$3600/$3000 Child Tax Credit: What do I have to do before July to get it?

IRS announces that payments for the Child Tax Credit will begin 15 July, but what actions are needed to receive it?

One of the measures included in the American Rescue Plan was an enhancement to the Child Tax Credit. Parents and guardians with children seventeen or younger in their care who make under a certain income are eligible.

What are the eligibility requirements?

Ninety percent of families are now eligible to receive the enhanced credit. These numbers are up significantly and will benefit more than twenty-four million children. To qualify, individuals must make $75,00 a year or less, those filing as Heads of Household must make $112,000 or less, and those married filing jointly must have a combined income of $150,000 or less. The benefit will be sent to parents and guardians in the care of biological children, step-children or step-siblings, foster or adopted children, siblings, grandchildren, and nieces, and nephews.

The only requirement is that the child lives with the taxpayer claiming the benefit for at least half the year. Meaning that single parents with joint custody, split evenly, can both claim the credit. As far as immigration status is concerned, the child must be a citizen or national or have legal immigration status.

The IRS has announced that they will begin sending payments on 15 July, and families can expect payments on that date through December as long as it does not fall on a weekend or holiday. Meaning that half of the total value of the credit will be distributed this year, the remainder can be claimed next year during tax season. Some individuals and families are opting to forgo monthly payments and claim the full credit next Spring.

Also see:

- IRS online portal for Child Tax Credit opening in July

- What to know about new direct payments from the IRS in July

- American Rescue Plan changes increase eligibility for the Child and Dependent Care Credit.

- How to claim the 2021 Child and Dependent Care tax credit

How have the eligibility requirements changed?

The changes made to the credit regarding eligibility under the American Rescue Plan were significant and include the type of credit it was listed as under the tax code, changes to income requirements, and the value per child.

Did you know: a permanent address is NOT required to receive the #ChildTaxCredit.

— House Democrats (@HouseDemocrats) June 1, 2021

If direct deposit is unavailable, parents experiencing homelessness can use the address of a trusted friend, relative or service provider.https://t.co/50LCexH3Ue

How do I register to receive the credit?

You do not need to do anything as long as you have submitted a 2020 tax return to the IRS. If you have not, do so as quickly as possible to ensure that the IRS has the information necessary to calculate and distribute the benefit.

What changes were made to the Child Tax Credit?

The changes made to the credit under the American Rescue Plan were significant and include the type of credit it was listed as under the tax code, changes to income requirements, the value per child, and more. These changes are expected to extend the benefit to twenty-four million children and cut child poverty in half this year.

Age of children

The eligibility age has increased to seventeen, and there are no limits on the number of children or dependents able to be claimed. Additionally, the cap for the total amount families were able to receive was $2,000. Now, the credit value has been increased to at least $3,000 for children over six and $3,600 for those under six. For example, a family with four children, three, seven, nine, and eleven, will receive a payment of $1,050 a month.

Income and Refundability Status

Before passing the American Rescue Plan, families had to have an earned income of at least $2,500 to claim the Child Tax Credit. Income minimums have been removed because to support families where members lost their jobs during the pandemic. Additionally, the previous structure penalized low-income families. According to the Center for American Progress, the “majority children in families in the bottom 10 percent of the income distribution were completely unable to claim the credit, and the majority of children in the bottom 30 percent were only eligible for a partial credit.”

Significant changes included making the tax credit fully refundable, meaning that even families who do not have a positive tax liability can claim the full benefit. Before, the credit structure was non-fundable which meant that many low-income families were not able to receive benefits. For decades many policymakers have argued for this change to ensure that the credit was available to the most vulnerable families in the country. Researchers at the Center of American Progress found that “70 percent of children in families headed by solo, female parents or guardians were ineligible for the full credit,” and argued that the “disparity in part [was] driven by structural sexism that fuels the gender pay gap and lowers the earnings of women and mothers, particularly women and mothers of color.”

Efforts to make the changes permanent

Democrats on Capitol Hill are arguing to make the changes permanent, but Republicans are opposed to any expansion of the country's welfare system.

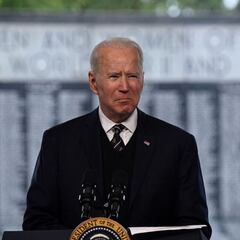

In April, President Biden announced his third proposal, the American Families Plan, which forms part of his Build Back Better economic agenda. The plan would make the changes to the Child and Dependent Tax Credit permanent through 2025. The measure currently holds vast public support, and some Democrats are championing the issue with hopes of getting the plan enacted this year.

Related stories

One argument being made for the extension of the credit is that it will increase household economic resilience. The average family in the United States has around $400 in savings, meaning when a crisis, like the covid-19 pandemic, hits, there is very little economic resilience within the economy. This vulnerability makes individuals and families, especially those with children, more reliant on the government for federal assistance. If the credit was extended, experts day families might be able to save more, and thus when the next economic crisis inevitably hits, they will be better prepared to weather the storm.

It's absolutely mystifying that my Senate colleagues would propose reversing the Child Tax Credit expansion – which would raise taxes on American families and double child poverty – to pay for their infrastructure plan. https://t.co/2c1NiVv0lB

— Michael Bennet (@SenatorBennet) May 27, 2021

Republicans, however, do not believe in this theory of change. Some members of the Republican party believe the expansion will disincentive parents from working and are not a fan of the price tag.However, for Democrats the benefits are worth the price as they will life millions out of poverty and with more money to spend, which some economists believe the credit could create a virtuous cycle of economic growth.