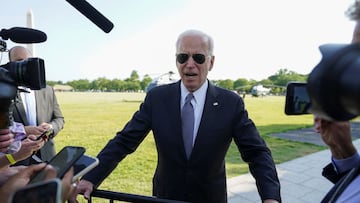

Biden’s $6 trillion budget plan: what will it include?

Reports suggest that the President is set to unveil a multi-trillion dollar budgetary proposal on Friday, providing federal funds for Biden's next legislative priorities.

President Biden is set to announce a proposed $6 trillion budget on Friday as he presses on with an ambitious economic agenda aimed at fuelling the United States’ post-pandemic recovery and reshaping American society.

The New York Times reports that Biden’s first budget request to Congress will see total spending to rise to $8.2 trillion by 2031, with deficits running above $1.3 trillion across the next decade.

Throughout the first few months of his presidency Biden has appeared intent on following a more progressive agenda than many were expecting and it is thought that the budgetary increase will be used to fund two large-scale relief bills that his administration has recently proposed.

What will be covered by Biden’s the $6 trillion budget?

One of Biden’s first priorities upon entering the White House was to pass the American Rescue Plan, which he signed into law in March. He followed that up with the proposed American Jobs Plan and the American Families Plan in April which are designed to implement more long-term change.

The former will provide major investment for traditional infrastructure like roads and bridges, but also provide extra funding to improve green technologies. Biden has made clear that clean energy solutions play a major role in his vision of the US’ future and it will be a significant part of the new budget.

President Biden's first federal budget proposal looks to transform the economy from transportation to education — all while confronting climate change. @Yamiche joins @JudyWoodruff with more on this $6 trillion blueprint of priorities. https://t.co/u01NnzUTIx pic.twitter.com/3CHC9JItSV

— PBS NewsHour (@NewsHour) May 27, 2021

The American Jobs Plan will also make improvements to the national electrical grid, which came under particular focus during the winter storms earlier this year. In less traditional infrastructure spending, the budget is also expected to cover a massive expansion of broadband access and to bolster care provision for the elderly and disabled.

The second piece of major legislation, the American Families Plan, will be used to pay for the expanded Child Tax Credit system through to the end of 2025. There will also be subsidies for child care for middle-class families and federal paid family leave.

Alongside these proposals, additional funding will be provided to ensure that all children are offered two years of pre-kindergarten schooling and two years of community college completely free of charge.

Over the course of the next decade, the combined cost of these two enormous spending proposals is expected to be around $4.1 trillion. Biden is also proposing a massive 16% increase in annual non-defence spending for 2022. This will see significant increase for the likes of housing assistance, agriculture, education and veterans’ affairs.

How will Biden pay for his new budget proposal?

Throughout campaigning and since taking office, Biden has reiterated a pledge that he will not raise taxes for anyone earning less than $400,000 per year. Interestingly, the budget documents seen by the New York Times do not suggest that Biden will not attempt to roll back some of the Trump administration’s tax cuts which are due to expire in 2025.

SCOOP🚨

— Jim Tankersley (@jimtankersley) May 27, 2021

President Biden will propose a budget on Friday that envisions the highest sustained level of federal spending since World War II -- and the highest debt/GDP ratio ever.https://t.co/t3QHrXozgG

CNBC report that much of the new spending will be paid for by a significant increase in additional revenues that will see an additional $3.6 trillion brought in over the same period. Biden is submitting an ambitious budgetary proposal but many believe that now is the right time for such a burst of federal spending.

Related stories

Maura Quint, executive director of progressive advocacy group Tax March, said of the proposal: “I think it's a good thing. What we have seen over many, many decades at this point is a shrinking government in ways that can help people.”

“Fundamentally, I think we need to go very big, and we’re only going to be better served individually and as a whole if we make investments of this size now.”