming schools, but his first budget wishlist drew howls of bipartisan concern over military spending.

The $1.5 trillion budget, reflecting an 8% increase in base funding from this year, marks a sharp contrast with the goals of Biden's predecessor, Donald Trump. It would spread billions of dollars more across areas ranging from public transit, poor schools, toxic site clean-ups, foreign aid and background checks on gun sales, but spend nothing on border walls.

The budget "makes things fairer," said Treasury Secretary Janet Yellen. Yet the proposal was greeted by bipartisan scorn over its suggested funding for the Department of Defense, roughly even on an inflation-adjusted basis at $715 billion. The administration also cut an "Overseas Contingency Operations" account that even government bureaucrats said had come to serve as a slush fund for extra military spending.

Biden's request displeased both liberals hoping to impose cuts and hawks who want military spending to increase to deal with threats from China, Russia, Iran and North Korea - a reminder of the uphill battle Biden faces in delivering the policies he promised as a candidate beyond the covid-19 emergency.

Does Walmart cash stimulus check payments?

Does Walmart cash stimulus check payments?

For those who don’t have a current bank account, there are several places who will cash your $1,400 stimulus check, including Walmart.

Just over a month remaining to file taxes

The IRS postponed the tax filing deadline to May 17 from April 15. The plan is set to offer taxpayers more time to file tax returns and settle bills.

Track your stimulus check using the IRS' Get My Payment tool

Find out when your third Economic Impact Payment is scheduled to be sent, or when and how we sent it with the Get My Payment application. The App can be downloaded via the Apple store and Google Play.

Are the third stimulus checks included in 2021 IRS tax filing?

Are the third stimulus checks included in 2021 IRS tax filing?

The US government is in the process of sending out a third round of stimulus payments. The $1,400 stimulus checks are an advance tax credit for 2021.

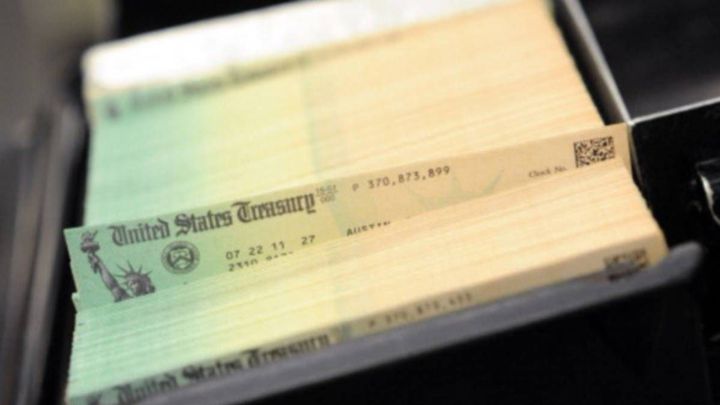

Biden administration disburses 25 million more stimulus payments to Americans

The Biden administration have confirmed that 25 million more stimulus payments worth a total of $36 billion had been sent out to Americans from the $1.9 trillion pandemic relief legislation.

The announcement of a fourth batch of checks was made by the Treasury Department and the Internal Revenue Service. It brings to 156 million payments the amount disbursed, with a total value of $372 billion.

The latest payments of up to $1,400 began processing last Friday, with some people receiving direct deposits, Treasury said in a statement.

The pandemic-hammered U.S. economy has been on the rebound, with 916,000 jobs created last month, bringing the jobless rate down to 6%.

Waiting for stimulus payment?

IRS tax filers can consult their account details for the latest status regarding any outstanding payments.

Dollar bounces higher as traders brace for inflation data

The dollar gained ground on Monday after last week's drop as traders assessed the outlook for Treasury yields, while awaiting crucial U.S. inflation and retail sales data in coming days.

The dollar's fortunes have been tied to the performance of Treasury yields for most of 2021, after concerns about rising inflation in the United States and a stimulus-fuelled economic rebound triggered a significant jump in yields on U.S. government bonds in February.

A fall in U.S. yields last week triggered the worst week for the dollar in 2021, but the currency found some stability on Monday. Federal Reserve Chairman Jerome Powell said in a U.S. media interview released on Sunday that the U.S. economy was at "an inflection point" and looked set for a strong rebound in the coming months, but he also warned of risks stemming from a hasty reopening.

Fourth stimulus check: what reasons are lawmakers giving for supporting or rejecting it?

Fourth stimulus check: what reasons are lawmakers giving for supporting or rejecting it?

There are growing calls in Congress for recurring payments to be included in President Biden's next spending package, but there will likely be strong GOP resistance to the proposals.

Fourth Stimulus check: what has Biden said and proposed?

Fourth Stimulus check: what has Biden said and proposed?

Congressional Democrats are calling on President Biden to back additional direct payments. Where does the White House stand on recurring payments?

Stimulus check live updates: welcome

Hello and welcome to our daily live blog on Monday 12 April.

We'll be with you throughout the day bringing you the latest information related to both the third stimulus check, which sees qualifying Americans get up to $1,400, and also on the possibility of a fourth, potentially recurring direct payment which is currently being debated.