Child Tax Credit: can you opt-out of the child tax credit?

Families are slated to begin receiving payments for the child tax credit in July, but some are wondering if they should delay their payments.

According to the White House around thirty-nine million families are able to receive benefits associated with the enhanced child tax credit passed through the American Rescue Plan. Payments for this tax credit, which will be distributed on a monthly basis are scheduled to begin in July. Before the changes made to the child tax credit, families were able to receive $2,000 per child. Now, families could receive $3,000 for children between the ages of six and seventeen and $3,600 for children younger than six.

Payments are scheduled to arrive on the 15th of each month between July to December. The remaining funds will be distributed when families file their 2021 income taxes next year.

For the first time ever, Child Tax Credit payments will be distributed on a monthly basis beginning on July 15th.

— Kyle Griffin (@kylegriffin1) May 17, 2021

Biden admin officials say that approximately 39 million households — around 88% of children in the U.S. — will benefit from the program.

Why are some families interested in opting out of the payments?

It is not so much that families are opting out, rather they are postponing payment. Since the child tax credit was passed more than two decades ago, it has been disbursed as a one-time payment with one’s tax return. Some taxpayers are opting for this approach, so rather than a monthly payment they will collect the bulk sum when filing their taxes next year.

In an interview with CNBC, economic policy expert Dr. Elaine Maag stated that “There’s evidence that shows that some people really like getting that large tax refund, and can use it as an opportunity to purchase a large household item like a refrigerator or put together first and last month’s rent so they can move.” In a way, delaying payment could be considered a savings strategy as taxpayers who know they qualify can trust that they will receive the hefty credit next year.

The Internal Revenue Service, the entity tasked with distributing the payments will launch a portal soon where eligible families can add their banking information. Through this portal, users will also be able to opt out of payments. This feature should be available on 1 July.

Efforts to make the changes to the child tax credit permanent

Related stories

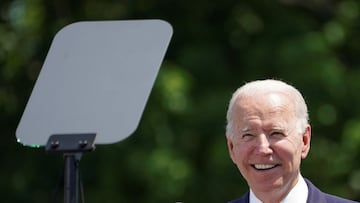

One of the components of President Biden’s American Families Plan is the extension of the enhanced child tax credit through 2025. Public policy experts believe that this extension could help make historic strides towards ending child poverty as nearly 88% of children are eligible to receive benefits.

Conservative think tanks, including the Heritage Foundation, have come out against the American Families Plan and Republican support on Capitol Hill for the proposal has been impossible to come by. While Democrats in the House, who hold a majority of seats should be able to pass the legislation, the fate of the bill as it enters the Senate is unknown. If no Republicans jump on board, it could be passed through a parliamentary tool known as Budget Reconciliation, but the Biden administration has stated that it would prefer to negotiate with the GOP before moving forward with that option.