When will the IRS start to send the $3,000/$3,600 Child Tax Credit payments?

The American Rescue Plan included a complete overhaul of the Child Tax Credit, but the IRS focused on the stimulus check distribution before sending out the payments.

The Internal Revenue Service has confirmed that payments for the enhanced Child Tax Credit (CTC) are slated to begin from 15 July.

From then on eligible households should continue to receive payments on the 15th of each month until the end of December, unless that date happens to fall on a weekend or holiday. The remaining balance of the 12-month tax credit will be realised during next year’s tax filing season.

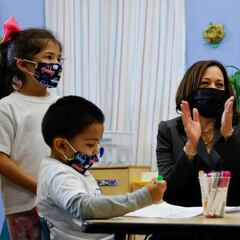

The Child Tax Credit means help directly in the bank accounts of the families who need it. Nearly all working families will automatically get monthly payments starting July 15th – no action needed. Head to https://t.co/P2RRSAlEgx for more information. pic.twitter.com/U1eSsBi18p

— President Biden (@POTUS) June 21, 2021

The White House is very optimistic about the impact that the monthly payments will have on American families, but some may decide to postpone the payments in order to claim the full value of as a bulk sum when they file their taxes. Those interested in this option can use a new portal, set to go live from 1 July, to make their preference clear.

Who can claim the Child Tax Credit?

The new CTC will benefit an estimated 88% of American children, which experts believe could have a hugely positive impact on rates of child poverty. The White House claim that the CTC could halve childhood poverty over the next 12 months.

In addition, the Center on Budget and Policy Priorities (CBPP) found that the expansion will also lift nearly ten million children above or closer to the poverty line; of which “2.3 million are Black, 4.1 million are Latino, and 441,000 are Asian American."

Read more

- How to sign up for the new Child Tax Credit

- IRS unveils new online tool for 2021 Child Tax Credit

- Suspected fraud creates delays for the IRS in sending refunds

This widening of eligibility is largely due to the removal of the minimum income thresholds, which had excluded some of the most economically vulnerable children in the United States. The CBPP found that single parents making under $10,000 a year with one child under six, would have received around $1,125 under the old tax code; with the updates, the payments will total $3,600.

Instead, the new requirements place caps on the maximum household income that families and individuals can make and still claim the credit. Only the following groups will receive the full amount:

- Single filers – earning $75,000 or less

- Head of households -- earning $112,000 or less

- Married couples filing jointly -- earning $150,000 or less

The amount on offer will gradually phase out above those thresholds, until individuals making more than $95,000 a year and married couples with a combined income of over $170,000 will receive no money from the CTC

Related stories

Representative Katie Porter of California has raised concerns that this structure which, while an improvement on the old version, could be unfair on single parents. In a video posted on twitter, Rep. Porter highlights what she calls the “Single Parent Penalty,” and describes how children in single-parent households will receive less in benefits than they would if their parents were married.

Rep. Katie Porter has introduced legislation aimed at helping single-parent families benefit from the expansion of the child tax credit enacted earlier this year.

— SPARE (@spareorg) June 2, 2021

As it stands, the income thresholds for married-parent households and single-parent households are not equal. pic.twitter.com/UgHnTc31QA

If a parent or guardian files as “single” or “Head of Household” and are even a little bit over the income limit, their benefits will be reduced. Rep. Porter argues that this makes a “child living in a single parent family, [...] less likely to get the tax credit.” The Congresswoman, who is a single parent herself, has put forth legislation to avoid this penalty for single family households.